Wondering What Your Home Might Be Worth?

Thinking about selling and want to know how much your home is worth? Call our new 24 Hour Home Value Hotline provided by Utah Realty to get a FREE home evaluation* from Utah Realty’s top agent. Don’t trust just any website to give you an accurate value assessment of your home. With three decades of full time experience you will get a personalized report tailored from a local Real Estate expert. See how your home compares to similar homes in your neighborhood today!

Complete the form by clicking on the link. You may just call or Text the 24 Hour Home Value Hotline at 801.205.3500 to receive your FREE home evaluation report within 24-48 hours.

Free Home Evaluation Report Link

-

For Sale By Owner (FSBO) Statistics

- FSBOs accounted for 8% of home sales in 2016. The typical FSBO home sold for $190,000 compared to $249,000 for agent-assisted home sales.

- FSBO methods used to market home:

- Yard sign: 35%

- Friends, relatives, or neighbors: 24%

- Online classified advertisements: 11%

- Open house: 15%

- For-sale-by-owner websites: 8%

- Social networking websites (e.g. Facebook, Twitter, etc.): 13%

- Multiple Listing Service (MLS) website: 26%

- Print newspaper advertisement: 5%

- Direct mail (flyers, postcards, etc.): 4%

- Video: 2%

- None: Did not actively market home: 28%

- Most difficult tasks for FSBO sellers:

- Getting the right price: 15%

- Understanding and performing paperwork: 12%

- Selling within the planned length of time: 13%

- Preparing/fixing up home for sale: 9%

- Having enough time to devote to all aspects of the sale: 3%

How To Make Your Dream of Homeownership a Reality

How To Make Your Dream of Homeownership a Reality According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and...

A Smaller Home Could Be Your Best Option

A Smaller Home Could Be Your Best Option Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief...

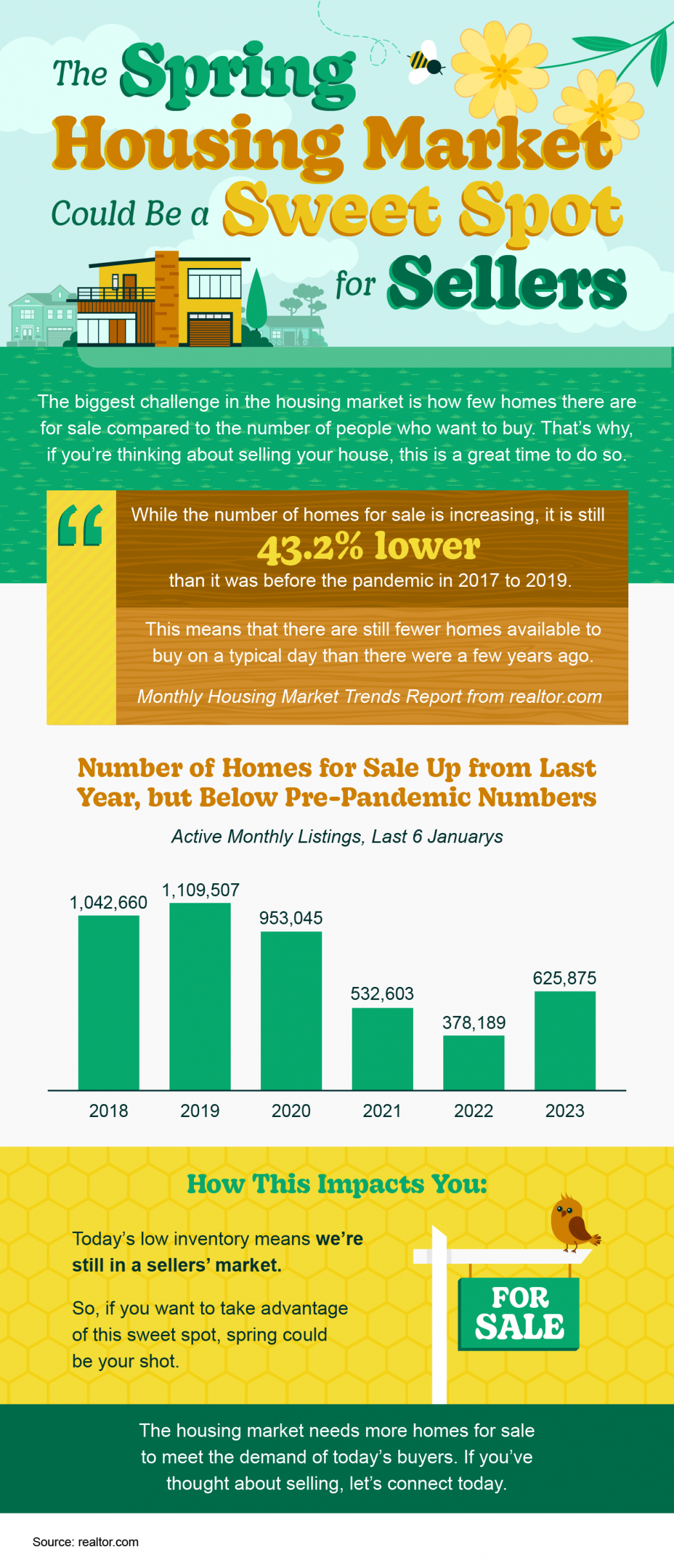

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers

The Utah Spring Housing Market Could Be a Sweet Spot for Sellers Some Highlights The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy. The number of homes for sale is up from last year but...

Now helping navigate the solutions when coping with divorce and Real Property

National Association of Divorce Professionals Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential...

What You Should Know About Closing Costs

What You Should Know About Closing Costs Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when...

How To Win as a Buyer in Today’s Housing Market In Utah

How To Win as a Buyer in Today’s Housing Market Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of...

Are We in a Housing Bubble?

The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting...

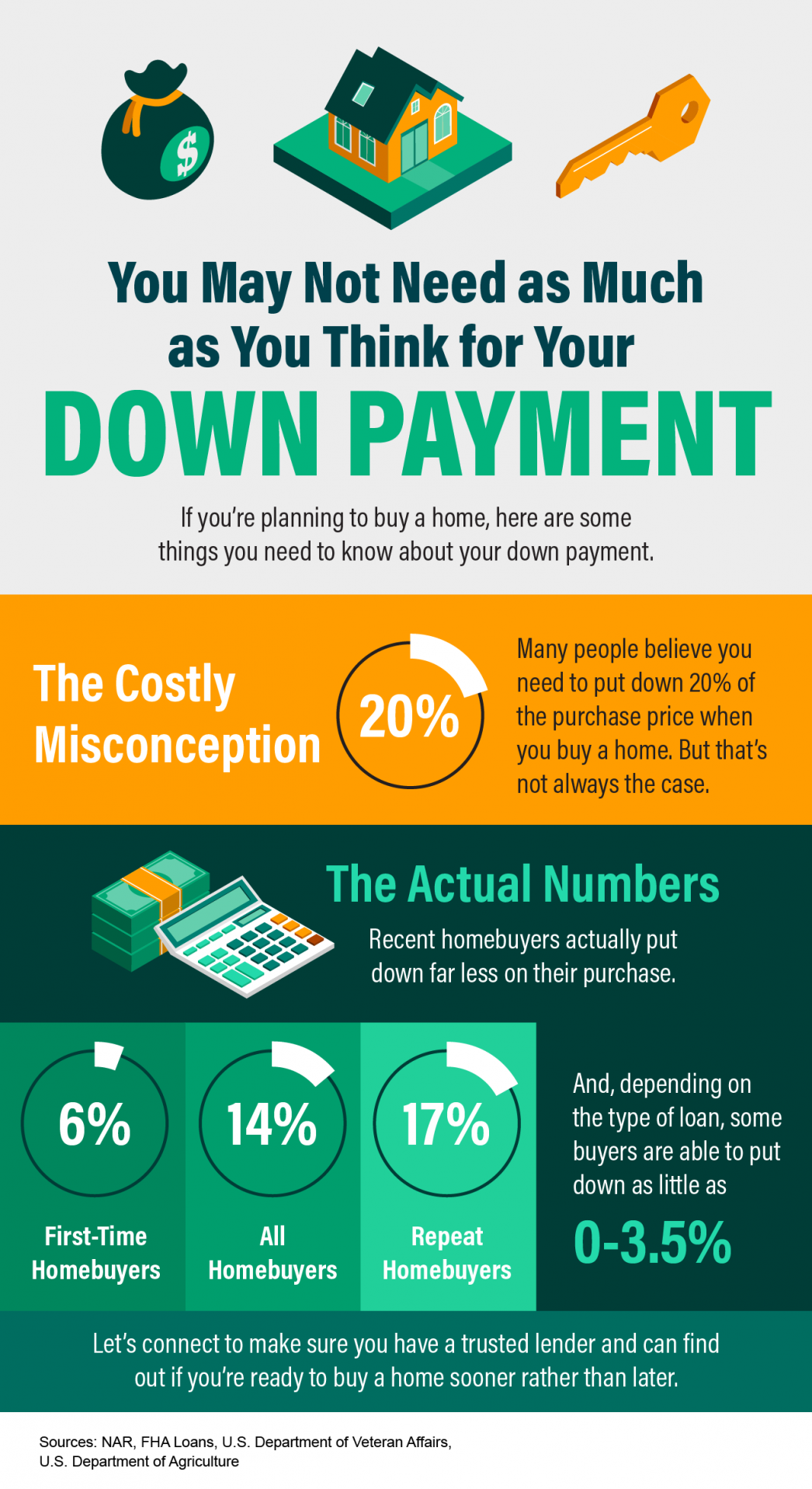

You May Not Need as Much as You Think for Your Down Payment

You May Not Need as Much as You Think for Your Down Payment Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA...