Wondering What Your Home Might Be Worth?

Thinking about selling and want to know how much your home is worth? Call our new 24 Hour Home Value Hotline provided by Utah Realty to get a FREE home evaluation* from Utah Realty’s top agent. Don’t trust just any website to give you an accurate value assessment of your home. With three decades of full time experience you will get a personalized report tailored from a local Real Estate expert. See how your home compares to similar homes in your neighborhood today!

Complete the form by clicking on the link. You may just call or Text the 24 Hour Home Value Hotline at 801.205.3500 to receive your FREE home evaluation report within 24-48 hours.

Free Home Evaluation Report Link

-

For Sale By Owner (FSBO) Statistics

- FSBOs accounted for 8% of home sales in 2016. The typical FSBO home sold for $190,000 compared to $249,000 for agent-assisted home sales.

- FSBO methods used to market home:

- Yard sign: 35%

- Friends, relatives, or neighbors: 24%

- Online classified advertisements: 11%

- Open house: 15%

- For-sale-by-owner websites: 8%

- Social networking websites (e.g. Facebook, Twitter, etc.): 13%

- Multiple Listing Service (MLS) website: 26%

- Print newspaper advertisement: 5%

- Direct mail (flyers, postcards, etc.): 4%

- Video: 2%

- None: Did not actively market home: 28%

- Most difficult tasks for FSBO sellers:

- Getting the right price: 15%

- Understanding and performing paperwork: 12%

- Selling within the planned length of time: 13%

- Preparing/fixing up home for sale: 9%

- Having enough time to devote to all aspects of the sale: 3%

First-Time Buyers Are Searching for Existing Homes This Year

First-Time Buyers Are Searching for Existing Homes This Year In the latest Housing Trends Report, the National Association of Home Builders (NAHB) measured the share of adults planning to buy a home over the next 12 months. The report indicates the percentage of all...

American Dream Grant

Homeownership matters. That is why the Salt Lake Board of Realtors® this year is giving away down payment housing grants. This is just one way for us to help our community. The next grant is for single parents. The deadline to apply for this grant is March 20.

Utah Real Estate Market Stats for December

An Exceptional Year for Salt Lake’sHousing Market | 2019 Was One of theBest Years in Overall Residential Sales

Attention Utah Home Buyers

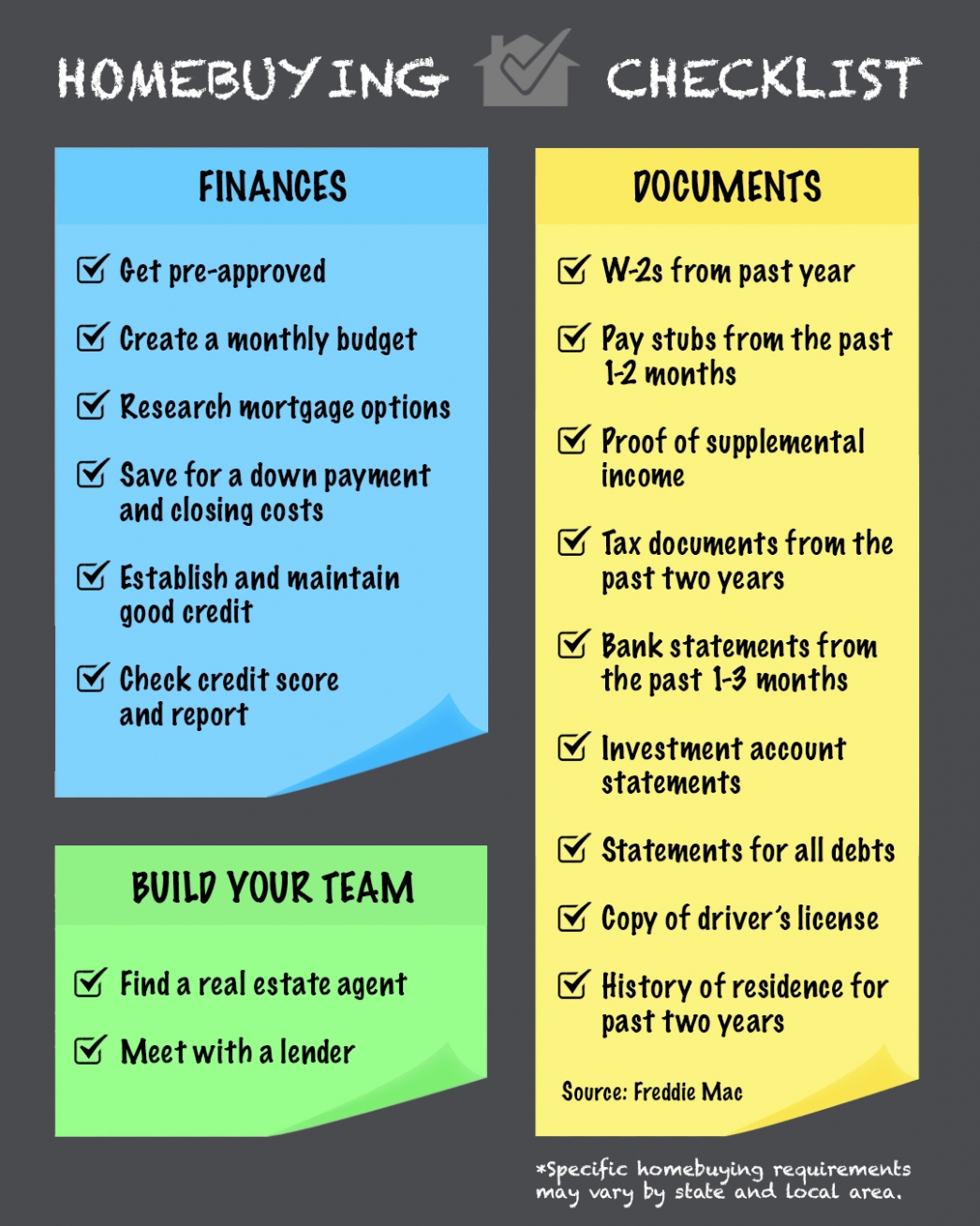

2020 Homebuying Checklist Some Highlights: If you’re thinking of buying a home, plan ahead and stay on the right track, starting with pre-approval. Being proactive about the homebuying process will help set you up for success in each step. Make sure to work with a...

How Buyers Can Win By Downsizing in 2020

Marty Gale SRESHow Buyers Can Win By Downsizing in 2020 Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as...

The 2 Surprising Things Homebuyers Really Want

The 2 Surprising Things Homebuyers Really Want In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though –...

2020 Expert Forecast in Numbers

The expert forecast is looking bright when it comes to the 2020 housing market. Let’s connect to talk about how these numbers can bring you one step closer to homeownership this year.

Homes Are More Affordable Today, Not Less Affordable

Homes Are More Affordable Today, Not Less Affordable There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several...

2020 Luxury Market Forecast

2020 Luxury Market Forecast By the end of last year, many homeowners found themselves with more equity than they realized, and at the same time their wages were increasing. When those two factors unite, it can spark homeowners to think about making a move to a larger...

Buying a Home Early in Life Can Increase Future Wealth

Buying a Home Early Can Significantly Increase Future Wealth According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60. The good news is, our younger generations are strong believers in...