Home Value Appreciation Stops Falling, Begins to Stabilize

The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer.

In a recent post on the National Association of Realtors’ Economists’ Outlook Blog, it was revealed that Realtors are starting to sense that home values are beginning to stabilize and that we may see appreciation beginning to accelerate again:

“About 3,000 REALTORS® who responded to NAR’s February 2019 REALTORS Confidence Index Survey had more optimistic— although modest— home price growth expectations over the next 12 months. Respondents expect home prices to typically increase by 1.9 percent nationally, up from 1.4 percent in the January survey.”

The thinking that home appreciation has bottomed-out was also confirmed in two additional housing reports recently released:

CoreLogic Home Price Index – The analysts at CoreLogic increased their projection for home appreciation for the next twelve months to 4.7% as compared to the 4.6% they projected in their previous report.

The Home Price Expectation Survey – In the 2019 first quarter survey, the nationwide panel of over one hundred economists, real estate experts, and investment & market strategists increased their projection for home value growth in 2019 to 4.3% compared to the 3.8% increase they had projected in the fourth quarter of 2018.

Bottom Line

Agents working the business every day, one of the premier data companies in the real estate space, and one hundred housing experts all agree: home price appreciation has ended its decline and looks to be stabilizing… and may even accelerate.

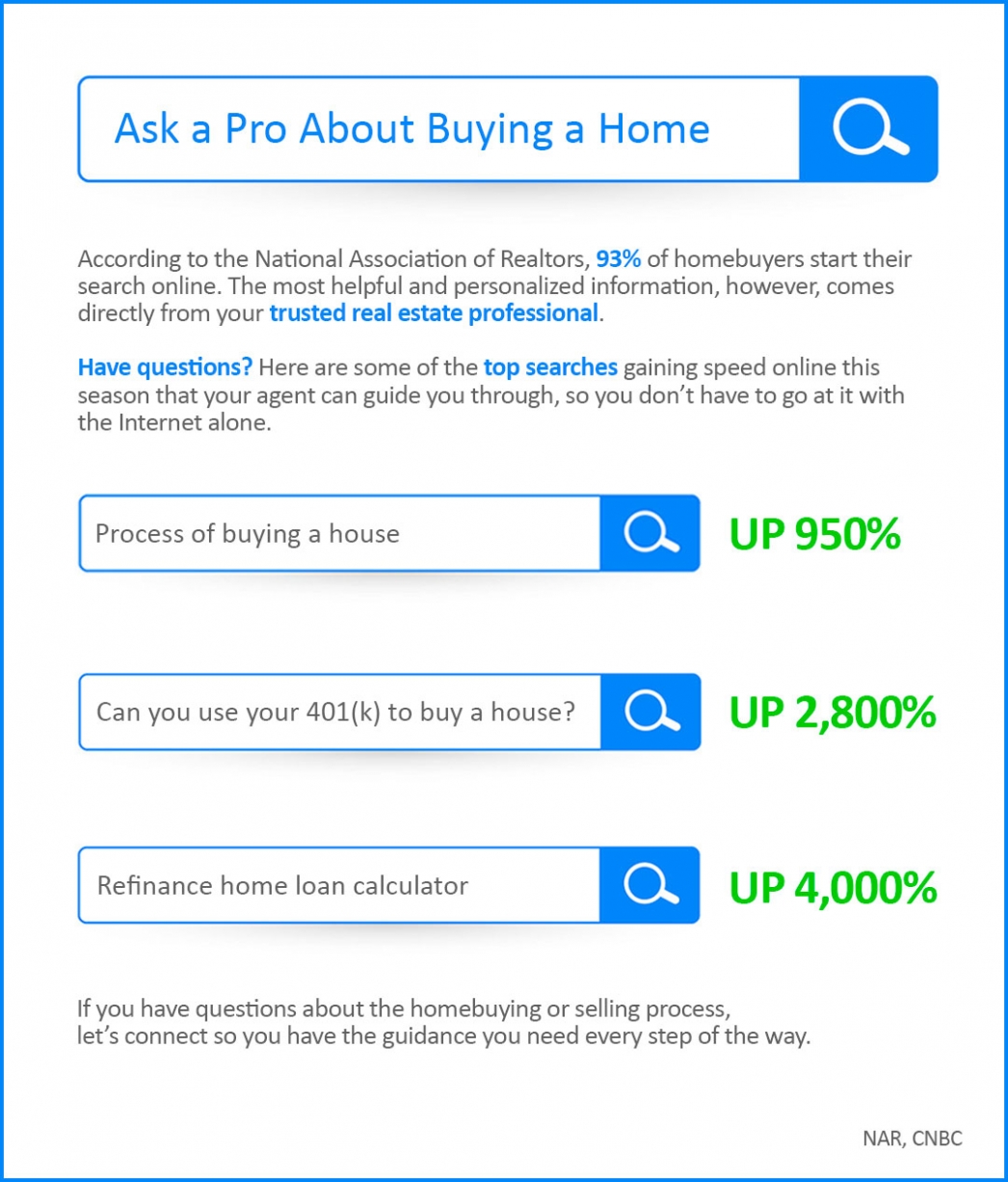

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

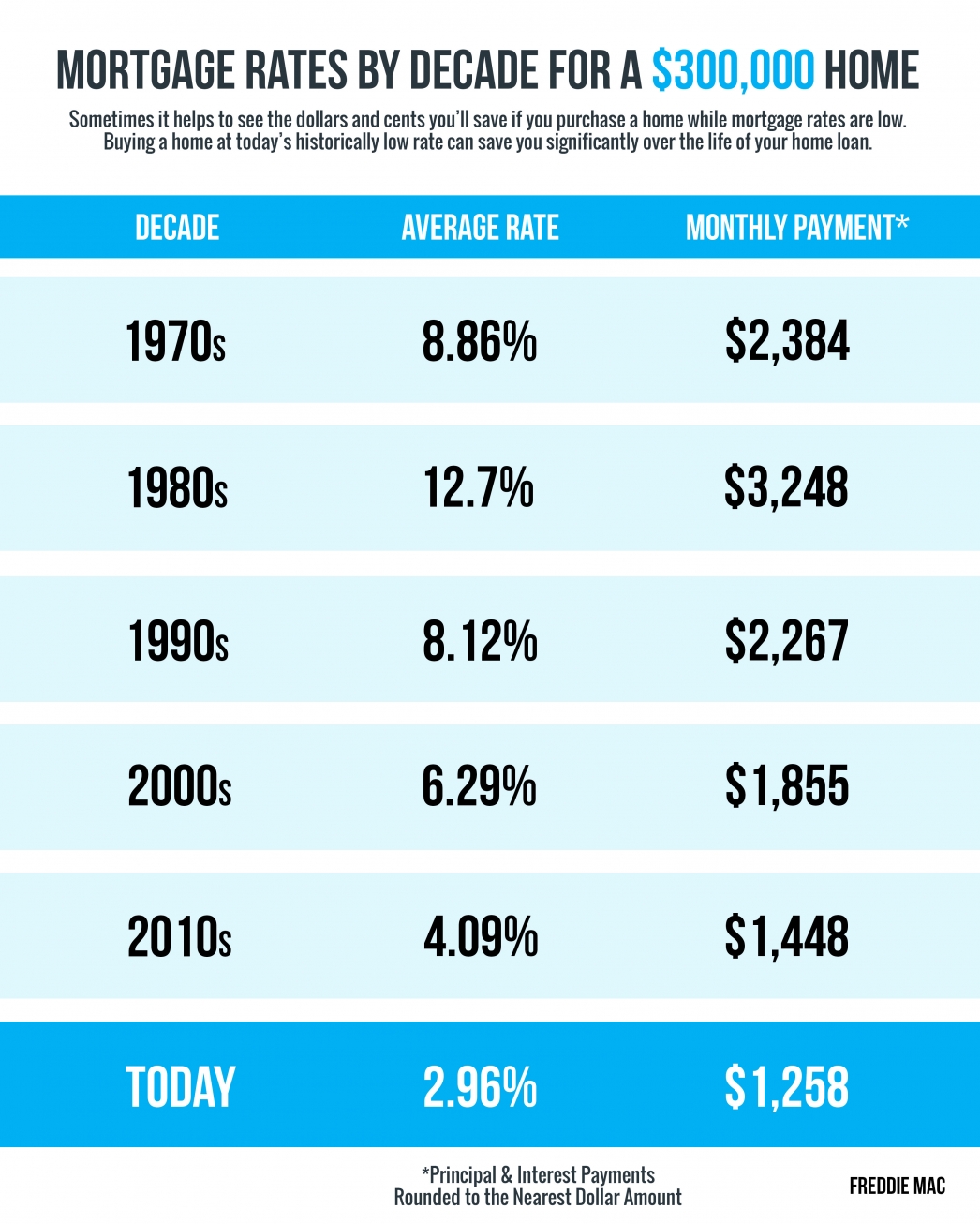

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...