Great News for Renters Who Want to Buy a Home

Rents in the United States have been skyrocketing since 2012. This has caused many renters to face a tremendous burden when juggling their housing expenses and the desire to save for a down payment at the same time. The recent stabilization of rental prices provides a great opportunity for renters to save more of their current income to put toward the purchase of a home.

Just last week the Joint Center of Housing Studies of Harvard University released the America’s Rental Housing 2020 Report. The results explain the financial challenges renters are experiencing today,

“Despite slowing demand and the continued strength of new construction, rental markets in the U.S. remain extremely tight. Vacancy rates are at decades-long lows, pushing up rents far faster than incomes. Both the number and share of cost-burdened renters are again on the rise, especially among middle-income households.”

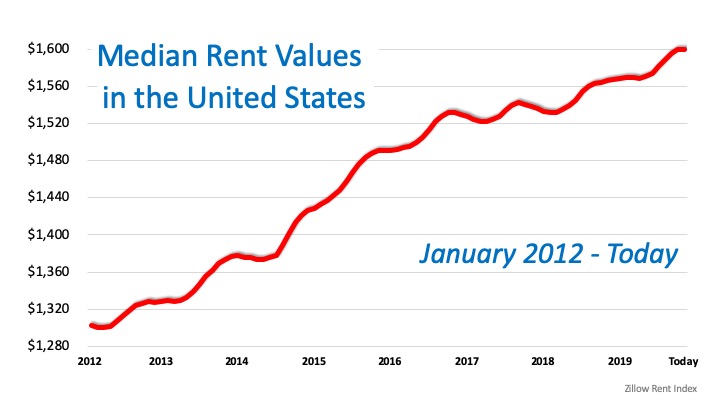

According to the most recent Zillow Rent Index, which measures the estimated market-rate rent for all homes and apartments, the typical U.S. rent now stands at $1,600 per month. Here is a graph of how the index’s median rent values have climbed over the last eight years:

Is Good News Coming?

There seems, however, to be some good news on the horizon. Four of the major rent indices are all reporting that rents are finally beginning to stabilize in all rental categories:

1. The Zillow Rent Index, linked above, only rose 2.6% over the last year.

2. RENTCafé’s research team also analyzes rent data across the 260 largest cities in the United States. The data on average rents comes directly from competitively rented, large-scale, multi-family properties (50+ units in size). Their 2019 Year-End Rent Report shows only a 3% increase in rents from last year, the slowest annual rise over the past 17 months.

3. The CoreLogic Single Family Rent Index reports on single-family only rental listing data in the Multiple Listing Service. Their latest index shows how overall year-over-year rent price increases have slowed since February 2016, when they peaked at 4.2%. They have stabilized around 3% since early 2019.

4. The Apartment List National Rent Report uses median rent statistics for recent movers taken from the Census Bureau American Community Survey. The 2020 report reveals that the year-over-year growth rate of 1.6% matches the rate at this time last year; it is just ahead of the 1.5% rate from January 2016. They also explain how “the past five years also saw stretches of notably faster rent growth. Year-over-year rent growth stood at 2.6% in January 2018, and in January 2016 it was 3.3%, more than double the current rate.”

It seems tenants are getting a breather from the rapid rent increases that have plagued them for almost a decade.

Bottom Line

Rental expenses are beginning to moderate, and at the same time, average wages are increasing. That power combination may allow renters who dream of buying a home of their own an opportunity to save more money to put toward a down payment. That’s sensational news!

3 Tips for Buying a Home Today

3 Tips for Buying a Home Today If you put off your home search at any point over the past two years, you may want to consider picking it back up based on today’s housing market conditions. Recent data shows the supply of homes for sale is increasing, giving buyers...

Planning To Retire? Your Equity Can Help You Reach Your Goal.

Planning To Retire? Your Equity Can Help You Reach Your Goal. Whether you’ve just retired or you’re thinking about retirement, you may be considering your options and trying to picture a whole new stage of your life. And you’re not alone. Research from the Retirement...

Experts Increase 2022 Home Price Projections

Experts Increase 2022 Home Price Projections If you’re wondering if home prices are going to come down due to the cooldown in the housing market or a potential recession, here’s what you need to know. Not only are experts forecasting home prices will continue to...

Pricing your house based on current market conditions means it’s more likely to sell quickly. Let’s connect so you can have the best advice when you sell today.

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers...

3 Graphs To Show This Isn’t a Housing Bubble

3 Graphs To Show This Isn’t a Housing Bubble With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that...

Why the Forbearance Program Changed the Housing Market

Why the Forbearance Program Changed the Housing Market When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over...

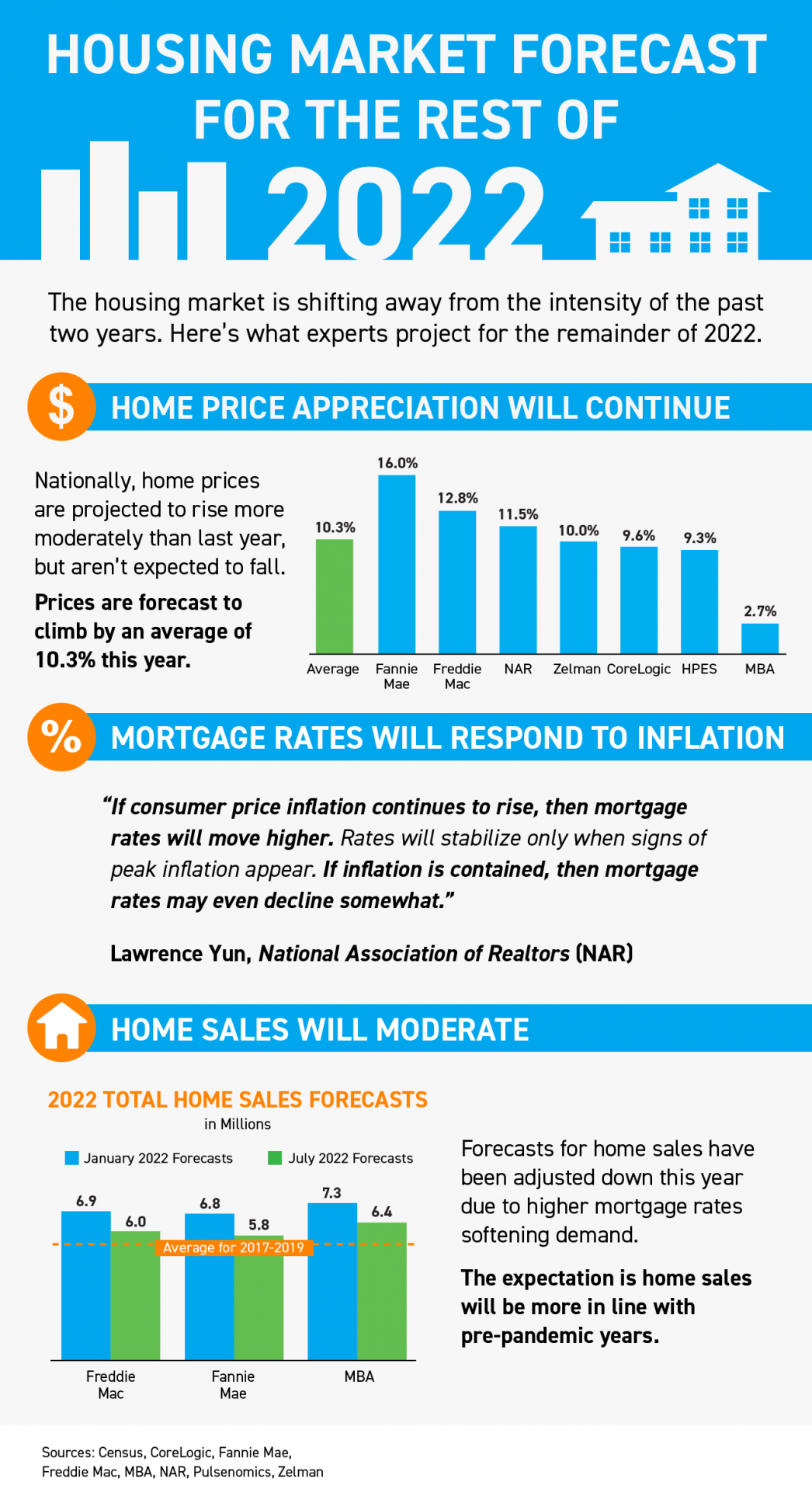

Housing Market Forecast for the Rest of 2022

Housing Market Forecast for the Rest of 2022 Some Highlights The housing market is shifting away from the intensity of the past two years. Here’s what experts project for the remainder of 2022. Home prices are forecast to rise more moderately than last year. Mortgage...

Why It’s Still a Sellers’ Market

Why It’s Still a Sellers’ Market As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you...

Pre-Approval Is a Strategic Move When You’re Buying a Home

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...