Strength of the Economy Is Surprising the Experts

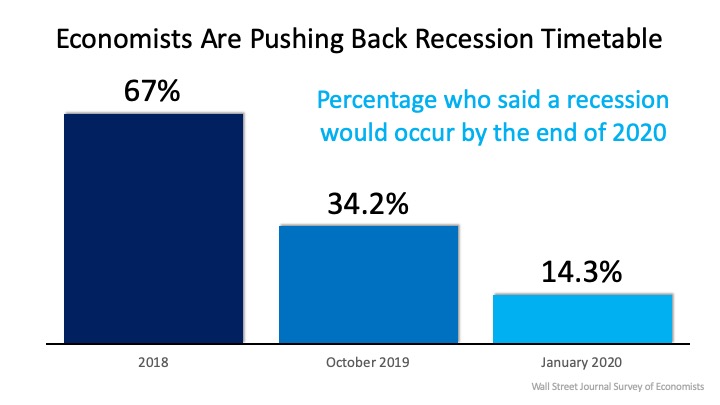

We’re currently in the longest economic recovery in U.S. history. That has caused some to ask experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by the Wall Street Journal (WSJ) for the Economic Forecasting Survey predicted we would have a recession no later than the end of this year (2020). The same study done just three months ago showed more than one third of the economists still saw an economic slowdown right around the corner.

The news caused concern among consumers. This is evidenced by a recent survey done by realtor.com that shows 53% of home purchasers (first-time and repeat buyers) currently in the market believe a recession will occur by the end of this year.

Wait! It seems the experts are changing their minds….

Now, in an article earlier this month, the Wall Street Journal (WSJ) revealed only 14.3% of those economists now believe we’re in danger of a recession occurring this year (see graph below): The WSJ article strongly stated,

The WSJ article strongly stated,

“The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election with a healthy labor market backing it up, economists say.”

This optimism regarding the economy was repeated by others as well.

CNBC, quoting Goldman Sachs economists:

“Just months after almost everyone on Wall Street worried that a recession was just around the corner, Goldman Sachs said a downturn is unlikely over the next several years. In fact, the firm’s economists stopped just short of saying that the U.S. economy is recession-proof.”

“When Barron’s gathers some of Wall Street’s best minds—as we do every January for our annual Roundtable—we expect some consensus, some disagreement…But the 10 veteran investors and economists who convened in New York on Jan. 6 at the Barron’s offices agree that there’s almost no chance of a recession this year.”

“The U.S. economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats mostly eliminated the risk of a recession.”

Robert A. Dye, Chief Economist at Comerica Bank:

“I expect that the U.S. economy will avoid a recession in 2020.”

Bottom Line

There probably won’t be a recession this year. That’s good news for you, whether you’re looking to buy or sell a home.

Should You Buy a Home Now or Wait Until Next Year?

Top Days to List Your Home for Sale in Utah by Utah Realty

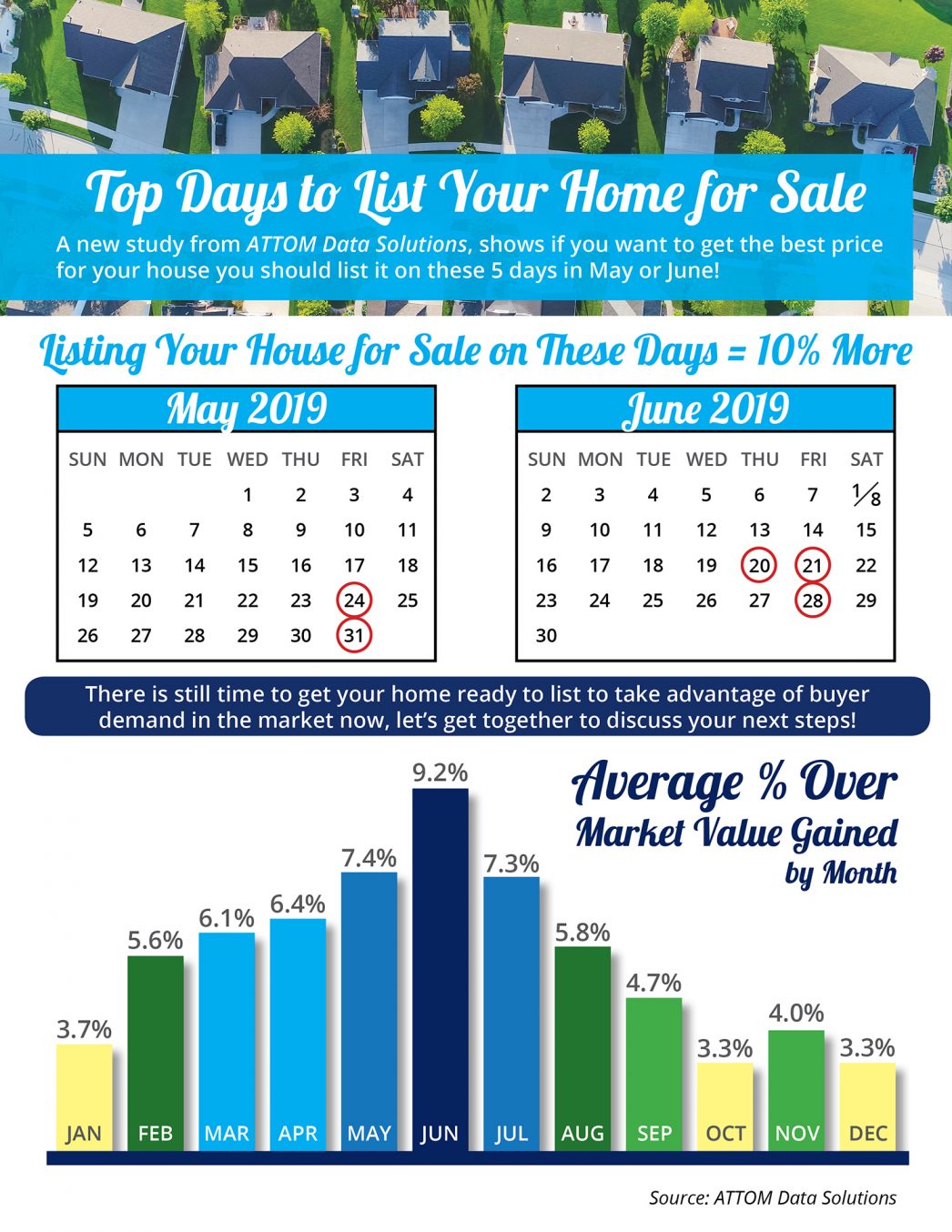

Top Days to List Your Home for Sale Some Highlights: ATTOM Data Solutions conducted an analysis of more than 29 million single family home and condo sales over the past eight years to determine the top days to list your home for sale. The top five days to list your...

Are Older Generations in Utah Really Not Selling Their Homes

Are Older Generations Really Not Selling Their Homes? Many studies suggest one of the main reasons for the inventory shortage in today’s market of homes for sale is that older generations have chosen to “age in place” over moving. The 2019 Home Buyers & Sellers...

Searching for your Utah Dream Home

Starting the Search for Your Dream Home? Here Are 5 Tips! In today’s real estate market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared. In...

Utah Home Prices

Salt Lake City's Home Prices Keep Climbing Salt Lake home prices have increased nearly 47 percent over the past five years, and more than 371 percent since 1991, according to a recent report by the Federal Housing Finance Agency. Nationwide, home prices have...

Parents of Utah Graduates, Are you about to be empty nesters!

Utah Realty Presents A Tale of Two Markets

Utah Realty Presents A Tale of Two Markets [INFOGRAPHIC] Some Highlights: An emerging trend for some time now has been the difference between available inventory and demand in the premium and luxury markets and that in the starter and trade-up markets and what those...

South Jordan Utah Home Buyers are Optimistic About Homeownership

Home Buyers are Optimistic About Homeownership! When we consider buying an item, we naturally go through a research process prior to making our decision. We ask our friends and family members who have made similar purchases about their experience, we get opinions and...

Utah Realty Tip of the Day! Access Important to Getting your Home Sold

Why Access Is One of the Most Important Factors in Getting Your House Sold! So, you’ve decided to sell your house. You’ve hired a real estate professional to help you through the entire process, and they have asked you what level of access you want to provide to your...

Cost of Renting vs Buying – Utah Realty

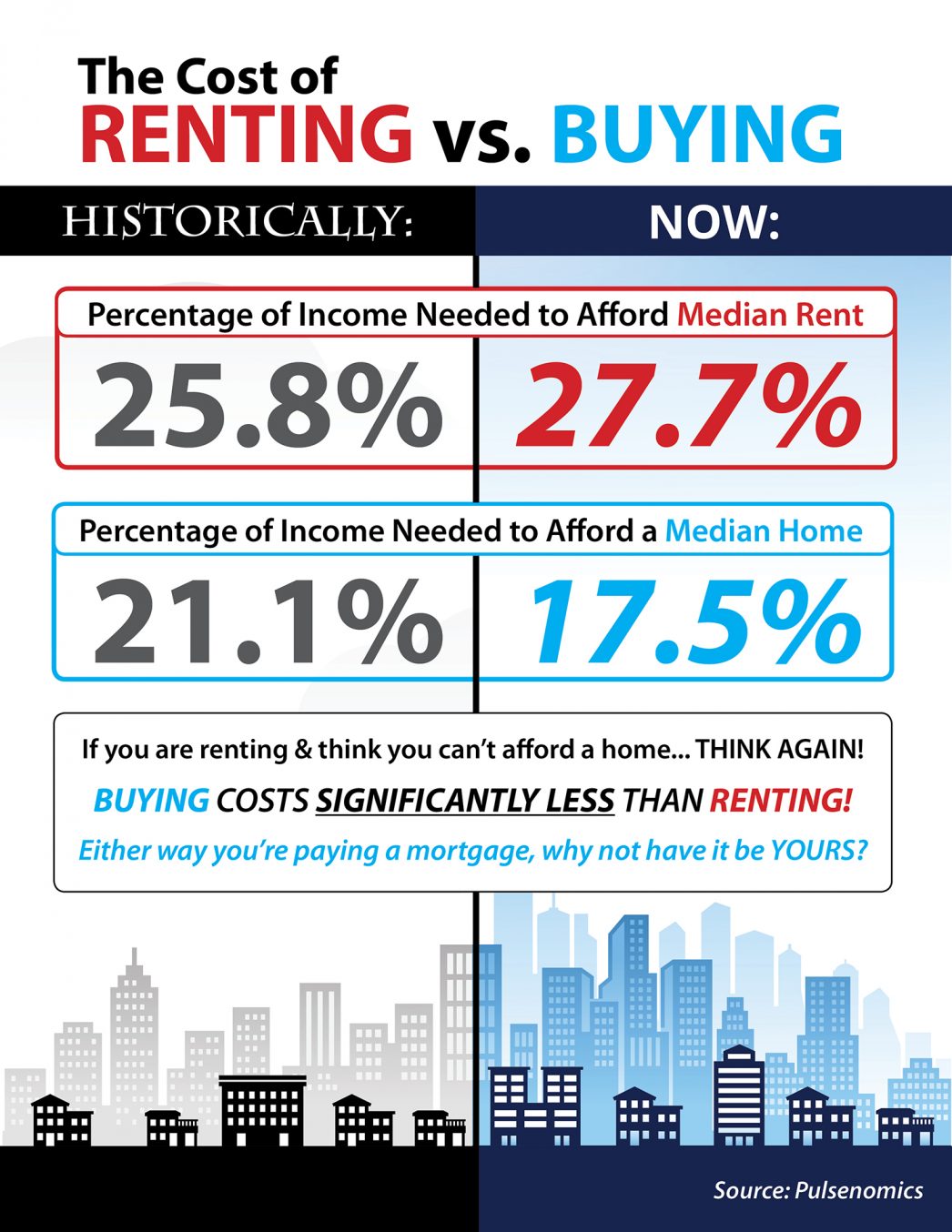

The Cost of Renting vs. Buying This Spring Some Highlights: Historically, the choice between renting or buying a home has been a tough decision. Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a...