Why a Move Could Bring You More Happiness This Year

Why a Move Could Bring You More Happiness This Year Over the past two years, we’ve lived through one of the most stressful periods in recent history. Because of the health crisis, many of us have spent more time at home and that’s led us to re-evaluate both what we...

Housing Inventory Lower than Last Year

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

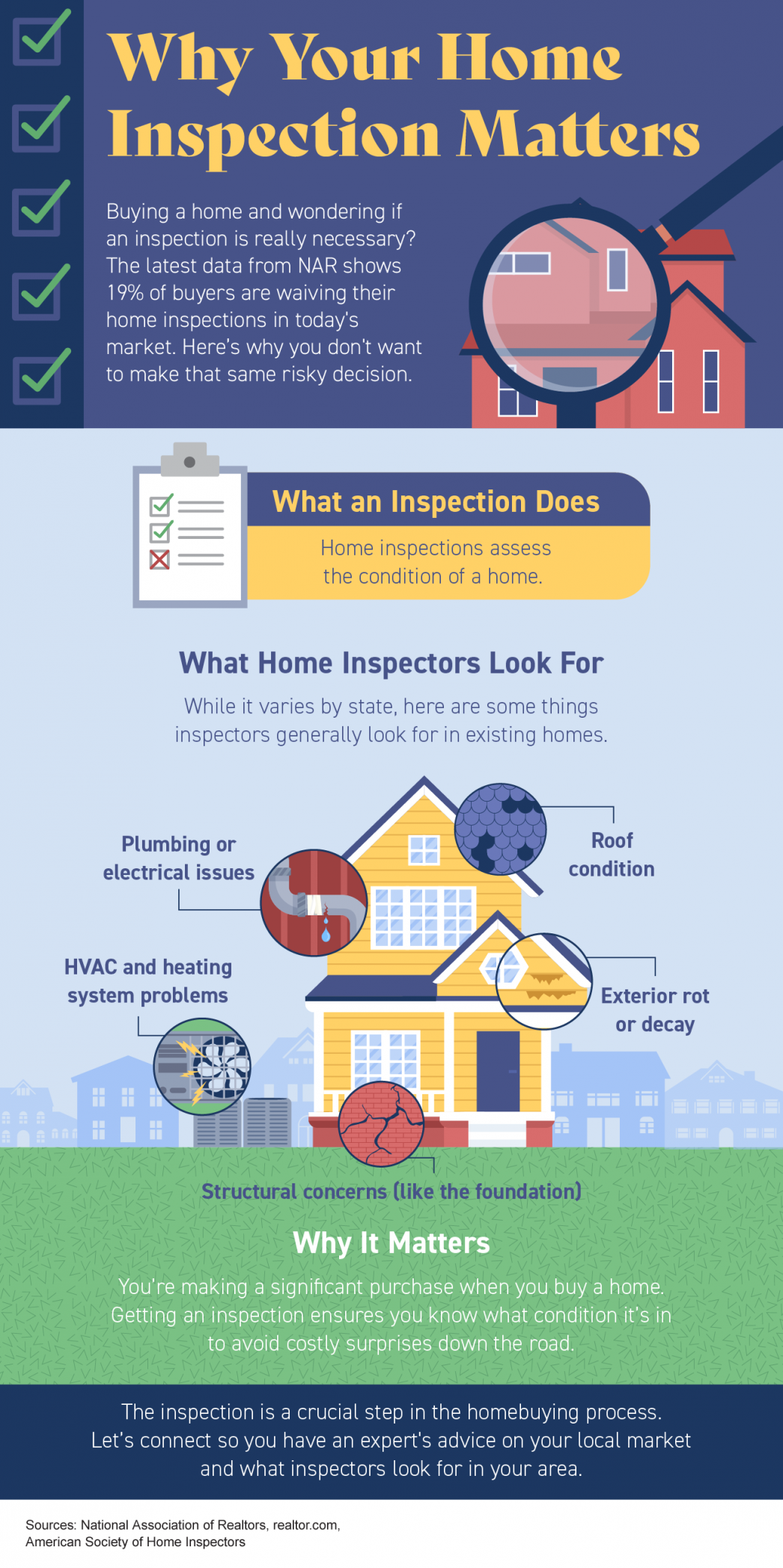

Why Your Home Inspection Matters

Why Your Home Inspection Matters Some Highlights Buying a home and wondering if your inspection is necessary? While some buyers may decide to waive their inspection, it’s risky decision. Your home inspection is a crucial step in the homebuying process. It assesses the...

Sold (My Favorite 4 Letter Word)

I Was able to help Sam and Lacie sell their home in Price Utah! Thank you for putting your trust in me! Sold (My Favorite 4 Letter Word)

Existing-home sales rose slightly during February after two consecutive months of regression.

Total existing-home sales increased by 3 percent last month to a seasonally-adjusted average of 5.54 million, according to the National Association of Realtors. Sales are up 1.1 percent from a year ago.

Buyer demand remains strong thanks to a healthy economy spurred by job growth and wage increases. While inventory levels are still low, they took a step in the right direction last month. Total housing inventory increased by 4.6 percent in February to 1.59 million existing homes for sale, per the NAR. However, inventory levels are down 8.1 percent compared to last year and has fallen year-over-year for 33 straight months.

Properties remained on the market for an average of 37 days last month and 46 percent of homes sold in February were listed for less than a month, per the NAR.

Housing affordability is becoming a concern as median existing-home prices continue to rise. The median existing-home price was $241,700 in February, an increase of 5.9 percent compared to February 2017.

Mortgage rates are also rising in tandem with home prices. The average commitment rate for a 30-year, conventional fixed-rate mortgage increased for the fifth straight month to 4.33 percent in February. That’s the highest rate since April 2014, when it was 4.34 percent.

NAR Chief Economist Lawrence Yun believes supply must start catching up to demand soon to balance the market.

“Mortgage rates are at their highest level in nearly four years, at a time when home prices are still climbing at double the pace of wage growth,” Yun said. “Homes for sale are going under contract a week faster than a year ago, which is quite remarkable given weakening affordability conditions and extremely tight supply.

To fully satisfy demand, most markets right now need a substantial increase in new listings.”

Yun believes unseasonably cold weather played a role in muting sales last month, particularly in the Northeast and the Midwest. Mother Nature could impact home sales in March as the Northeast braces for the fourth winter storm to cripple the region in roughly three weeks.