Does “Aging in Place” Make the Most Sense?

A desire among many seniors is to “age in place.” According to the Senior Resource Guide, the term means,

“…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.”

There is no doubt about it – there’s a comfort in staying in a home you’ve lived in for many years instead of moving to a totally new or unfamiliar environment. There is, however, new information that suggests this might not be the best option for everyone. The familiarity of your current home is the pro of aging in place, but the potential financial drawbacks to remodeling or renovating might actually be more costly than the long-term benefits.

A recent report from the Joint Center for Housing Studies of Harvard University (JCHS) titled Housing America’s Older Adults explained,

“Given their high homeownership rates, most older adults live in single-family homes. Of the 24 million homeowners age 65 and over, fully 80 percent lived in detached single-family units…The majority of these homes are now at least 40 years old and therefore may present maintenance challenges for their owners.”

If you’re in this spot, 40 years ago you may have had a growing family. For that reason, you probably purchased a 4-bedroom Colonial on a large piece of property in a child-friendly neighborhood. It was a great choice for your family, and you still love that home.

Today, your kids are likely grown and moved out, so you don’t need all of those bedrooms. Yard upkeep is probably very time consuming, too. You might be thinking about taking some equity out of your house and converting one of your bedrooms into a massive master bathroom, and maybe another room into an open-space reading nook. You might also be thinking about cutting back on lawn maintenance by installing a pool surrounded by beautiful paving stones.

It all sounds wonderful, doesn’t it? For the short term, you may really enjoy the new upgrades, but you’ll still have to climb those stairs, pay to heat and cool a home that’s larger than what you need, and continue fixing all the things that start to go wrong with a 40-year-old home.

Last month, in their Retirement Report, Kiplinger addressed the point,

“Renovations are just a part of what you need to make aging in place work for you. While it’s typically less expensive to remain in your home than to pay for assisted living, that doesn’t mean it’s a slam dunk to stay put. You’ll still have a long to-do list. Just one example: You need to plan ahead for how you will manage maintenance and care—for your home, and for yourself.”

So, at some point, the time may come when you decide to sell this house anyway. That can pose a big challenge if you’ve already taken cash value out of your home and used it to do the type of remodeling we mentioned above. Realistically, you may have inadvertently lowered the value of your home by doing things like reducing the number of bedrooms. The family moving into your neighborhood is probably similar to what your family was 40 years ago. They probably have young children, need the extra bedrooms, and may be nervous about the pool.

Bottom Line

Before you spend the money to remodel or renovate your current house so you can age in place, let’s get together to determine if it is truly your best option. Making a move to a smaller home in the neighborhood might make the most sense.

Keys to Selling Your House Virtually

Keys to Selling Your House VirtuallyIn a recent survey by realtor.com, people thinking about selling their homes indicated they’re generally willing to allow their agent and some potential buyers inside if done under the right conditions. They’re less comfortable,...

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big...

The Pain of Unemployment: It Will Be Deep, But Not for Long

The Pain of Unemployment: It Will Be Deep, But Not for LongThere are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million...

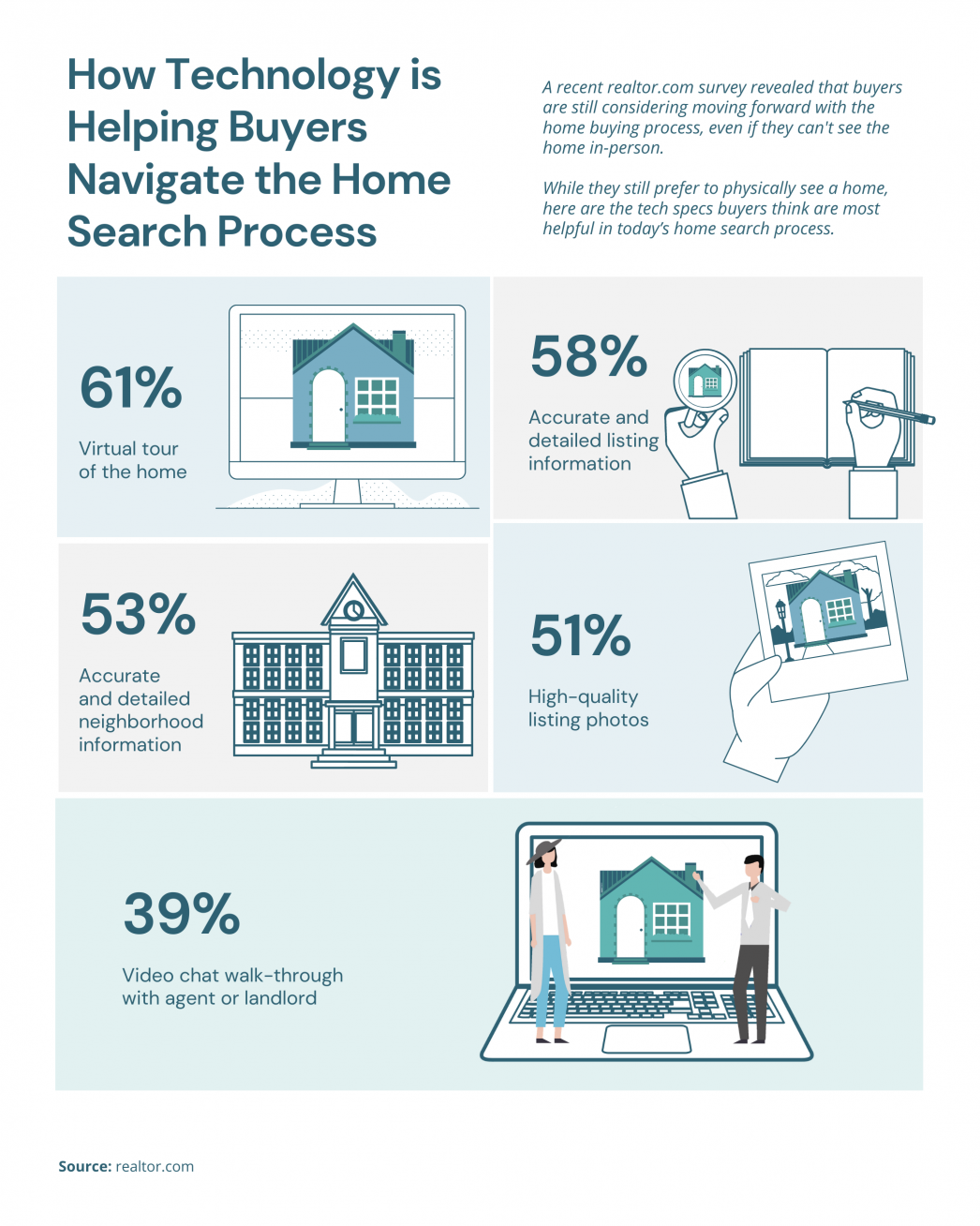

How Technology is Helping Buyers Navigate the Home Search Process

How Technology is Helping Buyers Navigate the Home Search Process Some Highlights:A recent realtor.com survey revealed that buyers are still considering moving forward with the homebuying process, even if they can’t see the home in-person.While they still prefer to...

A Recession Does Not Equal a Housing Crisis

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

Today’s Homebuyers Want Lower Prices. Sellers Disagree.Utah Single Family Inventory has risen from 5775 to 5940 from April 5th to April 16th.Utah County Single Family Inventory April 5th was 1401, April 16th up a little to 1466Salt Lake County Single Family Home...

Think This Is a Housing Crisis? Think Again.

Think This Is a Housing Crisis? Think Again.With all of the unanswered questions caused by COVID-19 and the economic slowdown we’re experiencing across the country today, many are asking if the housing market is in trouble. For those who remember 2008, it's logical to...

What If I Need to Sell My Home Now? What Can I Do?

What If I Need to Sell My Home Now? What Can I Do?Every day that passes, people have a need to buy and sell homes. That doesn’t stop during the current pandemic. If you’ve had a major life change recently, whether with your job or your family situation, you may be in...

Recession? Yes. Housing Crash? No.

Recession? Yes. Housing Crash? No.With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate...