Does “Aging in Place” Make the Most Sense?

A desire among many seniors is to “age in place.” According to the Senior Resource Guide, the term means,

“…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.”

There is no doubt about it – there’s a comfort in staying in a home you’ve lived in for many years instead of moving to a totally new or unfamiliar environment. There is, however, new information that suggests this might not be the best option for everyone. The familiarity of your current home is the pro of aging in place, but the potential financial drawbacks to remodeling or renovating might actually be more costly than the long-term benefits.

A recent report from the Joint Center for Housing Studies of Harvard University (JCHS) titled Housing America’s Older Adults explained,

“Given their high homeownership rates, most older adults live in single-family homes. Of the 24 million homeowners age 65 and over, fully 80 percent lived in detached single-family units…The majority of these homes are now at least 40 years old and therefore may present maintenance challenges for their owners.”

If you’re in this spot, 40 years ago you may have had a growing family. For that reason, you probably purchased a 4-bedroom Colonial on a large piece of property in a child-friendly neighborhood. It was a great choice for your family, and you still love that home.

Today, your kids are likely grown and moved out, so you don’t need all of those bedrooms. Yard upkeep is probably very time consuming, too. You might be thinking about taking some equity out of your house and converting one of your bedrooms into a massive master bathroom, and maybe another room into an open-space reading nook. You might also be thinking about cutting back on lawn maintenance by installing a pool surrounded by beautiful paving stones.

It all sounds wonderful, doesn’t it? For the short term, you may really enjoy the new upgrades, but you’ll still have to climb those stairs, pay to heat and cool a home that’s larger than what you need, and continue fixing all the things that start to go wrong with a 40-year-old home.

Last month, in their Retirement Report, Kiplinger addressed the point,

“Renovations are just a part of what you need to make aging in place work for you. While it’s typically less expensive to remain in your home than to pay for assisted living, that doesn’t mean it’s a slam dunk to stay put. You’ll still have a long to-do list. Just one example: You need to plan ahead for how you will manage maintenance and care—for your home, and for yourself.”

So, at some point, the time may come when you decide to sell this house anyway. That can pose a big challenge if you’ve already taken cash value out of your home and used it to do the type of remodeling we mentioned above. Realistically, you may have inadvertently lowered the value of your home by doing things like reducing the number of bedrooms. The family moving into your neighborhood is probably similar to what your family was 40 years ago. They probably have young children, need the extra bedrooms, and may be nervous about the pool.

Bottom Line

Before you spend the money to remodel or renovate your current house so you can age in place, let’s get together to determine if it is truly your best option. Making a move to a smaller home in the neighborhood might make the most sense.

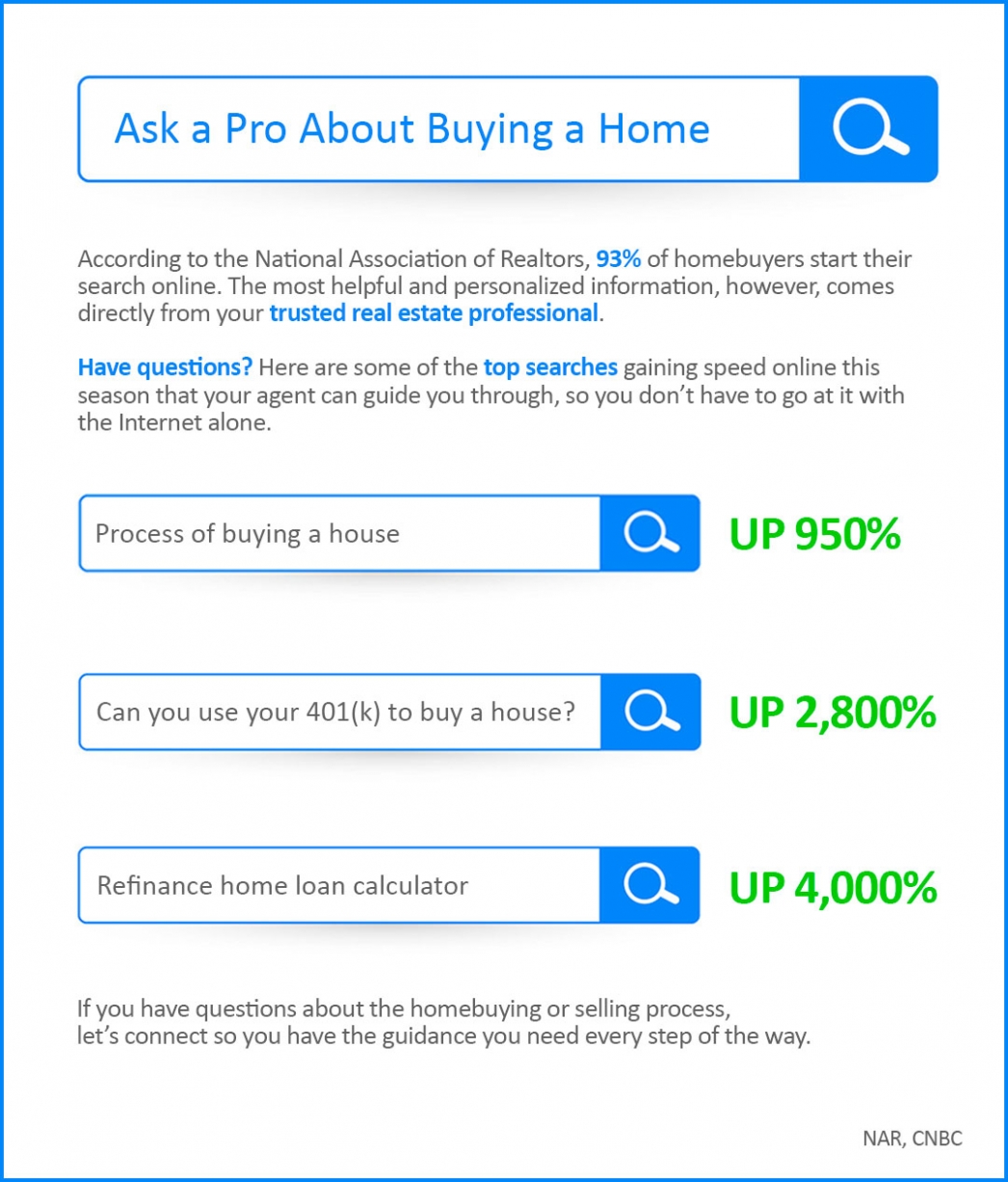

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

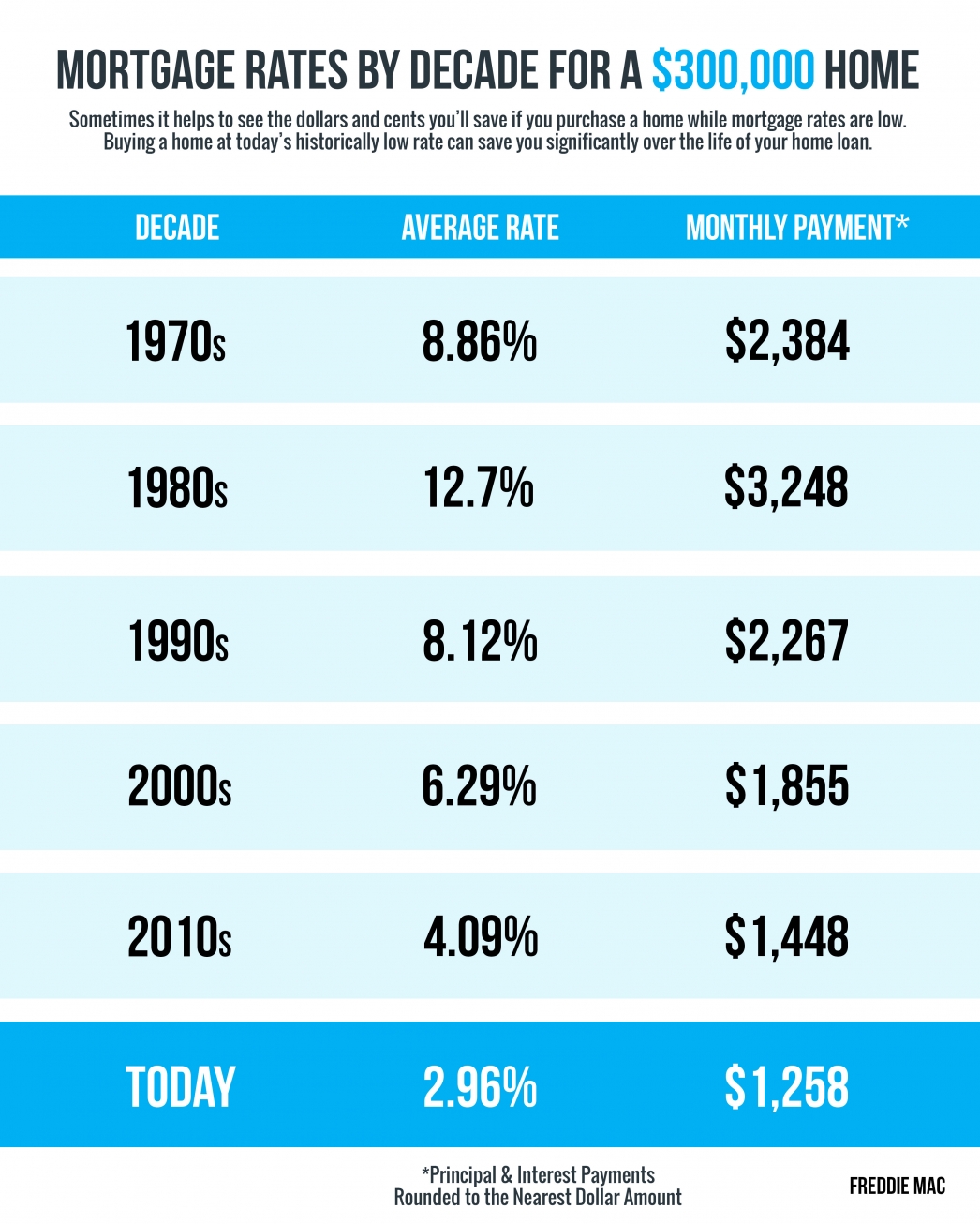

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...