Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

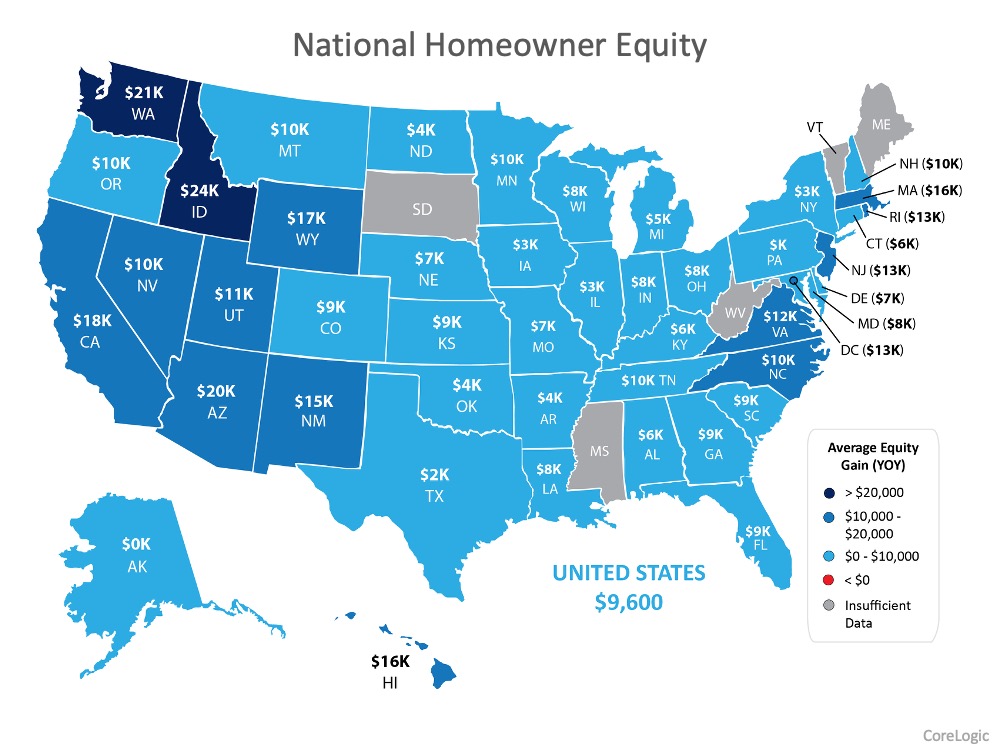

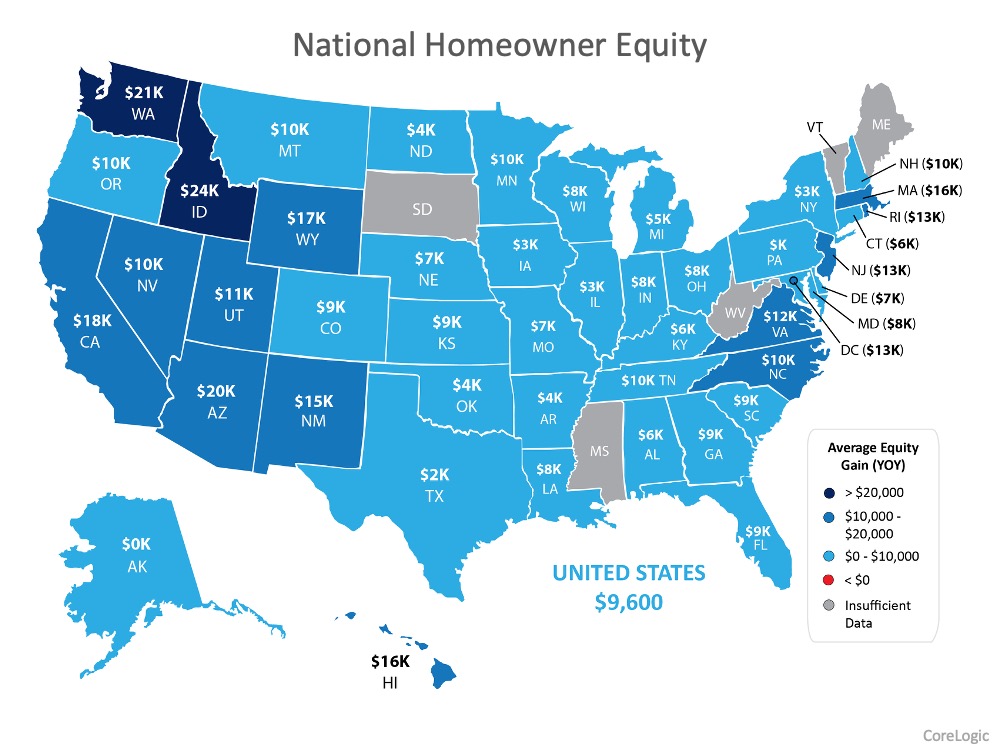

One of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights Report from CoreLogic, in nearly every state there was a year-over-year first-quarter equity increase, averaging out to a 6.5% overall gain.

The report notes:

“CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $590 billion since the first quarter of 2019, an increase of 6.5%, year over year.” (See map below):

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

That’s a huge win for homeowners, especially for those looking to sell their houses and make a move this summer. Having equity to re-invest in your next home is a major force that can make moving a reality, especially while buyers are expressing such a high demand for homes to purchase.

Frank Martell, President and CEO of CoreLogic addresses the potential long-term outlook and how homeowners will likely fare much more positively through the current recession than many did during the last one:

“Many homeowners will experience a recession during their lifetime, and it is reasonable to compare the current recession to those in the past. But the comparison is not apples to apples — every recession is different. Primary drivers of the Great Recession were an overbuilt housing stock, risky mortgages and the collapse of home prices, creating a massive increase in negative equity that proved difficult to recover from. Today’s housing environment has low vacancy and delinquency rates and a large home equity cushion.”

Bottom Line

Now is a great time to consider leveraging your equity and making a move, especially while buyer interest is high. Let’s connect to explore your equity position and make your next move a reality.

There are a number of reasons people need to sell their house. So if you’re on a deadline to sell quick, you might feel entirely alone in your circumstance.

This is because most people who sell their home do it the traditional method, believing that there is no effective alternative. Let Utah Realty bring many buyers to you and let you pick the best offer for you! In many cases we will drive your price up and put you in the decision drivers seat! Utah Realty with over 3 decades of experience, will make it incredibly simple to sell you house fast and easy and for top Dollar! Request your profit calculator quote today!

The Home Selling Method That’s Fast, Easy and Stress Free!

Reasons Why You Need or Want to Sell Fast?

We have encountered many different reasons homeowners might need to get their home sold fast.

Some of the reasons we have come across are inherited or distressed homes. Medical problems that suddenly appear, keeping up the with the utilities and taxes. Balloon due on the note. just to mention a few.

Other additional reasons why you want to sell your home as quick. Using Utah Realty might be the best first call you make!

Just totally burned out on the rental game

More so if you live out of town or out of State. Homeowners that have rentals get bogged down by problematic tenants. Squatters or tenants that make it a pastime to live in homes as long as possible without paying rent. Even people breaking in to your vacant rental and establishing a residence.

The home has become so run down it is beyond your ability to repair.

Up keep on home can be overwhelming financially and emotionally. Sometimes homes with fire damage, flood damage, meth contamination or just structural damages may not be worth hanging on to. Call Utah Realty for help and advise!

Contrary to popular belief, receiving a home from a deceased relative’s estate is not always a gift, and dealing with probate in these cases can be a headache. Why not sell to experienced home buyers who can do more with the property than you can?

Relocation is the factor

A new job moves you out of state or too far to drive, military deployment, Rightsizing or some type family health needs place you in a situation you might what to be closer to certain medical care.

You’re Undergoing Financial Problems

You just lost your job. are nearing foreclosure, obtained a new job that does not cover you expenses and can’t manage your debt anymore, the smart option may be to call Utah Realty for answers and advise, its free! Three decades of experience for you.

For Sale by Owner

What is Zillow

buy my house for cash

we buy houses for cash reviews

need to sell my house fast

companies that buy houses reviews

Selling the House When You Divorce

One of the options you have to deal with the house during divorce is to sell it and divide the proceeds.

If neither spouse wants to stay in the family home, or if neither can afford to buy out the other, you can put the property on the market and try to get the best possible price for it. Keep in mind that before the sales proceeds can be divided, you’ll have to pay off the mortgage, any equity line or second mortgage, and the brokers’ fees. You’ll also have to pay any capital gains tax that might apply. These expenses are one disadvantage of selling, especially if market conditions aren’t good for sellers. Another disadvantage is the need to uproot the kids when they’re already adjusting to a lot of change.

How to Avoid Costly Housing Mistakes During and After a Divorce

Divorce is rarely easy and often means a lot of difficult decisions. One of the most important decisions is what to do about the house.

In the midst of the heavy emotional and financial turmoil, what you need most is some non-emotional, straightforward, specific information and answers. Once you know how a divorce affects your home, your mortgage and taxes, critical decisions are easier. Neutral, third party information can help you make logical, rather than emotional, decisions.

Probably the first decision is whether you want to continue living in the house. Will the familiar surroundings bring you comfort and emotional security, or unpleasant memories? Do you want to minimize change by staying where you are, or sell your home and move to a new place that offers a new start?

Only you can answer those questions, but there will almost certainly be some financial repercussions to your decision process. What can you afford? Can you manage the old house on your new budget? Is refinancing possible? Or is it better to sell and buy? How much house can you buy on your new budget?

To help you know what questions you should ask and how to arrive at the right answer for your specific situation, a FREE special report has been prepared by industry experts entitled “Divorce: What You Need to Know About Your House, Your Home Loan and Taxes”.

Order this report NOW to find out how to make this part of your current situation less stressful. Don’t need a report and just want questions answered. Contact us today for a private confidential discussion. Laurie at 801-205-1600 or Marty at 801-205-3500 Free No obligation! We have worked with dozens of families like yours!

Notice Consumer Warning!! Attention Home Buyers!!

Attention Home Sellers!!

Is the Home You are Looking at ON-LINE Really For Sale???

Did you know the facts about where listings are originated?

Buyers beware of the Large Corporate Sites acting as posers in our real estate market! Posing as experts of value?

Sellers beware – over 98% of people looking on these sites are not buyers!

- Fact – an entirely new industry has been created that is based on EXPLOITATION of properties for sale.

- Fact – this system impedes the information pipeline by not getting you in touch with the actual listing agent who has accurate information about the property.

- Fact – as a result, all parties involved in the sales process including home sellers, prospective home buyers, real estate agents and brokers are HURT. The public is routinely MISLED.

When I and other real estate professionals create a property listing in our local Multiple Listing Service, we are given the choice of authorizing the sharing of that listing. One source is Internet Data Exchange or (IDX) with a member of the Multiple Listing Service organization. Brokers within the same Membership or MLS share, market and display other Brokers listings. This is controlled through the Local Board of Realtors®. Utah State Rules governing the real estate industry dictate that the Brokerage name must be listed on every displayed site.

The other way of sharing. Is known as listing syndication. Due to the poor standards currently in place, the listing then enters the proverbial “BLACK HOLE.”

Syndication sites are not part of the local Board of Realtors® and are not bound by any rules WHATSOEVER!

Sold properties or properties not on the market continue to be displayed as available for sale properties. How would you like to have people driving by the home you just bought to ask if it is for sale? Peeking in the windows? Walking around your home?

What is the result for Home Buyers and Home Owners?

Home buyers, when on these syndicated sites are looking at homes that are either NO LONGER FOR SALE, SOLD, OFF MARKET, AND EVEN NEVER FOR SALE AT ALL!

Only about 66% of the actual “For Sale” listings make it to syndicated sites from our local MLS.

Syndicators will openly brag about the fact they have more properties than anyone else! That may be true …. However many times those properties are not really for sale!

These syndication sites sell ad space to real estate agents that may or may not have knowledge about the home displayed next to their photo on the webpage.

What happens? What does that mean?

Home buyers are directed to agents who are UNFAMILIAR with the home, but have paid for the buyer lead. These agents are then free to promote other homes or areas that are familiar to them. The result is an epic fail. Buyers miss out on the best INFORMATION, and sellers miss out on valuable showing OPPORTUNITIES!

Massive Problem! There are two really big syndication sites most everyone knows. Their names. …willow and …rulia.

Hundreds more! Many are borrowing data from Realtor® Sites all over the country.

Best Advice!

Stick with a local expert with a IDX site that is Approved by the local board of Realtors® that complies with the National Association of Realtors® code of ethics and standards of practice.

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”

This means that “In the first quarter of 2020, the average homeowner gained approximately $9,600 in equity during the past year.”