No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

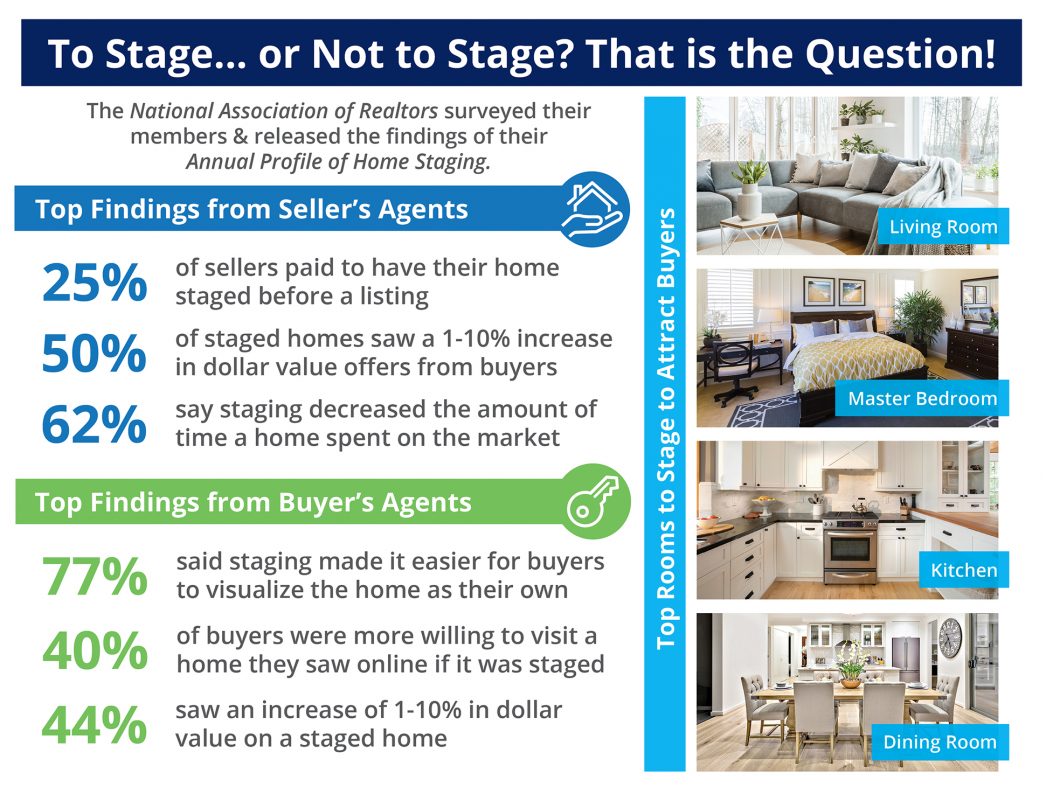

![The Impact Staging Your Home Has On Your Sale Price [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/05/06103923/To-Stage-ENG-STM-1046x808.jpg)

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

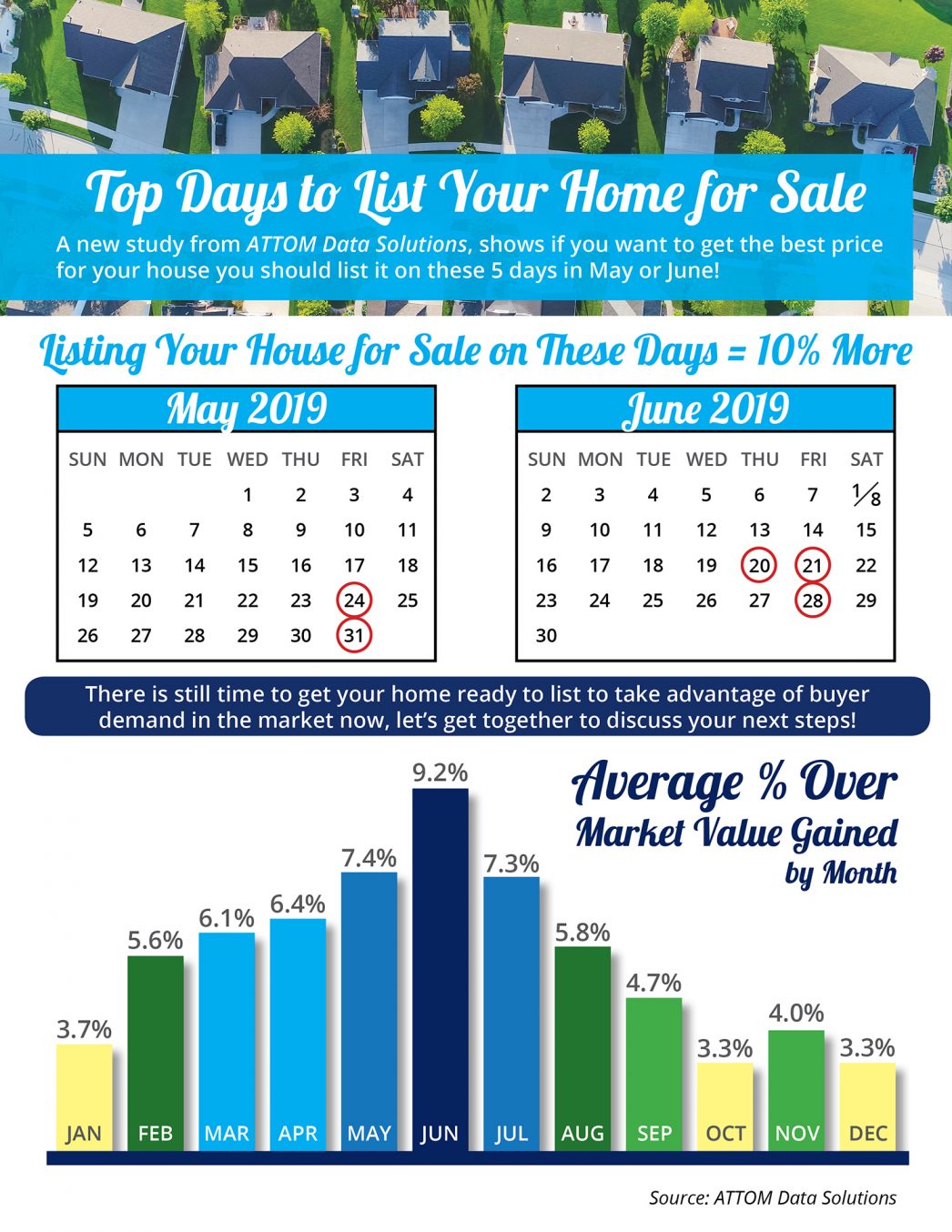

![Top Days to List Your Home for Sale [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/05/07122738/20190517-Top-Days-ENG-STM-1046x1354.jpg)

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

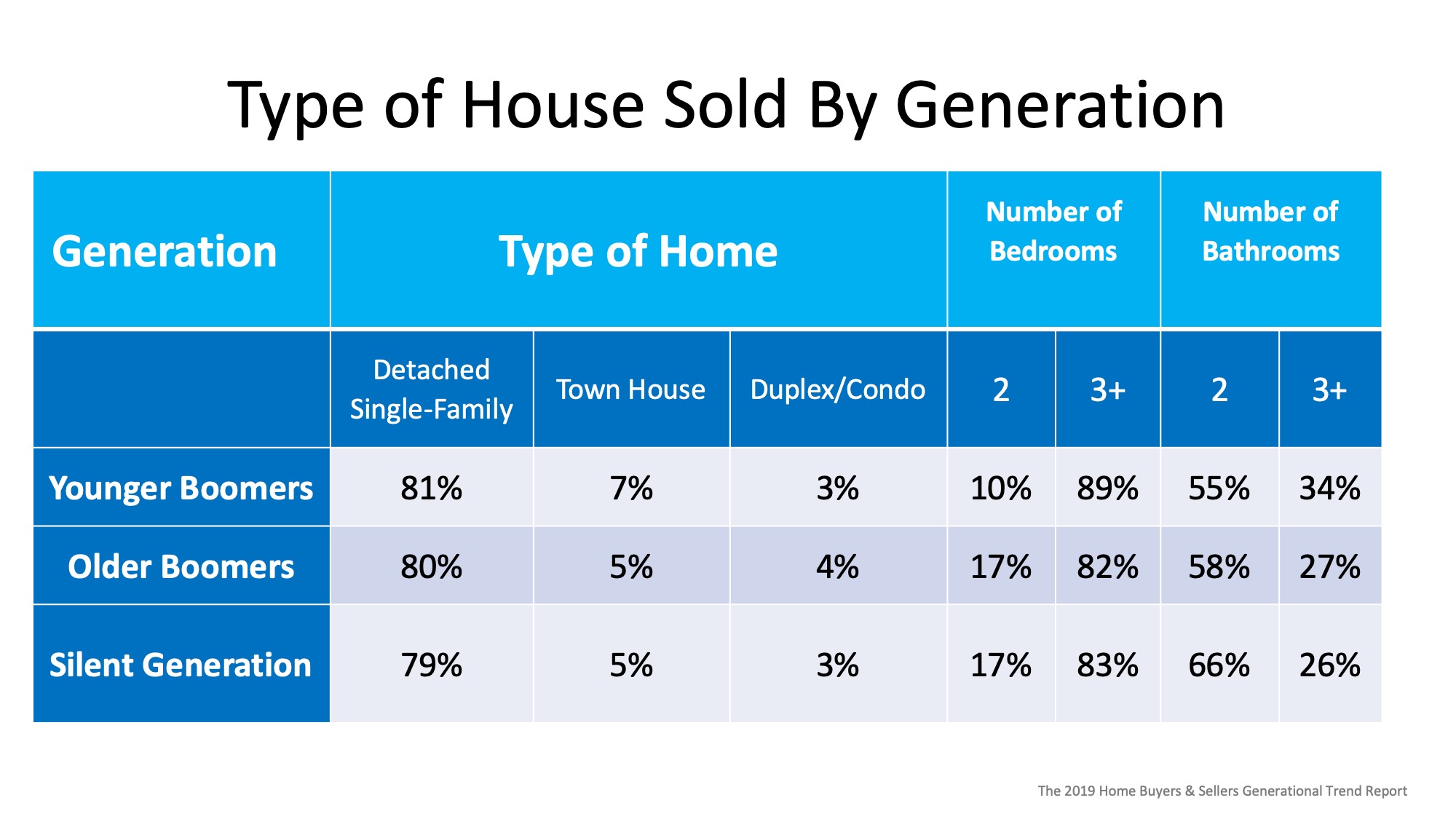

Many studies suggest one of the main reasons for the inventory shortage in today’s market of homes for sale is that older generations have chosen to “age in place” over moving.

NAR’s findings show that Baby Boomers (43%) and the Silent Generation (12%) made up 56% of sellers in 2018! This means the majority of sellers last year were over the age of 54. This also shows these generations ARE moving!

The report also shared the reasons why they chose to move. According to the research, the top reason was a desire to be closer to friends and family. Below is a full breakdown:

As we can see, they have plenty of reasons to sell their current home! But what type of homes are they trading in?

Once again, the report demonstrated that older generations are not keeping that 3-bedroom, 2-bath colonial home. Instead, they are putting it on the market and moving on with their lives!

If you are living in a house that no longer fits your needs, let’s get together to help you find a home that will!

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

In today’s real estate market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared.

In a realtor.com article entitled, “How to Find Your Dream Home—Without Losing Your Mind,” the author highlights some steps that first-time homebuyers can take to help carry their excitement of buying a home throughout the whole process.

One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search. Even if you are in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach.

This step will also help you narrow your search based on your budget and won’t leave you disappointed if the home you tour, and love, ends up being outside your budget!

Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now?

Before you start your search, list all the features of a home you would like and then qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help keep you focused on what’s most important.

Every neighborhood has its own charm. Before you commit to a home based solely on the house itself, the article suggests test-driving the area. Make sure that the area meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.”

Evaluate your family’s needs and settle on a style of home that would best serve those needs. Just because you’ve narrowed your search to a zip code, doesn’t mean that you need to tour every listing in that zip code.

An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.”

Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy to document what you love and don’t love about each property you visit.

Making notes on the listing sheet as you tour the property will also help you remember what the photos mean, or what you were feeling while touring the home.

In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

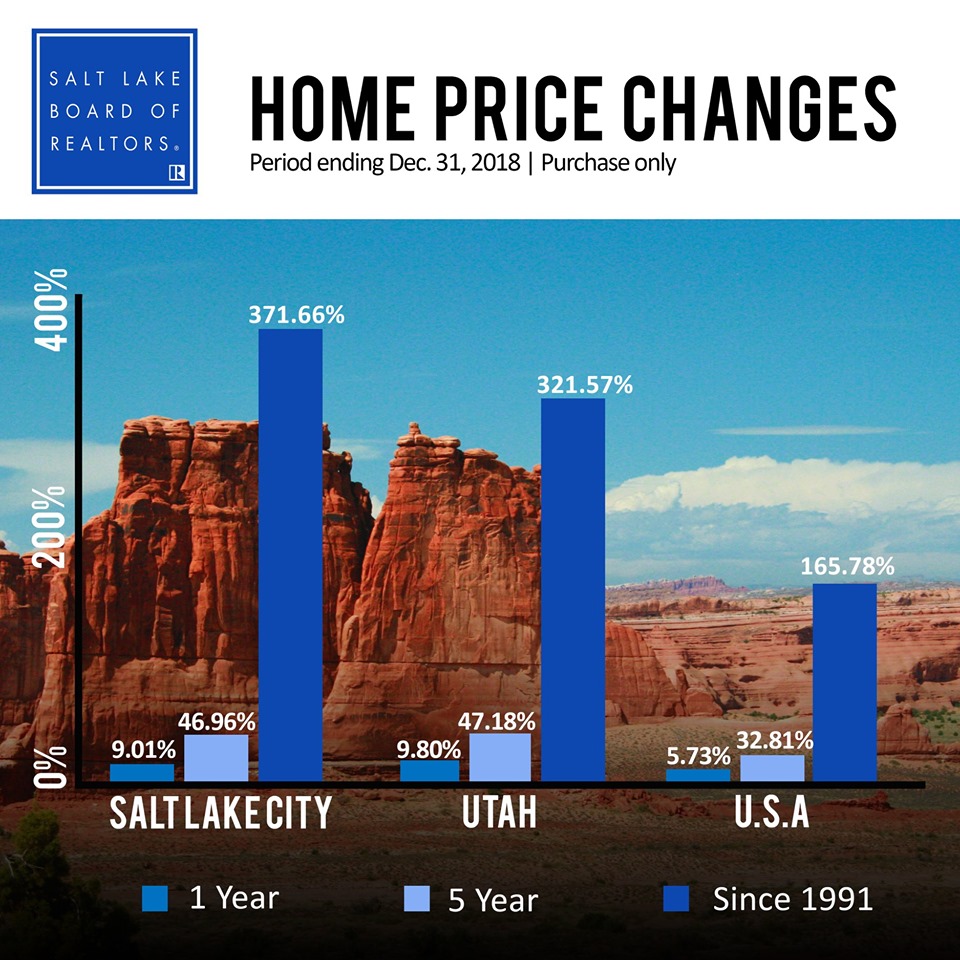

Salt Lake home prices have increased nearly 47 percent over the past five years, and more than 371 percent since 1991, according to a recent report by the Federal Housing Finance Agency. Nationwide, home prices have increased 32.81 percent over the same five-year period. Over the past year, home prices across Utah increased 9.80 percent, the third highest house-price appreciation of all states, the report said The FHFA House Price Index (HPI) is a broad measure of the movement of single-family house prices. The HPI is a weighted, repeat-sales index, meaning that it measures average price changes in repeat sales or refinancings on the same properties. (Courtesy of Salt Lake Board of Realtors)

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.