The median single-family home price in Salt Lake County in the fourth quarter increased to $378,000, up 8 percent compared to a median price of $350,000 in 2018’s fourth quarter.

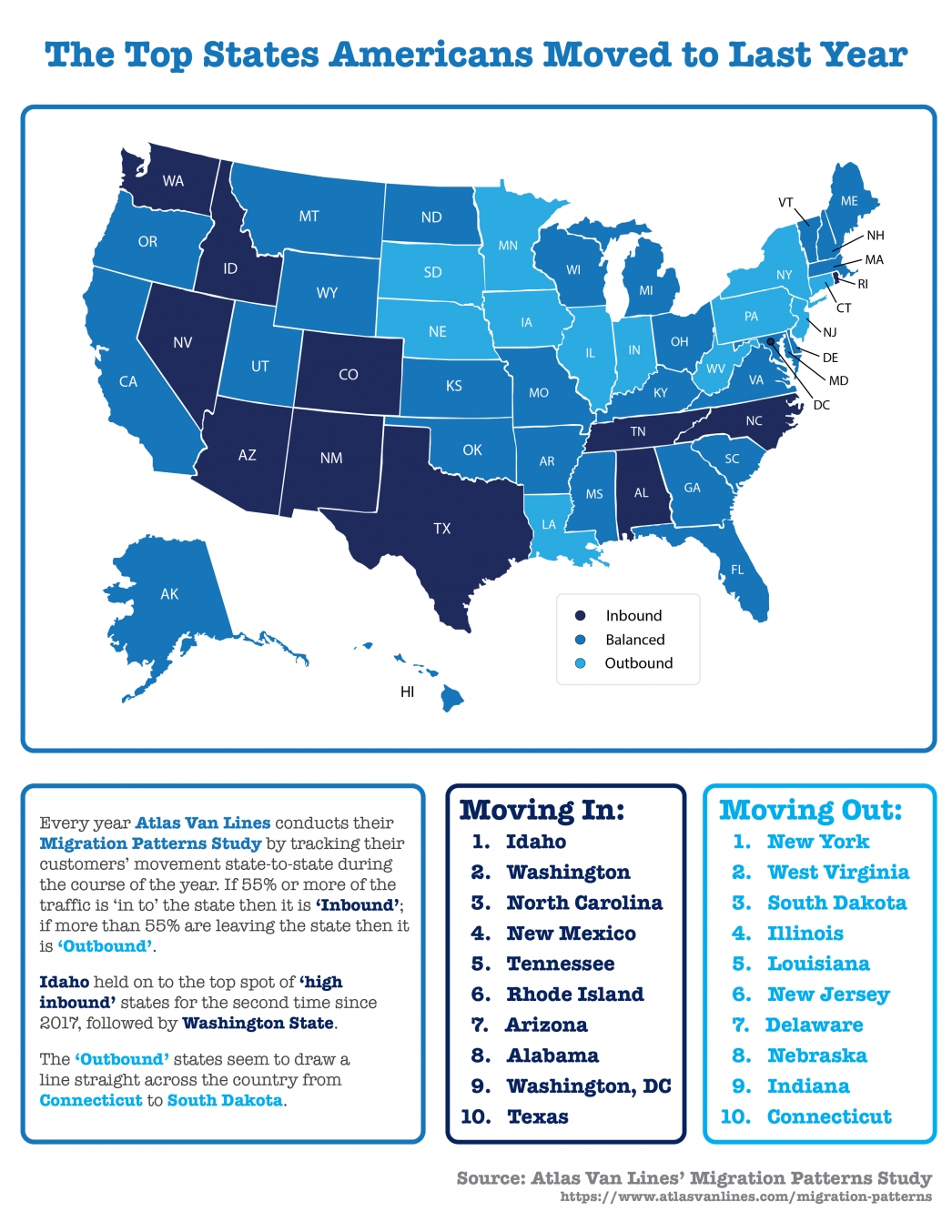

Strong demand for homes is being driven by net in-migration and population increase. In 2020, it is projected that Salt Lake County will add 13,700 people to the total county population, according to the 2020 Salt Lake Housing Forecast Report. New housing starts have lagged household formations, creating a housing deficit that continues to push prices higher. According to the Utah Housing Gap Coalition, over the past 10 years a 54,000-unit gap has accrued between the number of Utah families or individuals needing housing and the supply of housing units available.

Median home prices increased across all Wasatch Front counties including: Davis, up 9 percent; Tooele, up 12 percent; Utah, up 6 percent; and Weber, up 7 percent.

The top 10 highest median prices in the fourth quarter by ZIP code area were:

1. Alpine (84004) $752,500, up 30 percent

2. Emigration Canyon (84108) $646,500, up 24 percent

3. Avenues (84103) $644,000, up 14 percent

4. Eden (84310) $578,000, up 9 percent

5. Draper (84020) $570,000, up 8 percent

6. Sandy (84093) $533,500, up 11 percent

7. Holladay (84124) $528,500, up 11 percent

8. Sandy (84092) $518,500, up 10 percent

9. South Jordan (84095) $510,000, up 4 percent

10. Sugar House (84105) $497,430, up 11 percent

The five most affordable ZIP code areas were found in South Ogden ($237,250); Farr West ($252,500); Roy ($260,000); Glendale ($263,000); and Magna ($272,500).

Sales of single-family homes in Salt Lake County were up 1 percent in the fourth quarter year-over-year. Davis County sales increased 3 percent. Tooele County sales were up 7 percent. Utah County sales increased 11 percent. Sales in Weber County were up 4 percent.

The typical Salt Lake home was on the market 45 days in the fourth quarter before it sold, up from 40 days in 2018’s fourth quarter.

(courtesy of Salt Lake Board of Realtors)

![The Top States Americans Moved to Last Year [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/02/06035824/20200207-MEM-1046x1354.jpg)