Important News! Buying a Home Could Cost You!

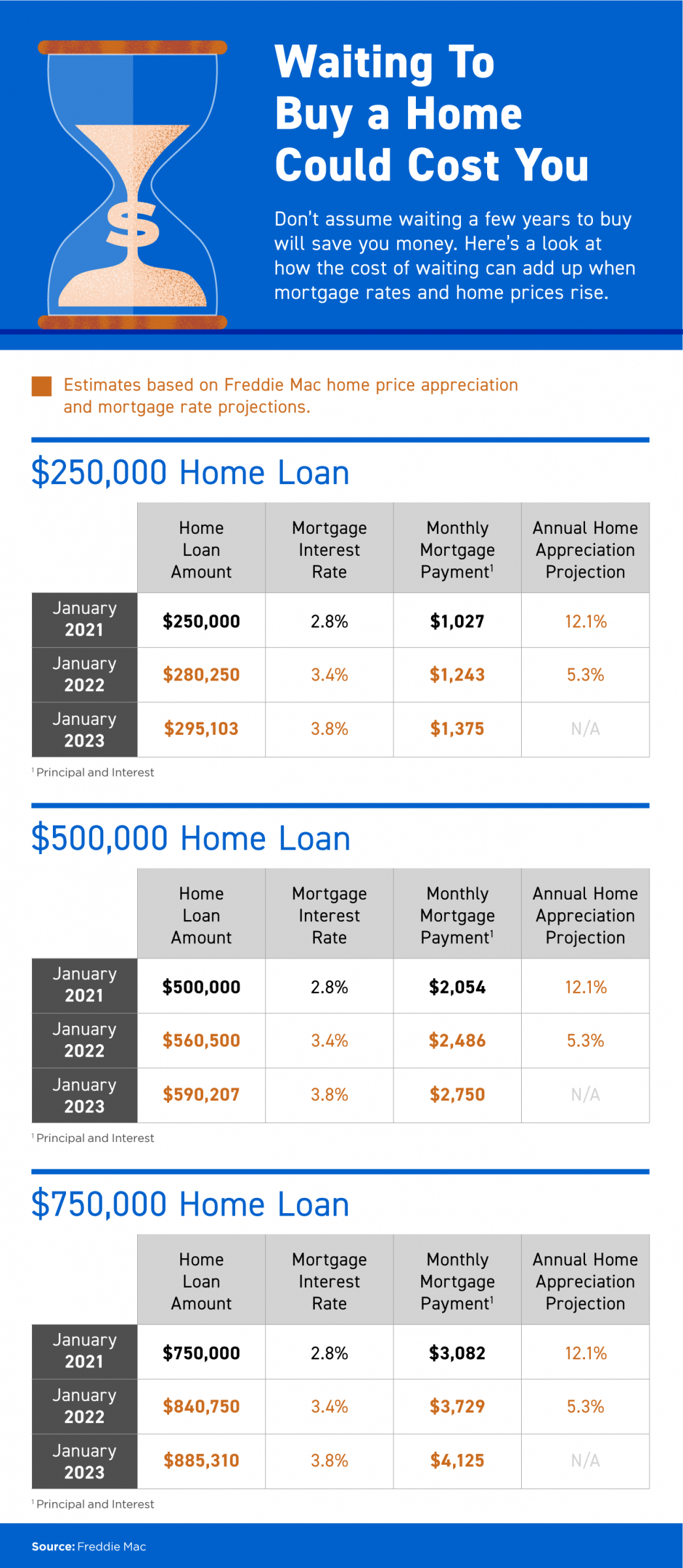

Waiting To Buy a Home Could Cost You

![Waiting To Buy a Home Could Cost You [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/07/29150353/20210723-MEM-1-1046x2403.png)

Some Highlights

- If you’re thinking of buying a home but wondering if waiting a few years will save you in the long run, think again.

- The longer the wait, the more you’ll pay, especially when mortgage rates and home prices rise. Even the slightest change in the mortgage rate can have a big impact on your buying power no matter your price point.

- Don’t assume waiting will save you money. Let’s connect to set the ball into motion today while mortgage rates are hovering near historic lows.

A Look at Home Price Appreciation Through 2025

A Look at Home Price Appreciation Through 2025

Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s equity. And with these recent gains, homeowners are witnessing their financial stability and well-being grow to record levels.

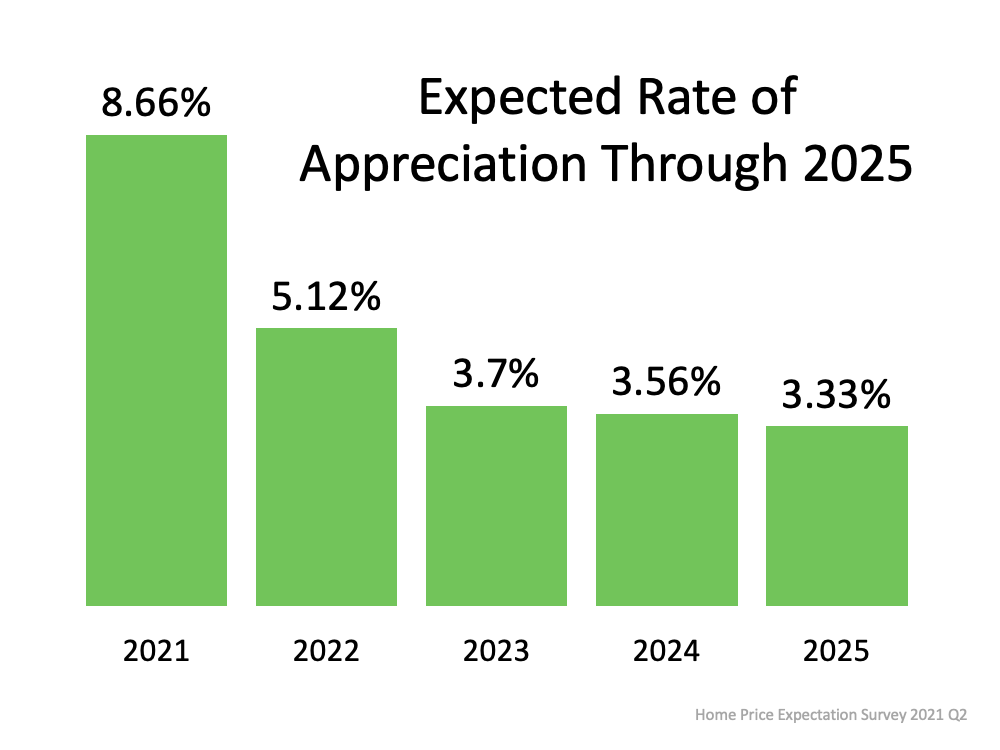

In more good news for homeowners, the most recent Home Price Expectations Survey – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists – forecasts home prices will continue appreciating over the next five years, adding to the record amount of equity homeowners have already gained over the past year. Below are the expected year-over-year rates of home price appreciation from the report:

What Does This Mean for Homeowners?

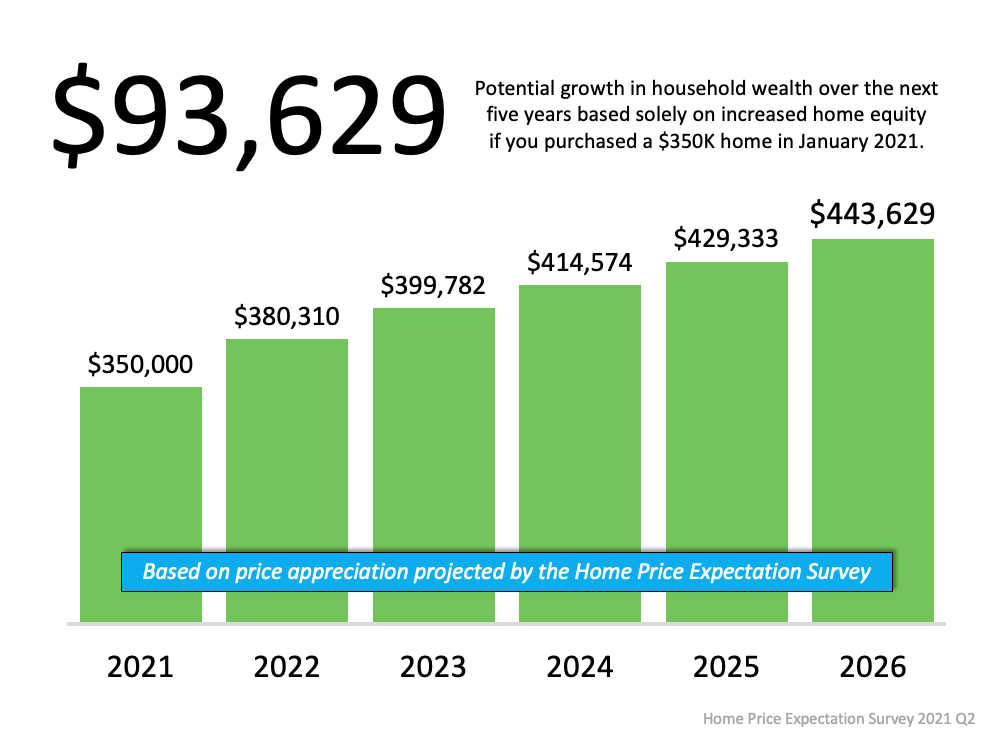

Home prices are climbing today, and the data in the survey indicates they’ll continue to increase, but at rates that approach a more normal pace. Even still, the amount of household wealth a homeowner stands to earn going forward is substantial. This truly becomes clear when we consider a scenario using a median-priced home purchased in January of 2021 and the projected rate of appreciation on that home over the next five years. As the graph below illustrates, a homeowner could increase their net worth by a significant amount – over $93,000 dollars by 2026.

Home Price Appreciation and Home Equity

CoreLogic recently released their quarterly Homeowner Equity Insights Report, which tracks the year-over-year increases in equity. It shows an average annual gain of $33,400 per borrower over the past 12 months. In the report, Dr. Frank Nothaft, Chief Economist for CoreLogic, further explains:

“Double-digit home price growth in the past year has bolstered home equity to a record amount. The national CoreLogic Home Price Index recorded an 11.4% rise in the year through March 2021, leading to a $216,000 increase in the average amount of equity held by homeowners with a mortgage.”

The expected, sustained growth of home prices means homeowners can continue to build on the past year’s record levels of home equity – and their financial prosperity. It also presents today’s homeowners with a unique opportunity: using their growing equity for a home upgrade. With so few homes available to purchase and strong buyer demand, there may not be a better time to sell your current house and move into one that better meets your needs.

Bottom Line

Home prices are expected to continue appreciating over the next five years, and the associated equity gains are the quickest way homeowners can build household wealth. If you’re a current homeowner who’s ready to take advantage of your built-up equity, let’s connect today to discuss your options.

Happy Independence Day

Happy Independence Day!

Wishing you a happy and safe Independence Day.

What Do Experts See on the Horizon for the Second Half of the Year 2021?

What Do Experts See on the Horizon for the Second Half of the Year?

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon?

Mortgage Rates Will Likely Increase, but Remain Low

Many experts are projecting a rise in interest rates. The latest Quarterly Forecast from Freddie Mac states:

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

However, even as mortgage rates rise, the anticipated increase is expected to be modest at most, and still well below historical averages. Rates remaining low is good news for homebuyers who are looking to maximize their purchasing power. The same report from Freddie Mac goes on to say:

“While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021….”

Home Price Appreciation Will Continue, but Price Growth Will Likely Slow

Joe Seydl, Senior Markets Economist at J.P. Morgan, projects home prices to continue rising as well, indicating buyers interested in purchasing a home should do so sooner rather than later. Waiting for rates or home prices to fall may not be wise:

“Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.”

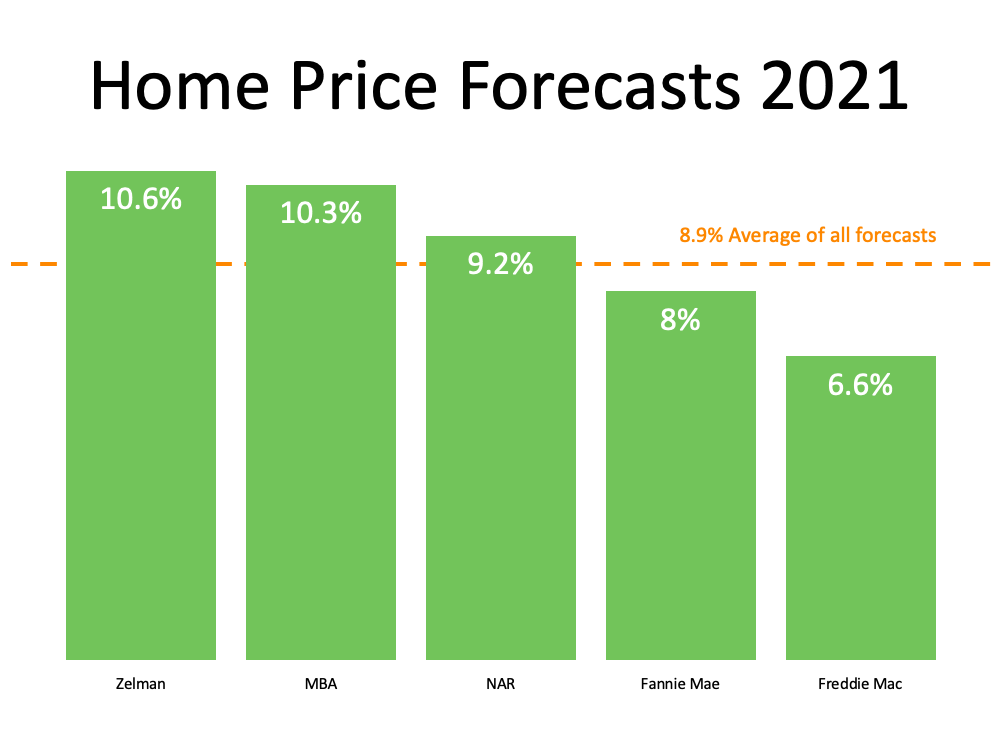

Other experts remain optimistic about home prices, too. The graph below highlights 2021 home price forecasts from multiple industry leaders:

Inventory Remains a Challenge, but There’s Reason To Be Optimistic

Home prices are rising, but they should moderate as more housing inventory comes to market. George Ratiu, Senior Economist at realtor.com, notes there are signs that we may see the current inventory challenges lessen, slowing the fast-paced home price appreciation and creating more choices for buyers:

“We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.”

New home starts are also showing signs of improvement, which further bolsters hopes of more options coming to market. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), writes:

“As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.”

Finally, while it may not fundamentally change the market conditions we’re currently experiencing, another reason to be optimistic more homes might come to market: our improving economy. Mark Fleming, Chief Economist at First American, notes:

“A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.”

Bottom Line

As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021. Let’s connect today to discuss how we can navigate the market together in the coming months.

What To Expect as Appraisal Gaps Grow

What To Expect as Appraisal Gaps Grow

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). Shawn Telford, Chief Appraiser at CoreLogic, elaborates:

“The frequency of buyers being willing to pay more than the market data supports is increasing.”

While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils.

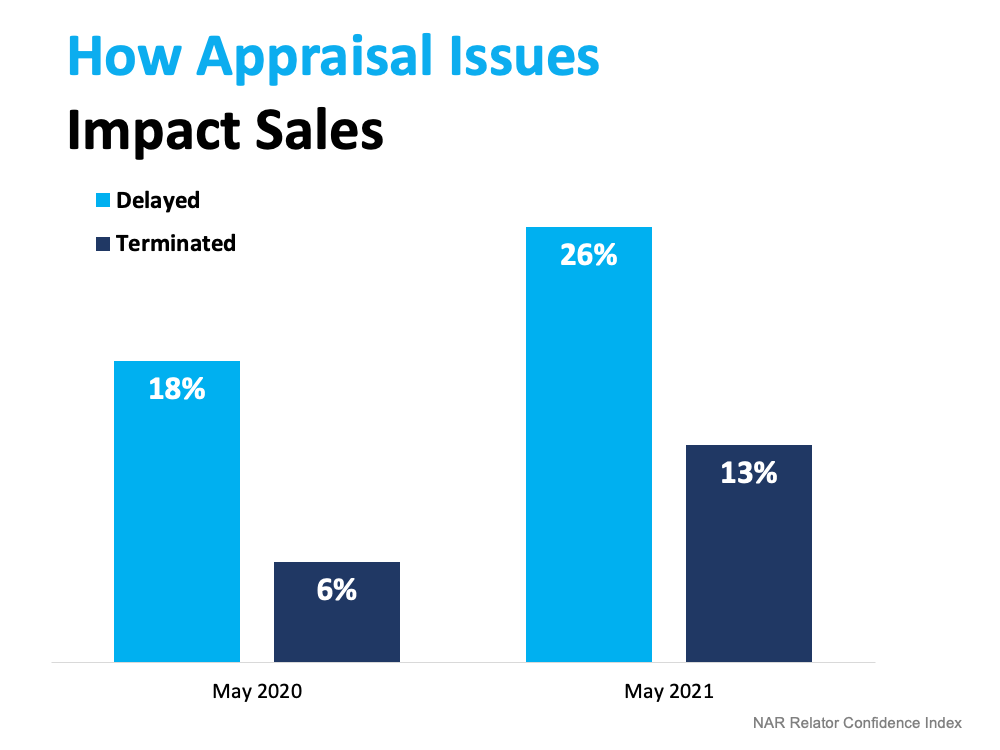

The chart below uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year. If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market.

Bottom Line

Whether you’re buying or selling, let’s connect so you have an ally throughout the process to help you navigate the unexpected, including appraisal gaps.