Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell

![Numbers Don’t Lie – It’s Still a Great Time To Sell [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/11/04145531/20211105-MEM-1046x2041.png)

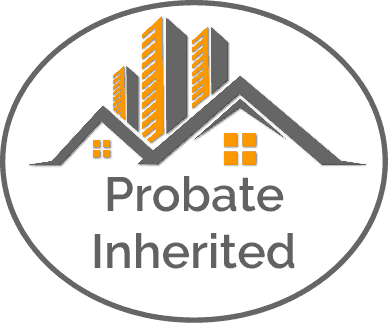

Some Highlights

- Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says.

- Housing supply is lower than last year, and home prices are up nationwide. Meanwhile, the average home is selling fast and receiving several offers. Listing now puts your house in the spotlight, meaning it could sell quickly – and for more than you’d expect.

- Feeling motivated? If you’re ready to sell and capitalize on today’s market, let’s connect.

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022

Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates have hit the lowest point ever recorded, and they’ve hovered in the historic-low territory. But even over the past few weeks, rates have started to rise. This past week, the average 30-year fixed rate was 3.14%.

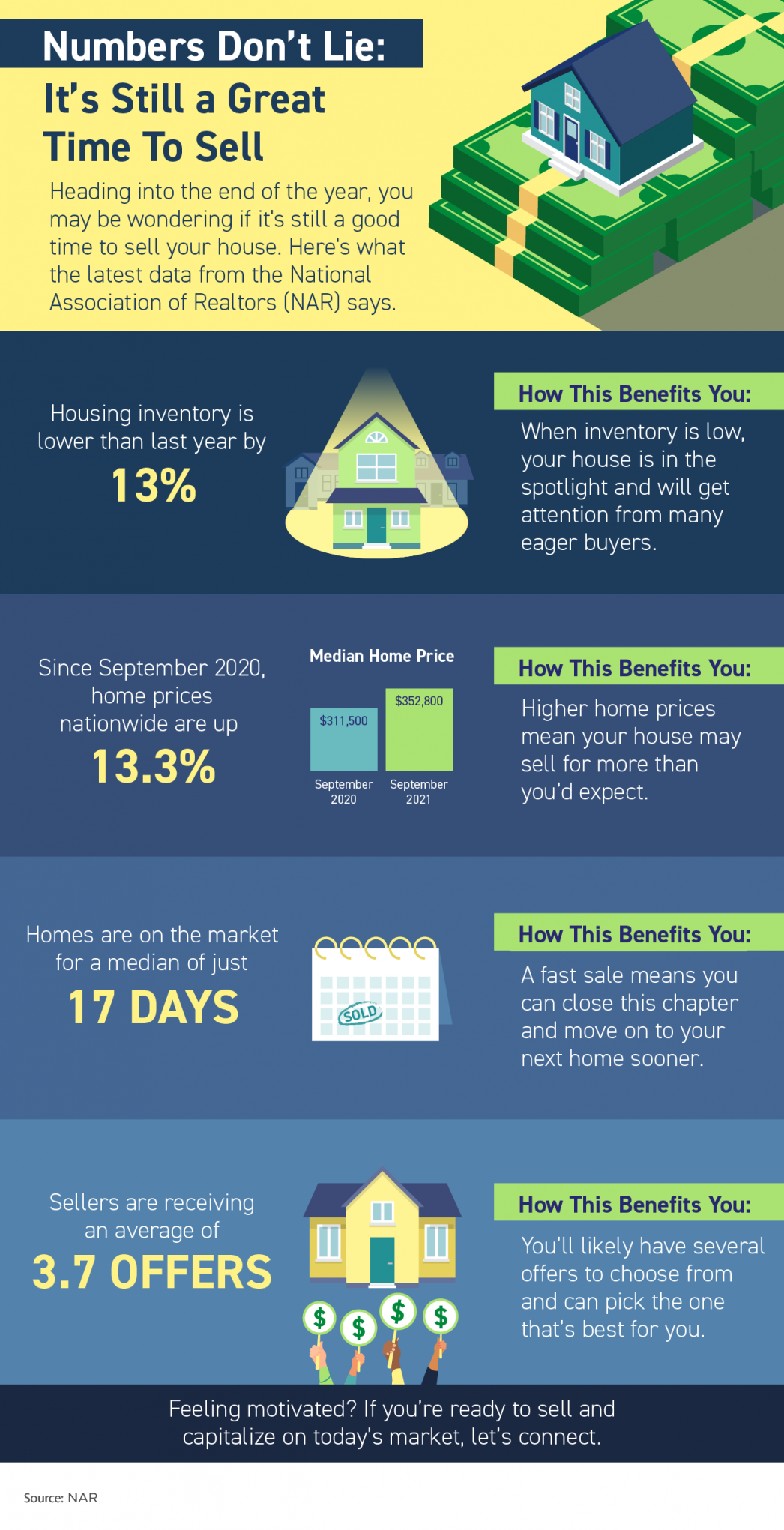

What does this mean if you’re thinking about making a move? Waiting until next year will cost you more in the long run. Here’s a look at what several experts project for mortgage rates going into 2022.

Freddie Mac:

“The average 30-year fixed-rate mortgage (FRM) is expected to be 3.0 percent in 2021 and 3.5 percent in 2022.”

Doug Duncan, Senior VP & Chief Economist, Fannie Mae:

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low and supportive of mortgage demand and affordability.”

First American:

“Consensus forecasts predict that mortgage rates will hit 3.2 percent by the end of the year, and 3.7 percent by the end of 2022.”

If rates rise even a half-point percentage over the next year, it will impact what you pay each month over the life of your loan – and that can really add up. So, the reality is, as prices and mortgage rates rise, it will cost more to purchase a home.

As you can see from the quotes above, industry experts project rates will rise in the months ahead. Here’s a table that compares other expert views and gives an average of those projections: Whether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s homebuying affordability. That could be just the game-changer you need to achieve your homeownership goals.

Whether you’re thinking about buying your first home, moving up to your dream home, or downsizing because your needs have changed, purchasing before mortgage rates rise even higher will help you take advantage of today’s homebuying affordability. That could be just the game-changer you need to achieve your homeownership goals.

Bottom Line

If you’re thinking of buying or selling over the next year, it may be wise to make your move sooner rather than later – before mortgage rates climb higher.

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market

With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), puts it best, saying:

“Housing demand remains strong as buyers likely want to secure a home before mortgage rates increase even further next year.”

But the sense of urgency they feel is complicated by the lack of homes for sale in today’s market. According to the latest Existing Home Sales Report from NAR:

“From one year ago, the inventory of unsold homes decreased 13%. . . .”

What Does This Mean for Sellers Today?

With buyers eager to purchase but so few homes available, sellers who list their houses this fall have a tremendous advantage – also known as leverage – when negotiating with buyers. That’s because, in today’s market, buyers want three things:

- To be the winning bid on their dream home.

- To buy before rates rise

- To buy before prices go even higher.

Your Leverage Can Help You Negotiate Your Best Terms

These three buyer needs give homeowners a leg up when selling their house. You might already realize this leverage enables you to sell at a good price, but it also means you can negotiate the best terms to suit your needs.

And since buyer demand is still high, there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, look closely at the terms of each offer to find out which one has the best perks for you.

If you have questions about what’s best for your situation, your trusted real estate advisor can help. They have the expertise and are skilled negotiators in all stages of the sales process.

Bottom Line

Today’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling. Let’s connect today to discuss how much leverage you have as a seller in today’s market.

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary

![The Mortgage Process Doesn’t Have To Be Scary [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/10/27142810/20211029-MEM-1046x1978.png)

Some Highlights

- Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare.

- Know your credit score and work to build strong credit. When you’re ready, lean on your agent to connect you with a lender so you can get pre-approved and begin your home search.

- Any major life change can be scary, and buying a home is no different. Let’s connect so you have an advisor by your side to take the fear out of the equation.

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends.

The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced historically.

There are many reasons for the limited number of homes on the market, but as you can see in the graph below, we’re well below where we’ve been for most of the past 10 years. Today, across the country, there is only a 2.4-month supply of homes available for sale.

The Opportunity

This lack of homes for sale is creating a challenge for many buyers who are growing frustrated in their search. On the other hand, this is a huge opportunity for sellers as low supply is driving up home values. According to CoreLogic, the average home has appreciated by more than $50,000 over the past year. And for many homeowners, that’s opening new doors as they re-think their needs and use their equity to move up or downsize.

According to Dr. Frank Nothaft, Chief Economist at CoreLogic:

“The average homeowner with a mortgage has more than $200,000 in home equity as of mid-2021.”

Today, many sellers are taking advantage of low interest rates and the equity they have in their homes to make a move.

Bottom Line

The biggest challenge in real estate is the lack of homes for sale, but this challenge is also an opportunity for sellers. If you’re thinking about selling your house, let’s connect to start the process.