Buying a Home Early Can Significantly Increase Future Wealth

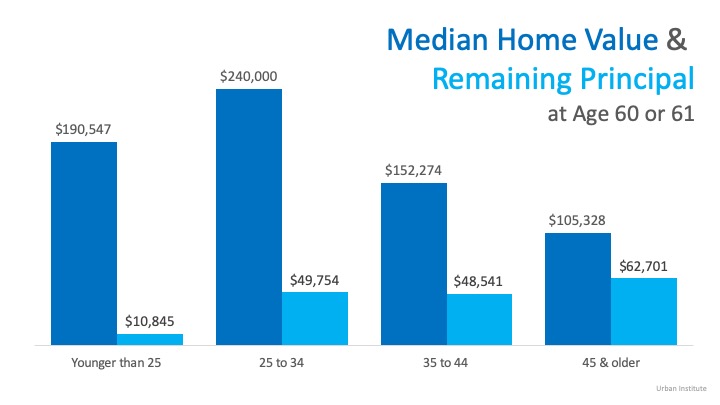

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

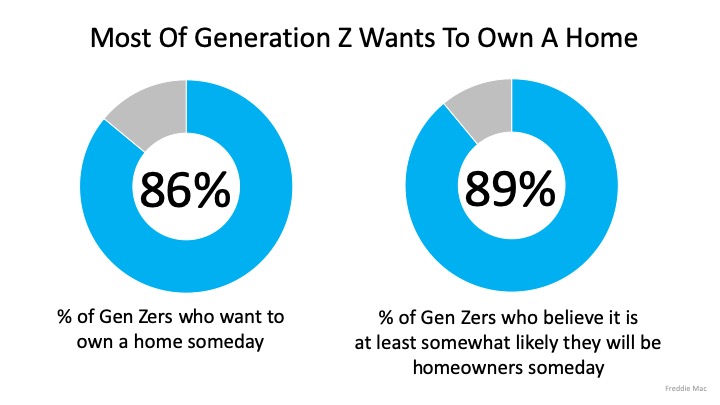

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

The Difference Having a Professional on Your Side Makes

The Difference Having a Professional on Your Side Makes In today’s fast-paced world, where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, with...

Utah Housing Loan Changes

Did you know? Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/ HomeAgain: May include an...

Buying a Home this Year?

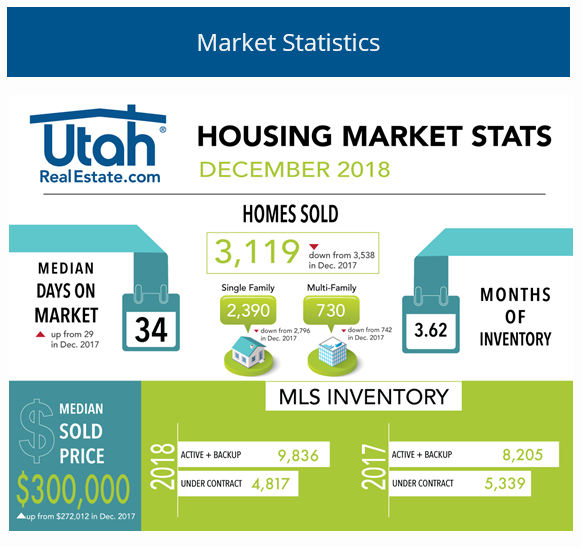

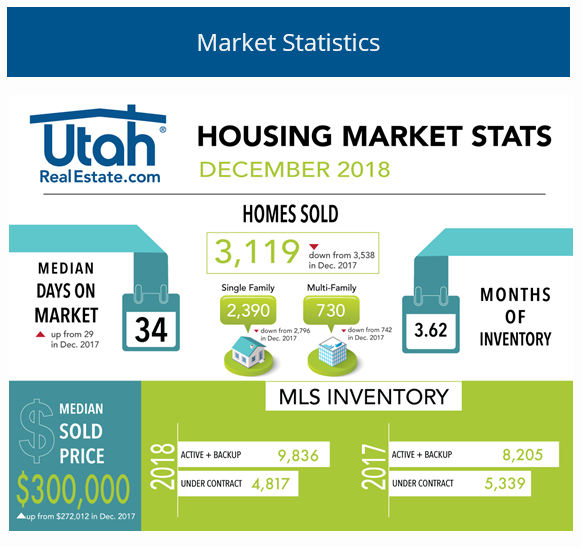

Utah Realty Market Statistics for December 2018

Housing Market Statistics for December of 2018

Average Home Mortgage Rates Over Time

With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years. Rates are projected to climb to 5.0% by this time next year according to Freddie Mac. The impact your interest rate makes on your monthly mortgage...

The best time to sell in Salt Lake and Utah County

https://bit.ly/2D0WkZv

Question??? Want to get the most money from the Sale of your Home?

Want to Get the Most Money from The Sale of Your Home? Use These 2 Tips! Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive the maximum value for your house? Here are two keys to...

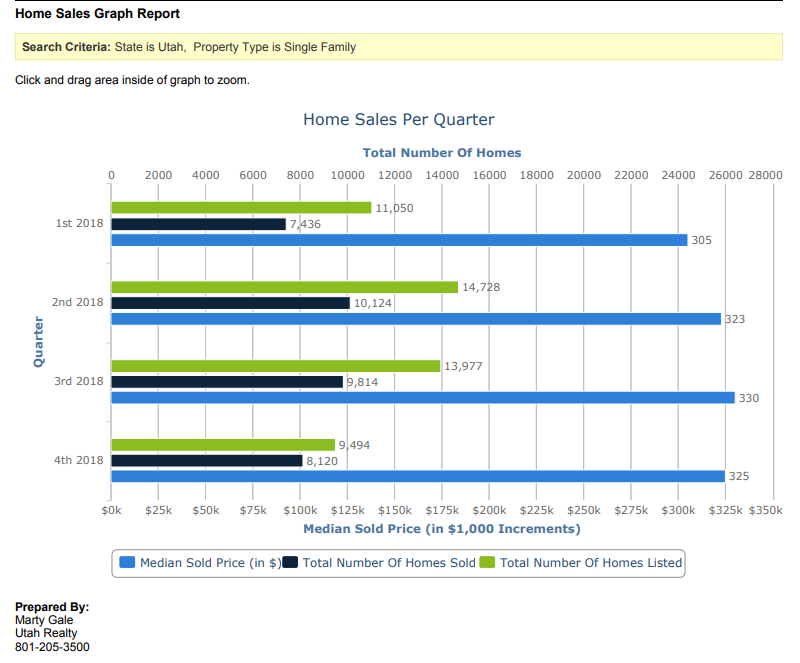

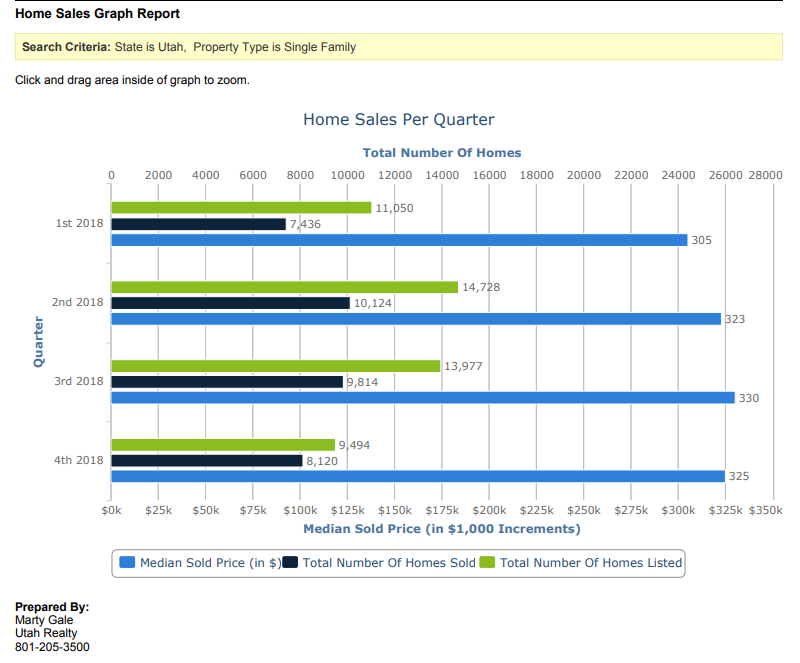

Year End Single Family & Condo Home Sales for Utah 2018

Utah Realty Magazine January 2019

[3d-flip-book mode="fullscreen" urlparam="fb3d-page" id="7193" title="false"]Enjoy Magazine January 2019 Utah Realty PDF Version

Top Renovations to Complete Before Selling

The Difference Having a Professional on Your Side Makes

The Difference Having a Professional on Your Side Makes In today’s fast-paced world, where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, with...

Utah Housing Loan Changes

Did you know? Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/ HomeAgain: May include an...

Buying a Home this Year?

Utah Realty Market Statistics for December 2018

Housing Market Statistics for December of 2018

Average Home Mortgage Rates Over Time

With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years. Rates are projected to climb to 5.0% by this time next year according to Freddie Mac. The impact your interest rate makes on your monthly mortgage...

The best time to sell in Salt Lake and Utah County

https://bit.ly/2D0WkZv

Question??? Want to get the most money from the Sale of your Home?

Want to Get the Most Money from The Sale of Your Home? Use These 2 Tips! Every homeowner wants to make sure they maximize their financial reward when selling their home. But how do you guarantee that you receive the maximum value for your house? Here are two keys to...

Year End Single Family & Condo Home Sales for Utah 2018

Utah Realty Magazine January 2019

[3d-flip-book mode="fullscreen" urlparam="fb3d-page" id="7193" title="false"]Enjoy Magazine January 2019 Utah Realty PDF Version

Top Renovations to Complete Before Selling

[mlcalc default=”mortgage_only”]