Buying a Home Early Can Significantly Increase Future Wealth

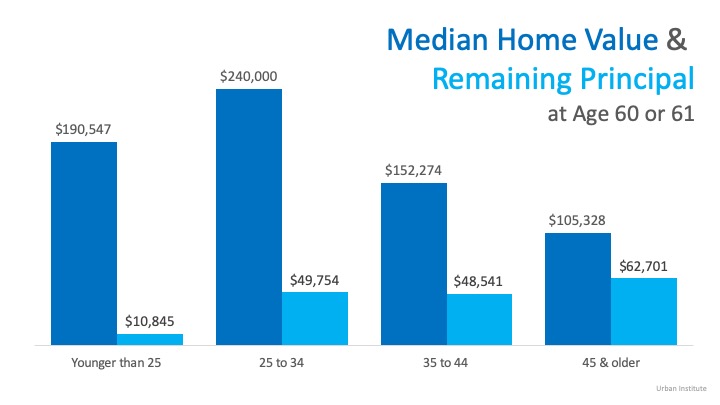

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

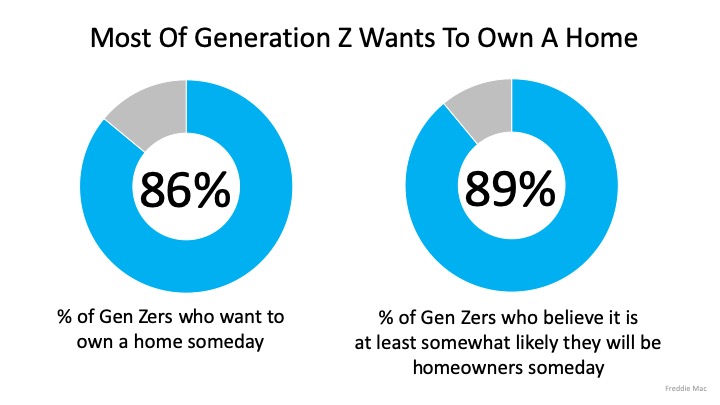

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Real Estate Will Lead the Economic Recovery

Real Estate Will Lead the Economic RecoveryWith more U.S. states reopening for business this summer, and as people start to return to work, we can expect the economy to begin improving. Most expert forecasts indicate this economic recovery will start to happen in the...

Unemployment Report Blows Away Skeptics

Unemployment Report Blows Away Skeptics Last Friday, the U.S. Bureau of Labor Statistics released their May Employment Situation Summary. Leading up to the release, most experts predicted the unemployment rate would jump up to approximately 20% from the 14.7% rate...

June is National Homeownership Month

National Homeownership Month Some Highlights National Homeownership Month is a great time to reflect on how we can each promote stronger community growth. Homeownership helps families build financial freedom, find greater happiness and satisfaction, and make a...

The Expert Economic Recovery Forecast

10 Questions to Ask an Elder Law Attorney

10 Questions to Ask an Elder Law Attorney Elder law attorneys cover a wide variety of legal areas, potentially including guardianship, long-term care planning, knowledge of government benefit programs, powers of attorney, estate planning, advance medical directives,...

Three Things to Understand About Unemployment Statistics

Three Things to Understand About Unemployment StatisticsTomorrow morning the Bureau of Labor Statistics will release the latest Employment Situation Summary, which will include the most current unemployment rate. It will be a horrific number. Many analysts believe...

Home Prices: It’s All About Supply and Demand

Home Prices: It’s All About Supply and Demand As we enter the summer months and work through the challenges associated with the current health crisis, many are wondering what impact the economic slowdown will have on home prices. Looking at the big picture, supply and...

The Benefits of Homeownership May Reach Further Than You Think

The Benefits of Homeownership May Reach Further Than You Think More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens...

Pandemic Mortgage Relief

Clients who are struggling financially because of the pandemic may look to you for advice if they can’t pay their mortgage.Keep up on mortgage relief options, so you’re prepared to guide them to appropriate resources.For instance, thanks to the Coronavirus Aid,...

Top Reasons to Own Your Home

Real Estate Will Lead the Economic Recovery

Real Estate Will Lead the Economic RecoveryWith more U.S. states reopening for business this summer, and as people start to return to work, we can expect the economy to begin improving. Most expert forecasts indicate this economic recovery will start to happen in the...

Unemployment Report Blows Away Skeptics

Unemployment Report Blows Away Skeptics Last Friday, the U.S. Bureau of Labor Statistics released their May Employment Situation Summary. Leading up to the release, most experts predicted the unemployment rate would jump up to approximately 20% from the 14.7% rate...

June is National Homeownership Month

National Homeownership Month Some Highlights National Homeownership Month is a great time to reflect on how we can each promote stronger community growth. Homeownership helps families build financial freedom, find greater happiness and satisfaction, and make a...

The Expert Economic Recovery Forecast

10 Questions to Ask an Elder Law Attorney

10 Questions to Ask an Elder Law Attorney Elder law attorneys cover a wide variety of legal areas, potentially including guardianship, long-term care planning, knowledge of government benefit programs, powers of attorney, estate planning, advance medical directives,...

Three Things to Understand About Unemployment Statistics

Three Things to Understand About Unemployment StatisticsTomorrow morning the Bureau of Labor Statistics will release the latest Employment Situation Summary, which will include the most current unemployment rate. It will be a horrific number. Many analysts believe...

Home Prices: It’s All About Supply and Demand

Home Prices: It’s All About Supply and Demand As we enter the summer months and work through the challenges associated with the current health crisis, many are wondering what impact the economic slowdown will have on home prices. Looking at the big picture, supply and...

The Benefits of Homeownership May Reach Further Than You Think

The Benefits of Homeownership May Reach Further Than You Think More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens...

Pandemic Mortgage Relief

Clients who are struggling financially because of the pandemic may look to you for advice if they can’t pay their mortgage.Keep up on mortgage relief options, so you’re prepared to guide them to appropriate resources.For instance, thanks to the Coronavirus Aid,...

Top Reasons to Own Your Home

[mlcalc default=”mortgage_only”]