Buying a Home Early Can Significantly Increase Future Wealth

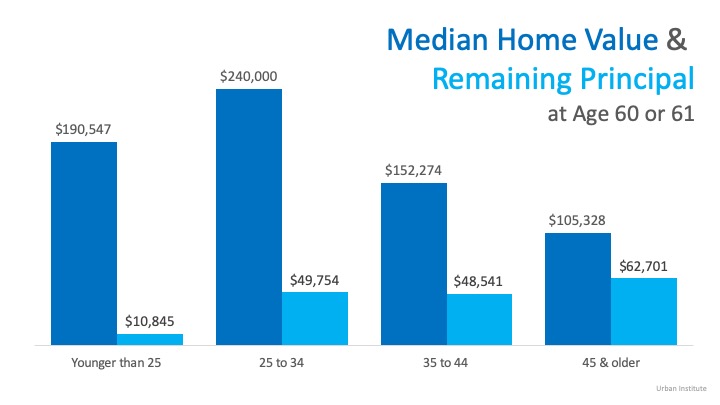

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

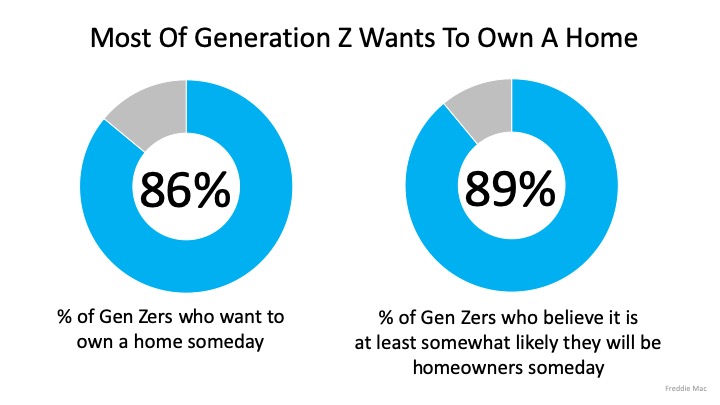

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

New Index Reveals Impact of COVID-19 on Real Estate

New Index Reveals Impact of COVID-19 on Real Estate Earlier this month, realtor.com announced the release of their initial Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market. The index leverages a weighted...

What Are the Experts Saying About Future Home Prices?

What Are the Experts Saying About Future Home Prices?A worldwide pandemic and an economic recession have had a tremendous effect on the nation. The uncertainty brought about by both has made predicting consumer behavior nearly impossible. For that reason, forecasting...

Utah Homebuyers Are in the Mood to Buy Today

Homebuyers Are in the Mood to Buy TodayAccording to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a...

Top Reasons to Own a Home in 2020

Find your home today!

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

Want to Make a Move? Homeowner Equity is Growing Year-Over-YearOne of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights...

Three Reasons Homebuyers Are Ready to Purchase In 2020

Three Reasons Homebuyers Are Ready to Purchase This YearA recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health...

Real Estate Tops Best Investment Poll for 7th Year Running

Real Estate Tops Best Investment Poll for 7th Year RunningEvery year, Gallup conducts a survey of Americans to determine their choice for the best long-term investment. Respondents are asked to select real estate, stocks/mutual funds, gold, savings accounts/CDs, or...

How Did Covid-19 pandemic affect Salt Lake County home sales

How did the Covid-19 pandemic affect Salt Lake County home sales? In April, sales of all housing types fell to an eight-year low, and were down 28 percent compared to April 2019. The silver lining? Deferred spring home sales are now being realized as the market...

Are You Ready for the Summer Housing Market?

Are You Ready for the Summer Housing Market? As the health crisis started making its way throughout our country earlier this spring, sellers have been cautious about putting their homes on the market. This hesitation stemmed primarily from fear of the spread of the...

Is a Recession Here? Yes. Does that Mean a Housing Crash? No.

Is a Recession Here? Yes. Does that Mean a Housing Crash? No. On Monday, the National Bureau of Economic Research (NBER) announced that the U.S. economy is officially in a recession. This did not come as a surprise to many, as the Bureau defines a recession this way:...

New Index Reveals Impact of COVID-19 on Real Estate

New Index Reveals Impact of COVID-19 on Real Estate Earlier this month, realtor.com announced the release of their initial Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market. The index leverages a weighted...

What Are the Experts Saying About Future Home Prices?

What Are the Experts Saying About Future Home Prices?A worldwide pandemic and an economic recession have had a tremendous effect on the nation. The uncertainty brought about by both has made predicting consumer behavior nearly impossible. For that reason, forecasting...

Utah Homebuyers Are in the Mood to Buy Today

Homebuyers Are in the Mood to Buy TodayAccording to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a...

Top Reasons to Own a Home in 2020

Find your home today!

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

Want to Make a Move? Homeowner Equity is Growing Year-Over-YearOne of the bright spots of the 2020 real estate market is the growth in equity homeowners are experiencing across the country. According to the recently released Homeowner Equity Insights...

Three Reasons Homebuyers Are Ready to Purchase In 2020

Three Reasons Homebuyers Are Ready to Purchase This YearA recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health...

Real Estate Tops Best Investment Poll for 7th Year Running

Real Estate Tops Best Investment Poll for 7th Year RunningEvery year, Gallup conducts a survey of Americans to determine their choice for the best long-term investment. Respondents are asked to select real estate, stocks/mutual funds, gold, savings accounts/CDs, or...

How Did Covid-19 pandemic affect Salt Lake County home sales

How did the Covid-19 pandemic affect Salt Lake County home sales? In April, sales of all housing types fell to an eight-year low, and were down 28 percent compared to April 2019. The silver lining? Deferred spring home sales are now being realized as the market...

Are You Ready for the Summer Housing Market?

Are You Ready for the Summer Housing Market? As the health crisis started making its way throughout our country earlier this spring, sellers have been cautious about putting their homes on the market. This hesitation stemmed primarily from fear of the spread of the...

Is a Recession Here? Yes. Does that Mean a Housing Crash? No.

Is a Recession Here? Yes. Does that Mean a Housing Crash? No. On Monday, the National Bureau of Economic Research (NBER) announced that the U.S. economy is officially in a recession. This did not come as a surprise to many, as the Bureau defines a recession this way:...

[mlcalc default=”mortgage_only”]