Buying a Home Early Can Significantly Increase Future Wealth

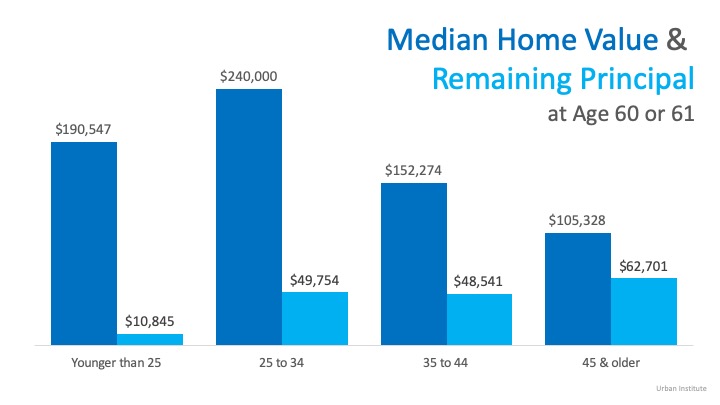

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

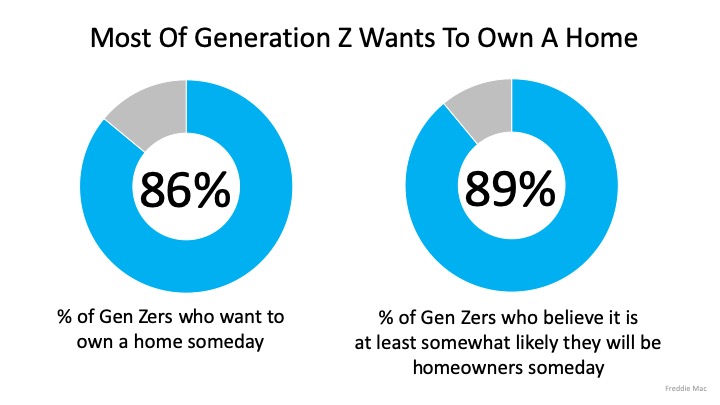

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

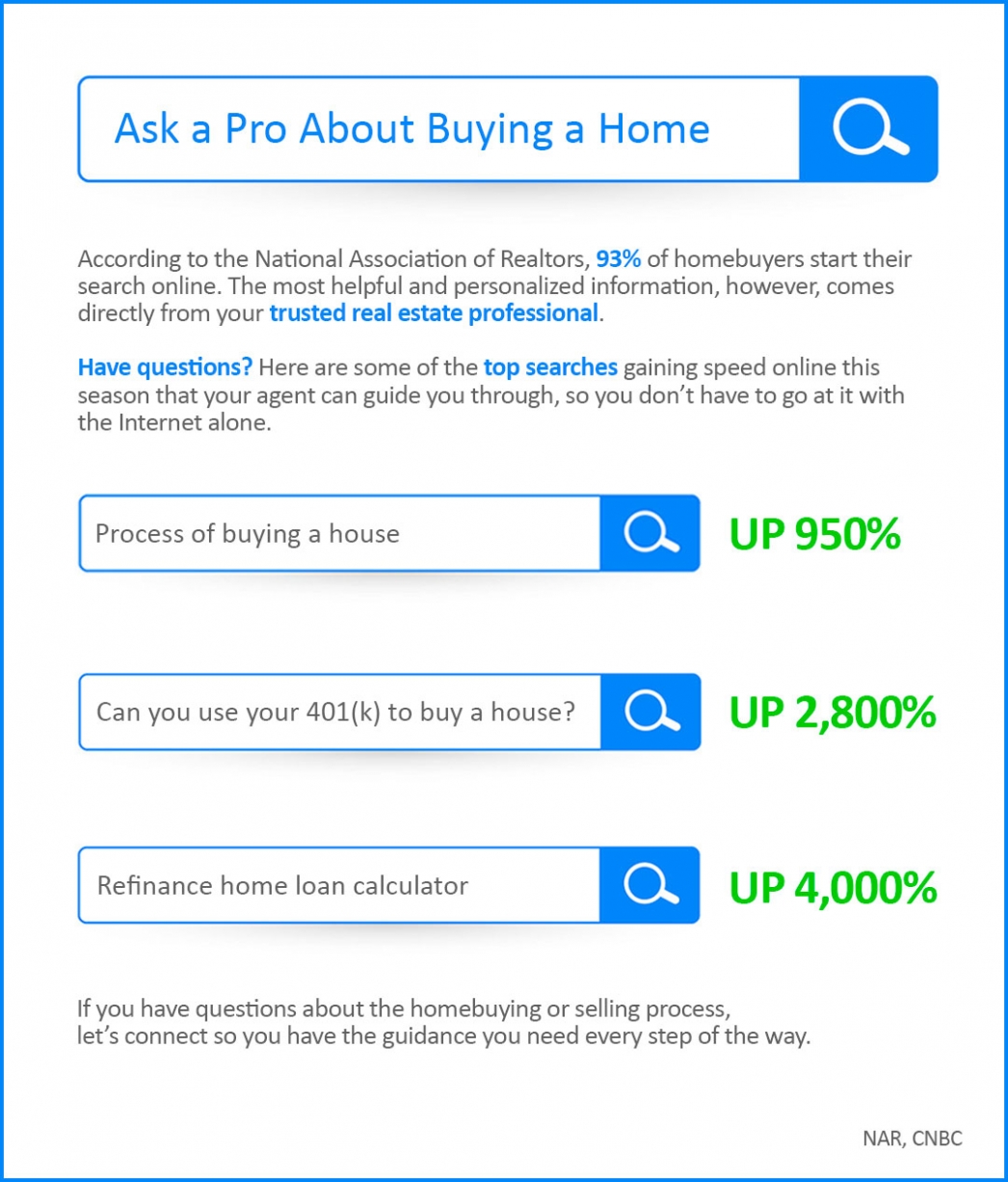

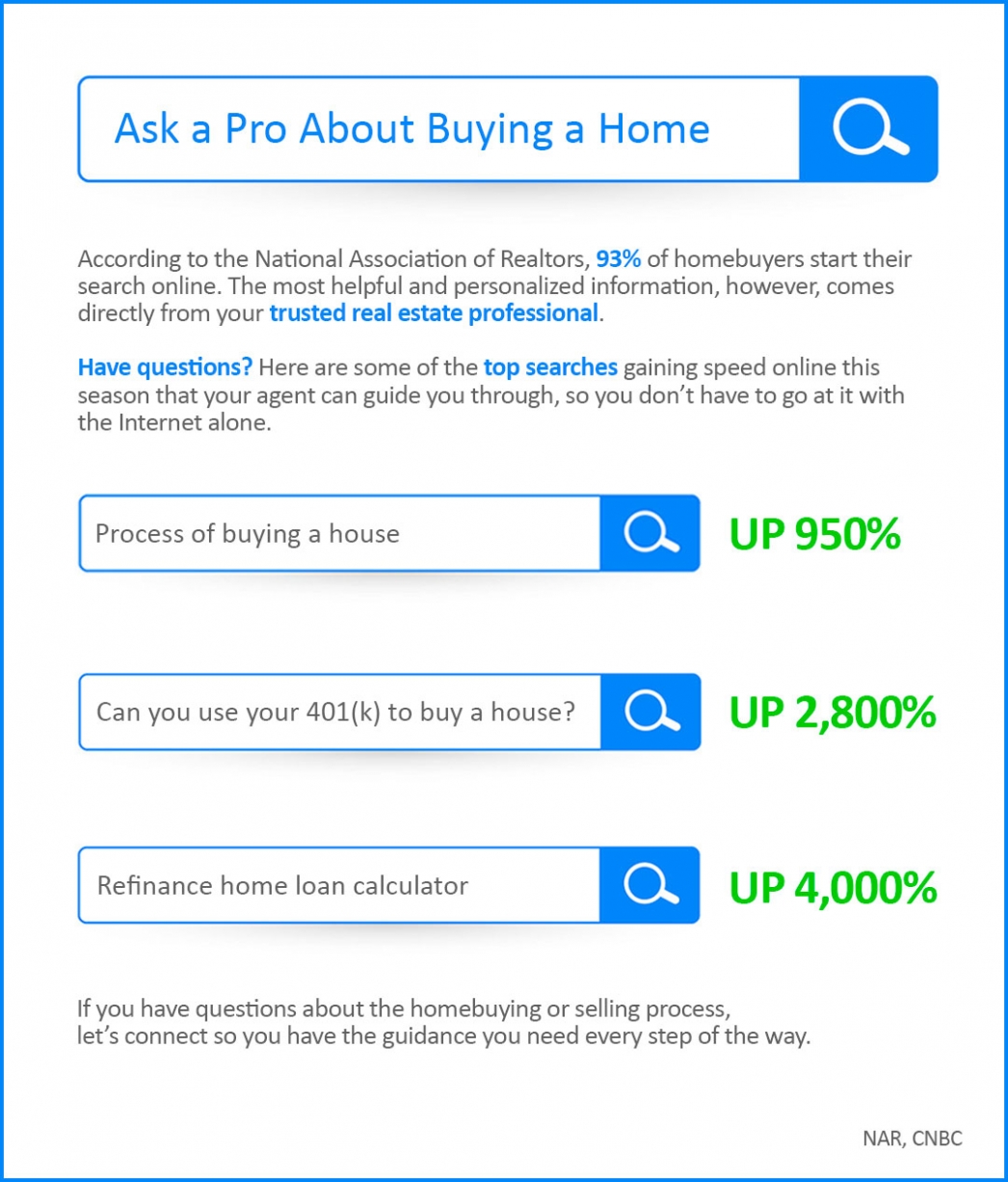

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

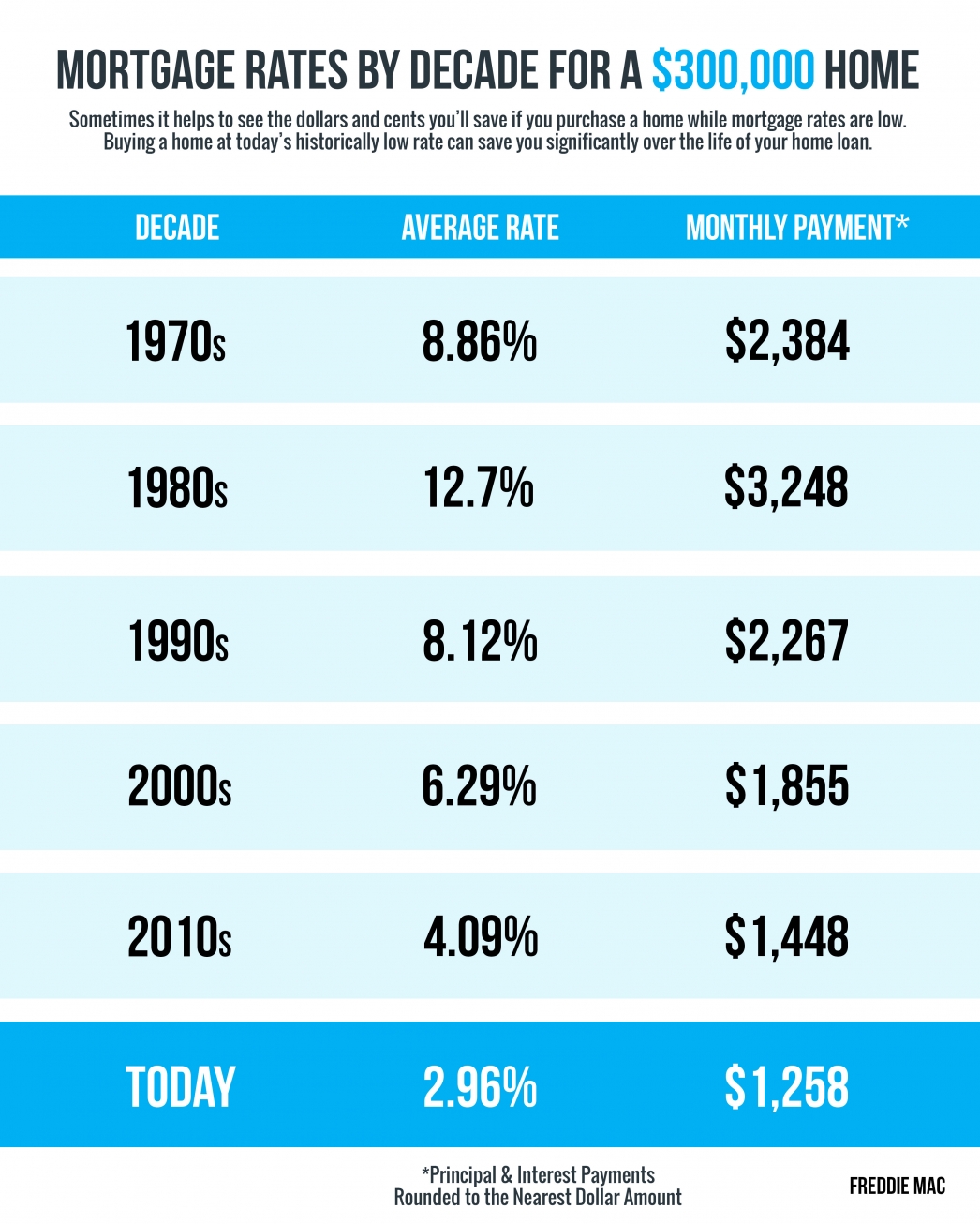

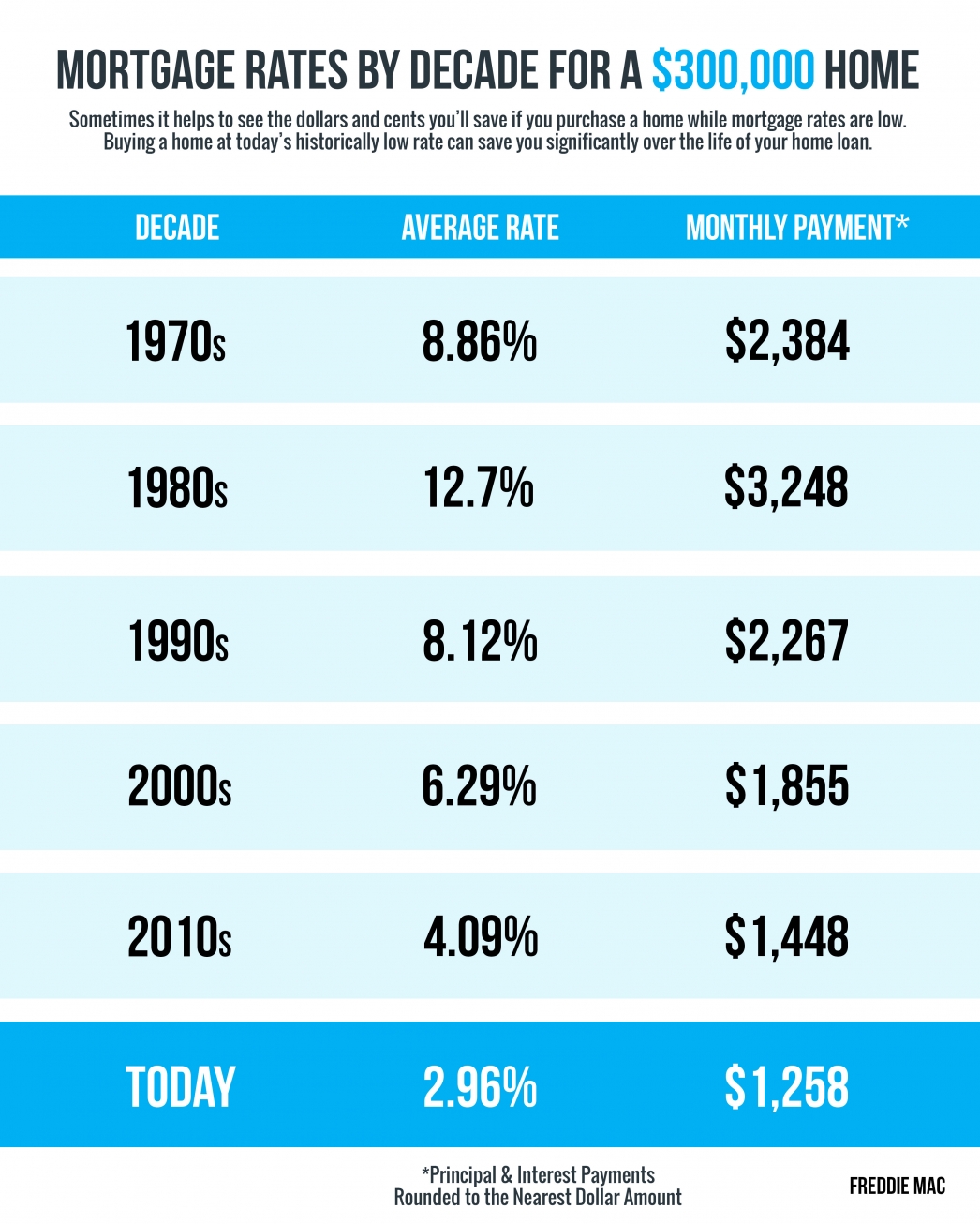

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...

[mlcalc default=”mortgage_only”]