3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

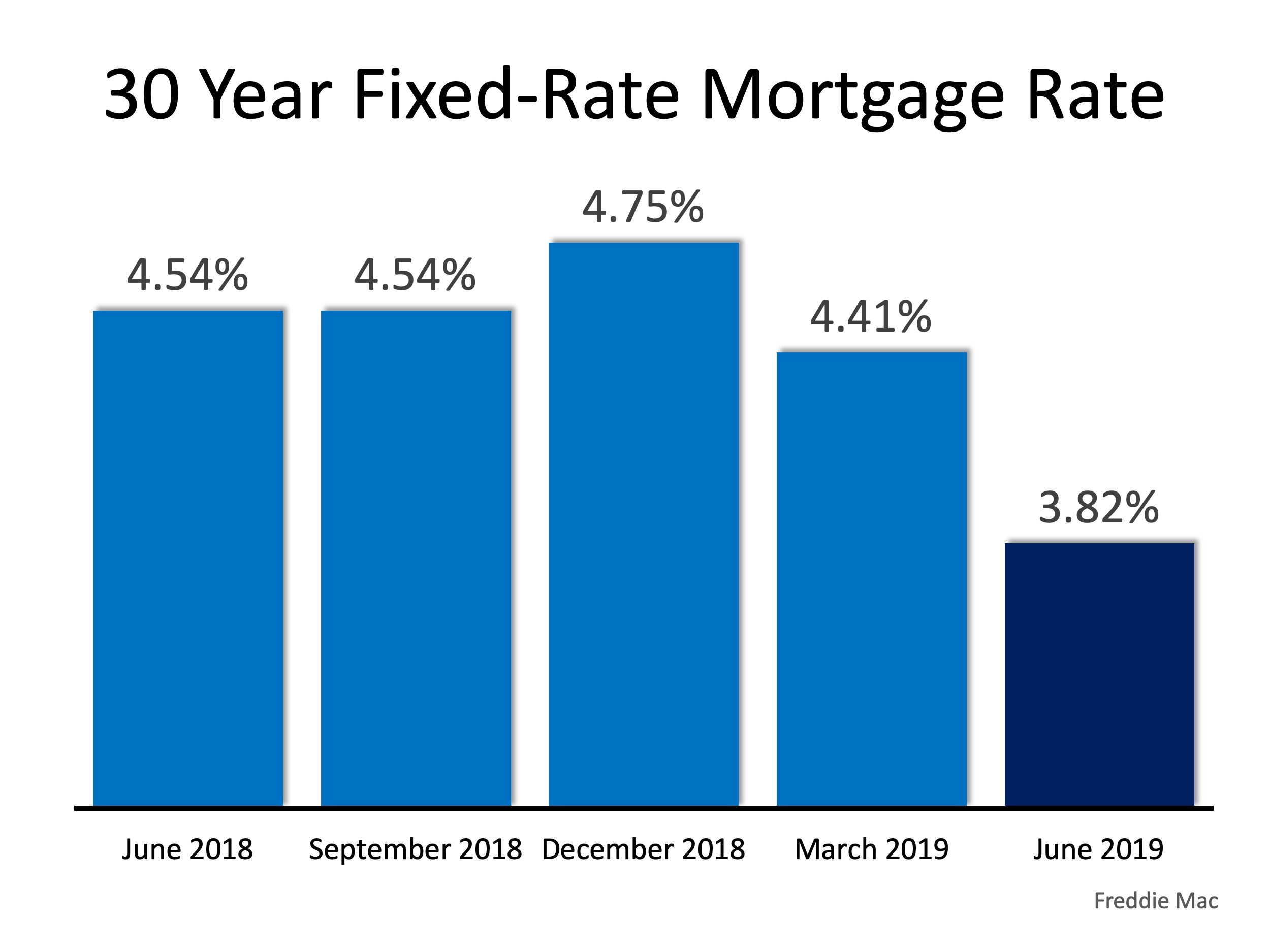

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

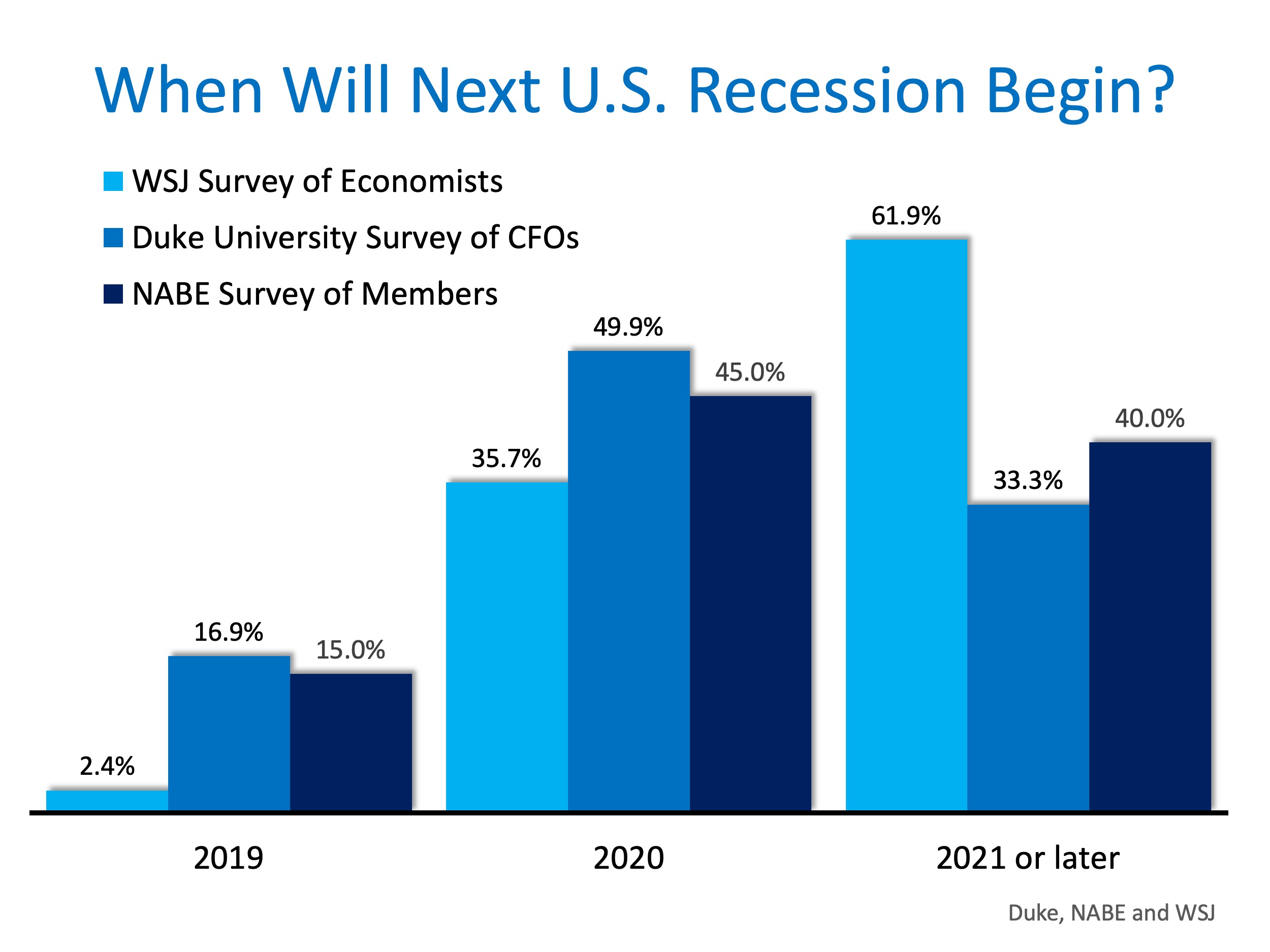

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

Why should I use a Realtor® to sell my home

Why should I use a Realtor® to sell my home? By Marty Gale Does selling my home myself save me money? I recently received a call from a Mortgage originator (Loan Officer) that is a friend of mind. What prompted me to write this article was a discussion he had...

home price appreciation each month for over a year

Home Value Appreciation Stops Falling, Begins to Stabilize The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer. In a...

Celebrating a Closing

Yvonne is celebrating the purchase of her lovely rambler home. Congratulations Yvonne!

Utah Buyer Demand Will Be Strong for Years

Home Buyer Demand Will Be Strong for Years to Come There has been a lot written about millennials and their preference to live in city centers above their favorite pizza place. Some have even gone so far as to say that millennials are a “Renter-Generation”. And while...

Pet-Friendly Homes Are in High Demand

Why Pet-Friendly Homes Are in High Demand One of the many benefits of owning your own home is the freedom to find your ‘furever’ friend. By pointing out the aspects of your home that make it ‘pet-friendly’ in your listing, you’ll attract these buyers, rather than...

Selling Your Family Home is a Type of Loss

Selling Your Family Home is a Type of Loss It’s easy to tell yourself that your house is just a building made of walls and ceilings and light fixtures and flooring, but when it comes time to sell, you may start to feel the sting of grief. After all, you don’t know if...

3 Graphs About Today’s Real Estate Market

3 Graphs that Show What You Need to Know About Today’s Real Estate Market The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates...

Now is the Time to Move-Up

Looking to Upgrade Your Current Home? Now’s the Time to Move-Up! In every area of the country, homes that are priced at the top 25% of the price range for that area are considered to be Premium Homes. In today’s real estate market there are deals to be had at the...

Utah Home Prices Top Three In the Country

Utah home prices increased 9.80 percent in the fourth quarter year-over-year, giving the state the third fastest growing home prices nationally, according to the Federal Housing Finance Agency. Idaho was No. 1, with prices there rising 11.93 percent. North Dakota was...

what credit score do you need to buy a house in utah

What Credit Score Do You Need To Buy A House? There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are...