3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

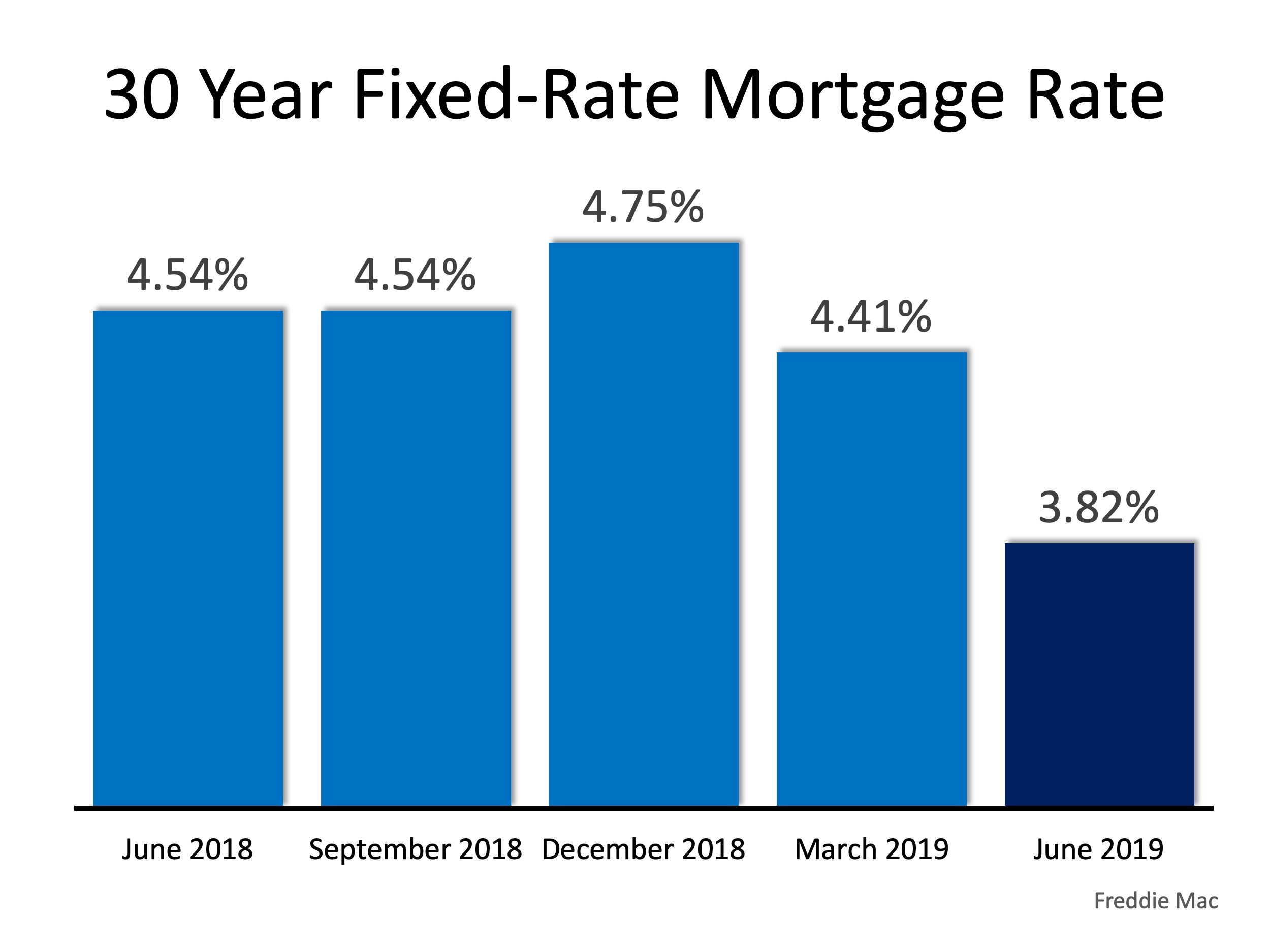

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

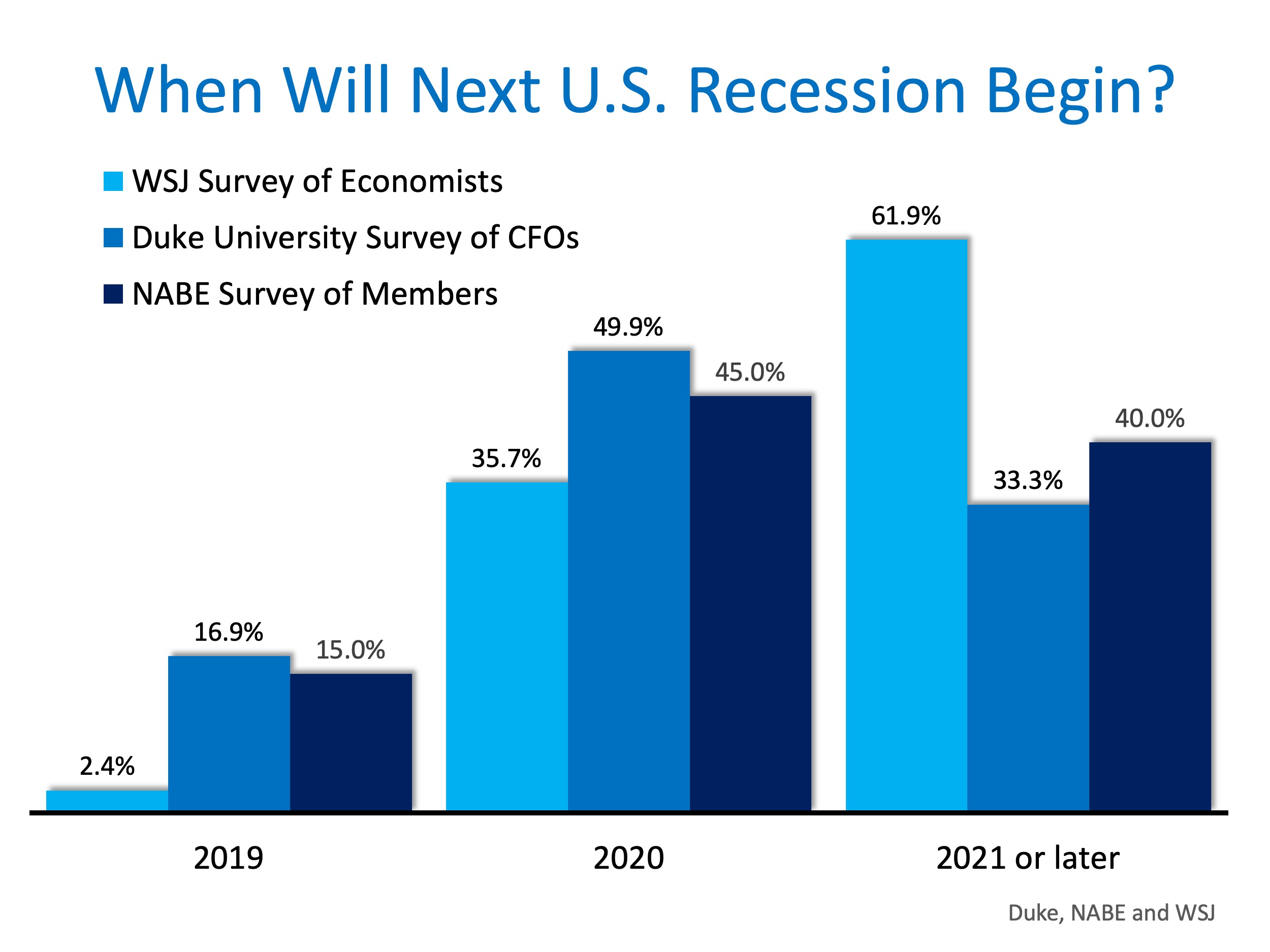

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

Economists Forecast Recovery to Begin in the Second Half of 2020

Economists Forecast Recovery to Begin in the Second Half of 2020With the U.S. economy on everyone’s minds right now, questions about the country’s financial outlook continue to come up daily. The one that seems to keep rising to the top is: when will the economy begin...

Buying or Selling a Home? You Need an Expert Kind of Guide

Buying or Selling a Home? You Need an Expert Kind of GuideIn a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate through the process. You need someone you can turn...

We Remember & Honor Those Who Gave All

We Remember & Honor Those Who Gave All We remember, today and always.

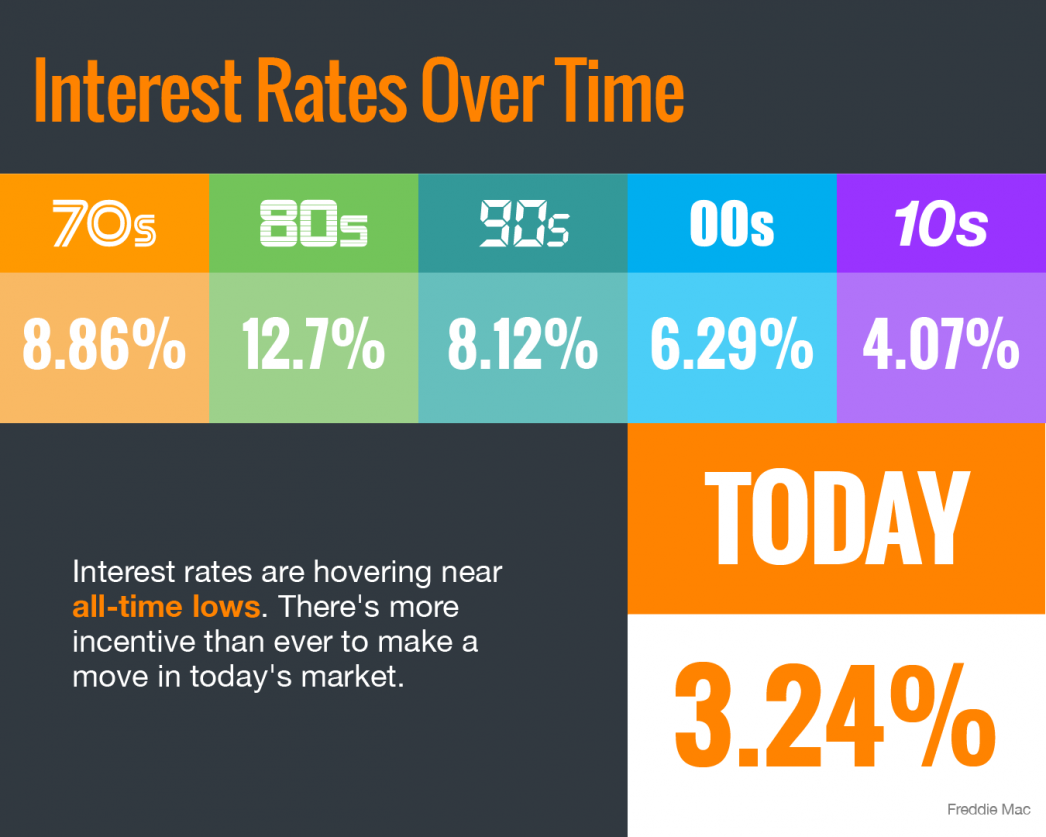

Interest Rates Hover Near Historic All-Time Lows

Interest Rates Hover Near Historic All-Time LowsSome HighlightsMortgage interest rates have dropped considerably this spring and are hovering at a historically low level.Locking in at a low rate today could save you thousands of dollars over the lifetime of your home...

Summer is the new Spring for Placing your home on the Market

Experts Predict Economic Recovery Should Begin in the Second Half of 2020

Experts Predict Economic Recovery Should Begin in the Second Half of the Year One of the biggest questions we all seem to be asking these days is: When are we going to start to see an economic recovery? As the country begins to slowly reopen, moving forward in...

6 Reasons Why Selling Your House on Your Own Is a Mistake

6 Reasons Why Selling Your House on Your Own Is a Mistake There are many benefits to working with a real estate professional when selling your house. During challenging times like the one we face today, it becomes even more important to have an expert help guide you...

Housing Market Positioned to Bring Back the Economy

Housing Market Positioned to Bring Back the EconomyAll eyes are on the American economy. As it goes, so does the world economy. With states beginning to reopen, the question becomes: which sectors of the economy will drive its recovery? There seems to be a growing...

#1 Financial Benefit of Homeownership: Family Wealth

#1 Financial Benefit of Homeownership: Family WealthWhile growing up, we were taught by our parents and grandparents that owning a home is a financially savvy move. They explained how a mortgage is like a “forced savings plan.” When you pay rent, that money is lost...

Adapting Your Home As a Senior

Adapting Your Home Adapting with Age Most of us would prefer to age in our current home. But as health and aging issues make more areas of the home hard to access or pose a greater risk of injury, doing so can be difficult. We can begin to feel trapped and that...