3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

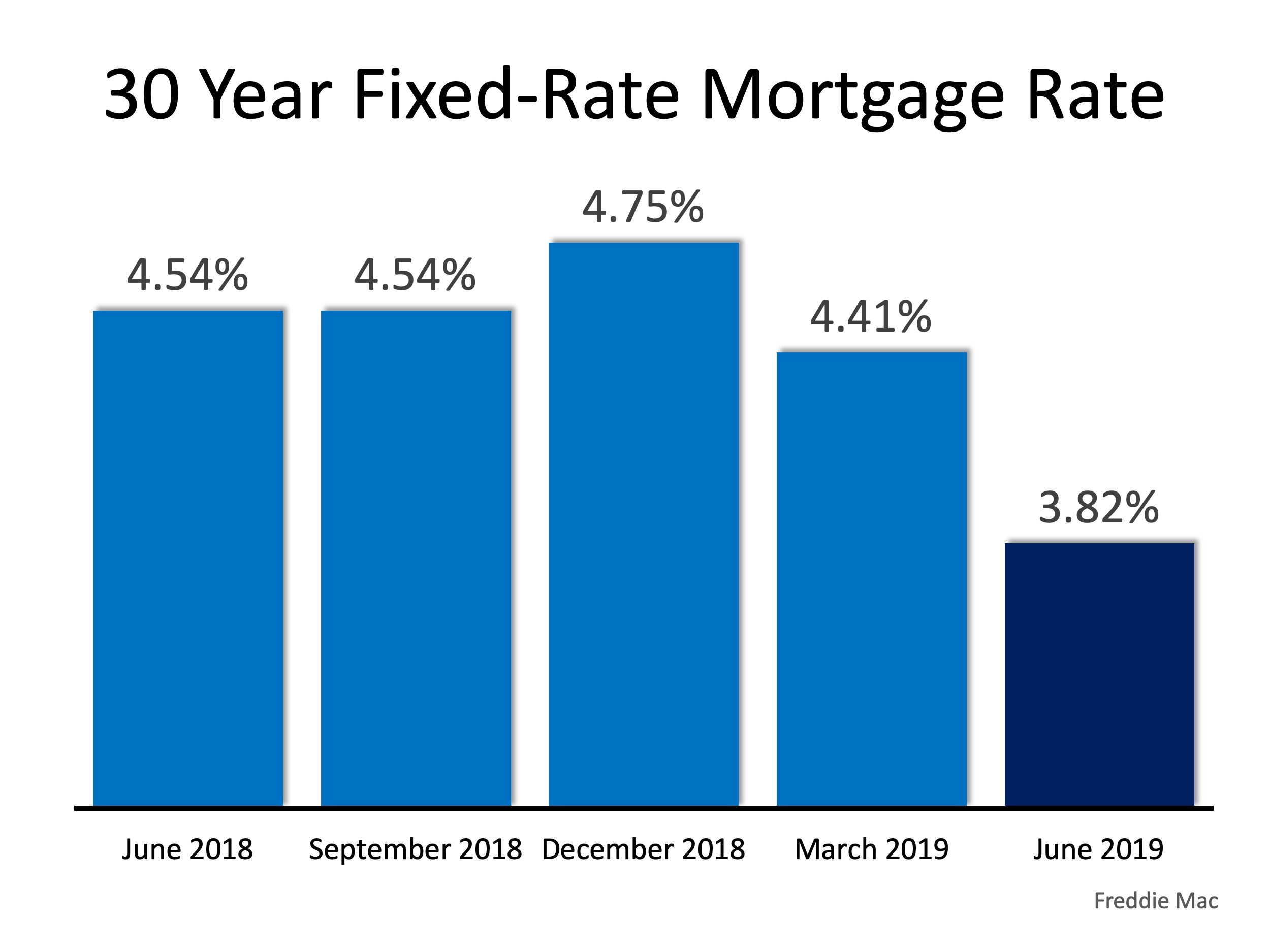

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

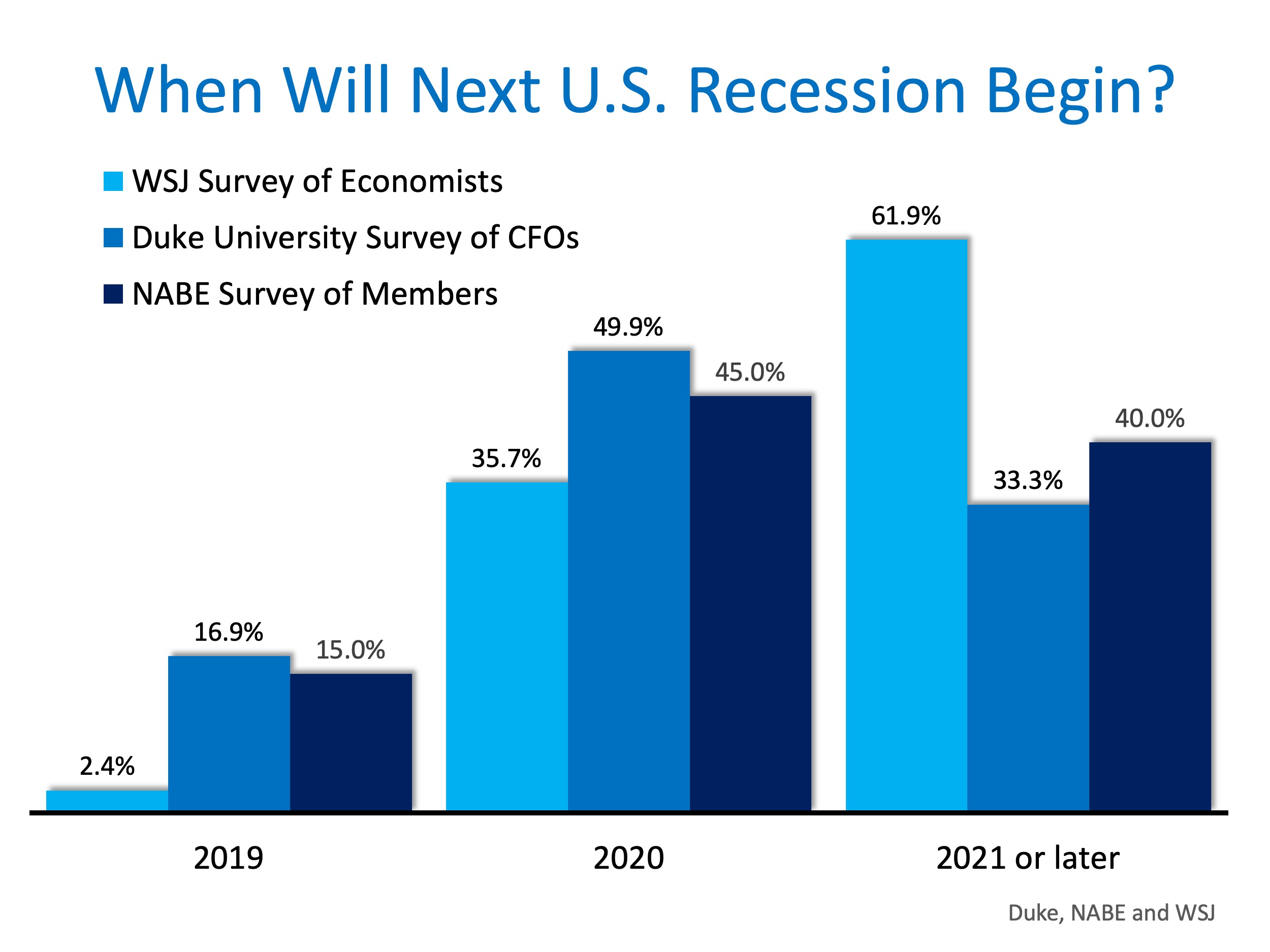

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

Is It Enough To Offer Asking Price in Today’s Housing Market?

Is It Enough To Offer Asking Price in Today’s Housing Market? If you’re planning to buy a home this season, you’re probably thinking about what you’ll need to do to get your offer accepted. In previous years, it was common for buyers to try and determine how much less...

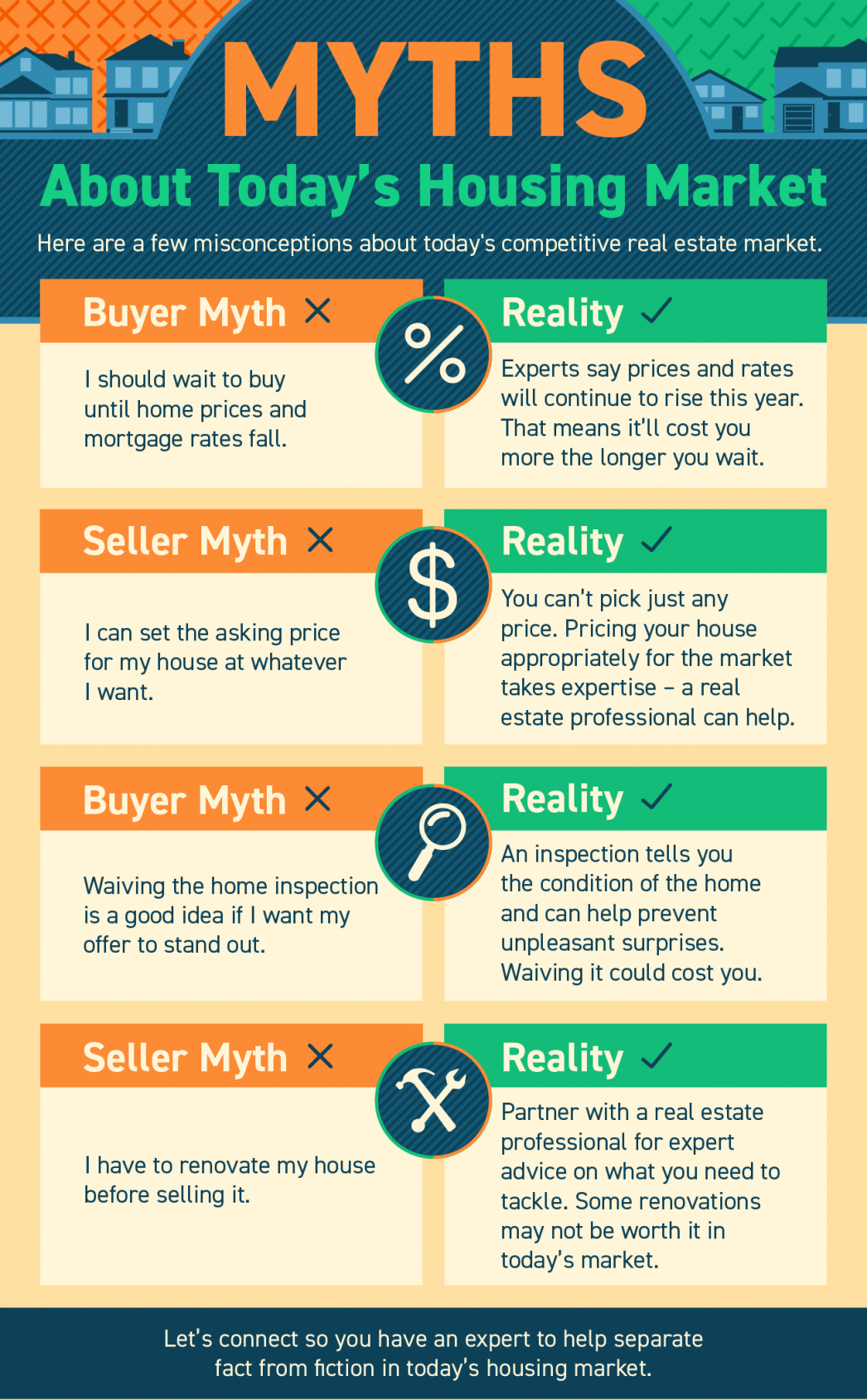

Myths About Today’s Housing Market

Myths About Today’s Housing Market Some Highlights If you’re planning to buy or sell a home today, it’s important to be aware of common misconceptions. Whether it’s timing your purchase as a buyer based on home prices and mortgage rates or knowing what to upgrade or...

Why This Housing Market Is Not a Bubble Ready To Pop

Why This Housing Market Is Not a Bubble Ready To Pop Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American...

How the Appraisal and Inspection Empower You as a Homebuyer

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Where Are Mortgage Rates Headed?

Where Are Mortgage Rates Headed? There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is: Don't ever try and forecast...

Why a Real Estate Professional Is Key When Selling Your House

Why a Real Estate Professional Is Key When Selling Your House With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly...

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

Using Your Tax Refund To Achieve Your Homeownership Goals This Year If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re...

The Future of Home Price Appreciation and What It Means for You

The Future of Home Price Appreciation and What It Means for You Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15...

Balancing Your Wants and Needs as a Homebuyer Today

Balancing Your Wants and Needs as a Homebuyer Today Since the number of homes for sale is low today, it can feel challenging to find one that checks all your boxes. But if you know which features are absolutely essential in your next home and which ones are just nice...

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

What’s Happening with Mortgage Rates, and Where Will They Go from Here? Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more...