What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

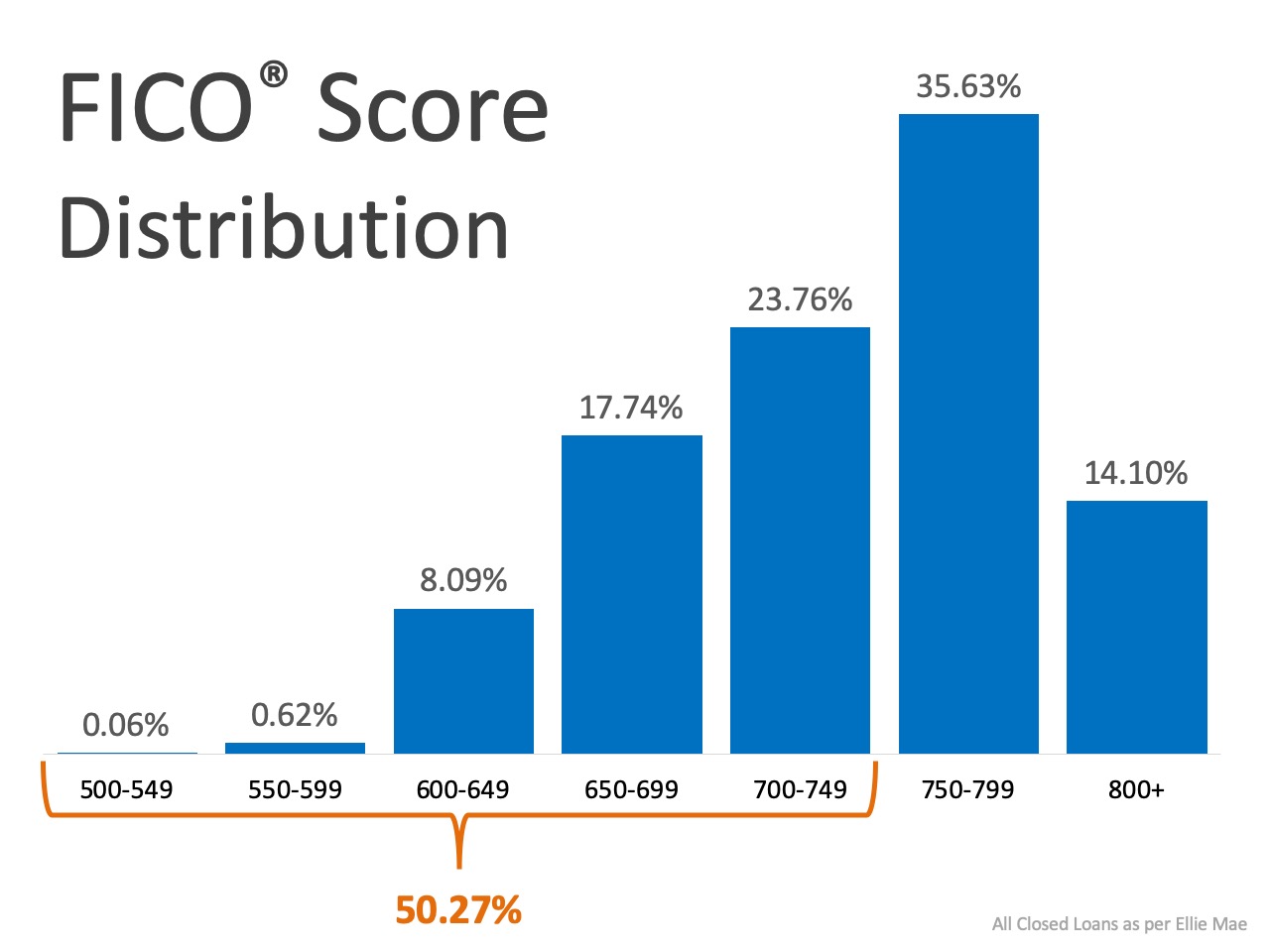

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

Strategic Approaches To Dividing Assets During Divorce

In the emotionally charged arena of divorce, the division of assets stands as one of the most contentious and critical challenges couples face. Strategic approaches are essential for navigating this complex process, ensuring a fair and equitable distribution that...

Buying Real Estate With Crypto Currency In Utah

Buying Real Estate With Crypto Currency In Utah As the world continues to evolve, so too does the way we invest and transact. In recent years, cryptocurrencies such as Bitcoin and Ethereum have emerged as prominent investment vehicles for tech-savvy individuals. And...

Luxury Homes Above 1,000,000 2024 Predictions And Trends For Utah

Luxury Homes Above 1,000,000 2024 Predictions And Trends For Utah Welcome to our Utah Realty Luxury Homes blog, where we dive deep into the world of luxury real estate and explore the upcoming predictions and trends for Utah in 2024. As the demand for opulent homes...

Coping with Holiday Stress as a Senior or Caregiver

Are you a caregiver juggling the responsibilities of caring for your loved one at home, while also trying to navigate the stress and pressures of the holiday season? As the holidays approach, it’s important for caregivers to prioritize their own well-being and find...

What’s New and Attractive In Luxury Home Surfaces

Welcome to Utah Realty, where we explore the latest trends in surfaces that are revolutionizing home interiors. In this article, we delve into four hot new looks that will elevate the ambiance of every room in your home. Inspired by the vibrant pulse of city streets,...

Luxury Home Design Trends In Utah

Luxury Home Design Trends In Utah Welcome to our blog where we delve into the world of luxury home design trends in the picturesque state of Utah. Known for its breathtaking landscapes and vibrant cities, Utah has become a hub for those seeking unparalleled elegance...

Economic Trends And Factors Influencing The Luxury Home Market In Utah

Welcome to our blog article all about the exciting developments and trends in Utah's luxury home market this fall! As the leaves change color and the cool autumn breeze settles in, Utah's real estate market is buzzing with activity. Whether you're a potential buyer or...

Optimal Timing for Selling Your Luxury Home: Unveiling the Best Season”

Optimal Timing for Selling Your Luxury Home: Unveiling the Best Season" Introduction: In the ever-evolving real estate market, timing plays a crucial role in maximizing the potential of selling your luxury home. As an AI assistant, I am here to shed...

Today’s Housing Inventory Is a Sweet Spot for Sellers

Today’s Housing Inventory Is a Sweet Spot for Sellers One of the biggest challenges in the housing market right now is how few homes there are for sale compared to the number of people who want to buy them. To help emphasize just how limited housing inventory still...

Why Buying or Selling a Home Helps the Economy and Your Community

Why Buying or Selling a Home Helps the Economy and Your Community If you're thinking about buying or selling a house, it's important to know that it doesn't just affect your life, but also your community. The National Association of Realtors (NAR) releases a report...