3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

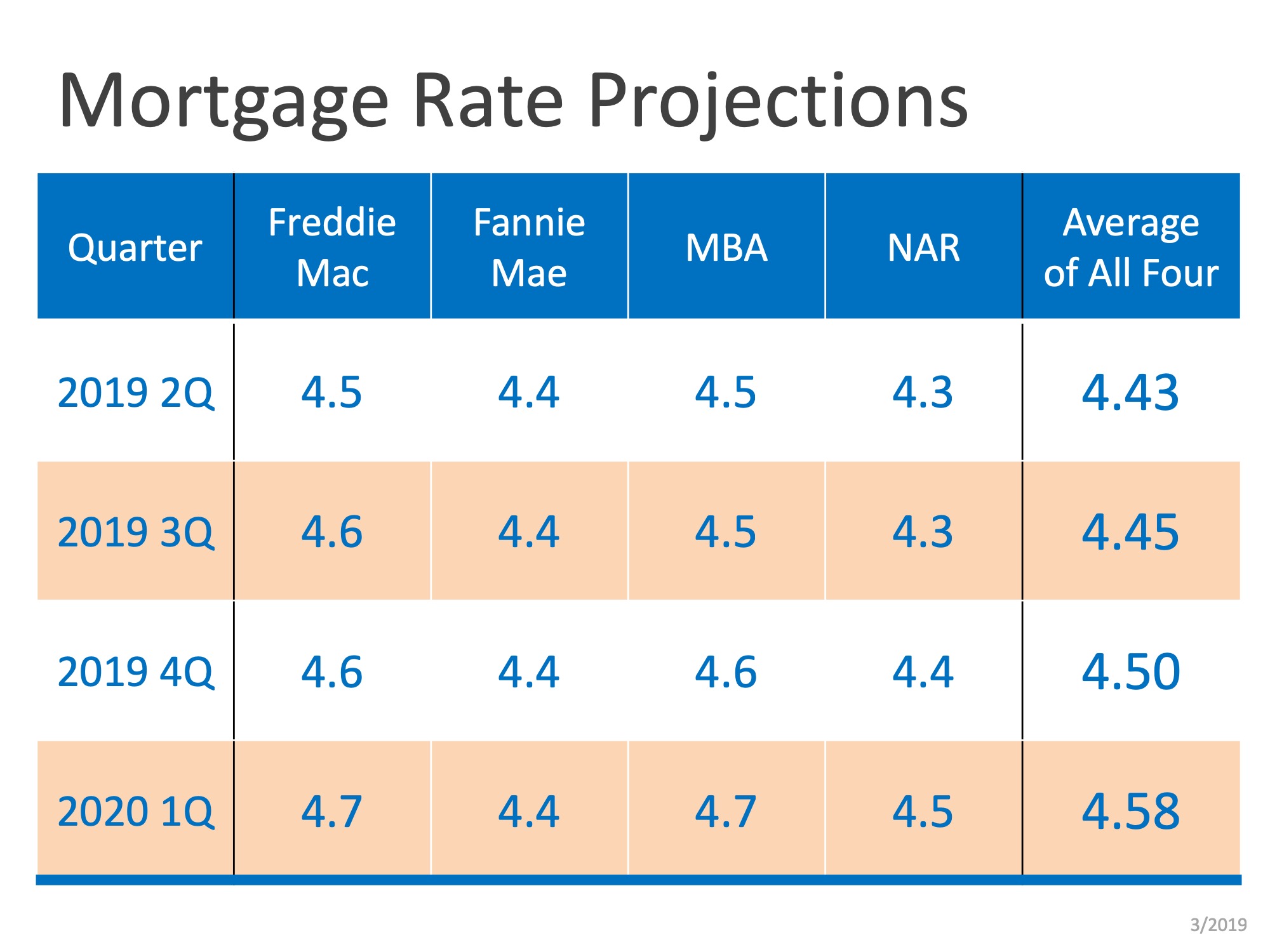

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

7 Reasons to Put Your House For Sale This Holiday Season

7 Reasons to List Your House This Holiday Season Around this time each year, many homeowners decide to wait until after the holidays to list their houses. Similarly, others who already have their homes on the market remove their listings until the spring. Let’s unpack...

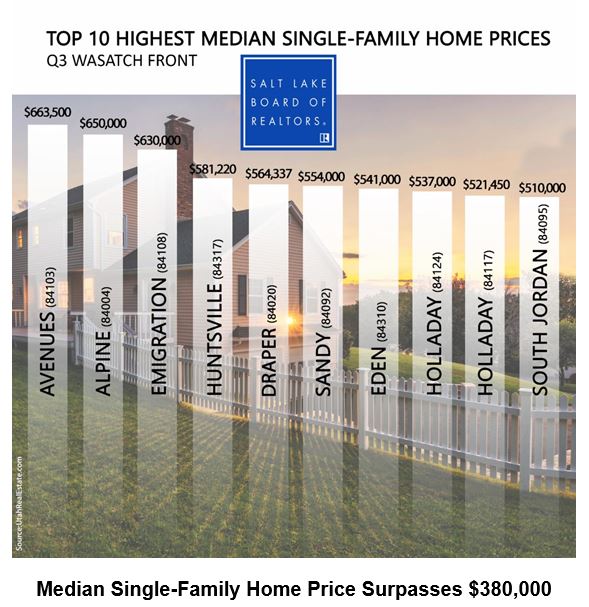

Top 10 Highest Single Family Home Prices Utah

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the...

Veterans Day 11-11-19

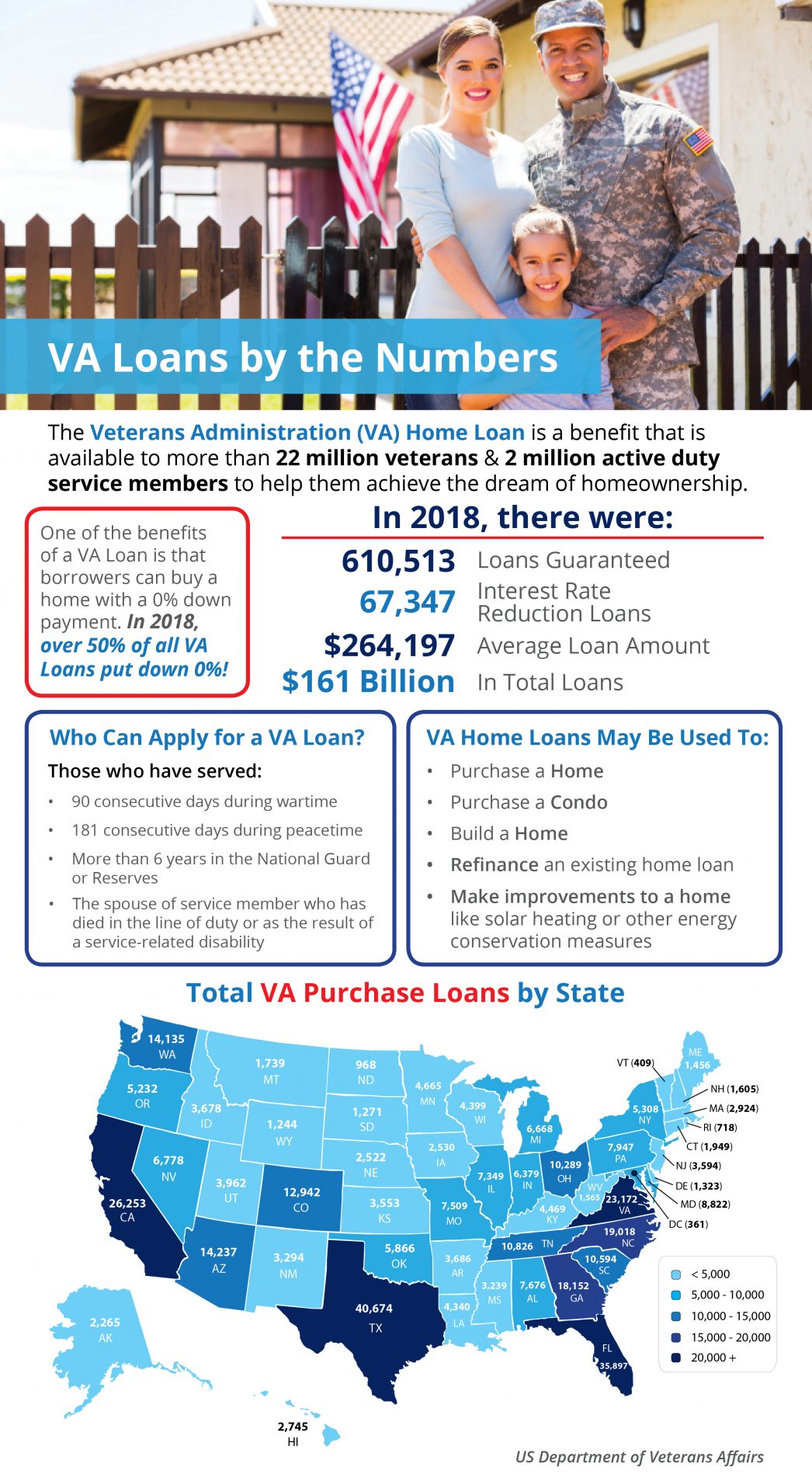

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice. This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI...

Protected Class

Things you should not have your clients put in a letter to a buyer or seller. Protected Class A group of people with a common characteristic who are legally protected from employment discrimination on the basis of that characteristic. Protected classes are created by...

Utah Realty Presents VA Home Loans by the Numbers

Utah Realty Presents VA Home Loans by the Numbers Some Highlights: The Veterans Administration (VA) Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members to help them achieve the dream of homeownership. In...

The #1 Reason to List Your House in the Winter

The #1 Reason to List Your House in the Winter Many sellers believe spring is the best time to put their homes on the market because buyer demand traditionally increases at that time of year. What they don’t realize is if every homeowner believes the same thing, then...

Don’t Get Spooked by the Real Estate Market!

Have a Hauntingly Good Halloween! Having an agent to help guide you is key in today's complex housing...

Taking the Fear Out of the Mortgage Process

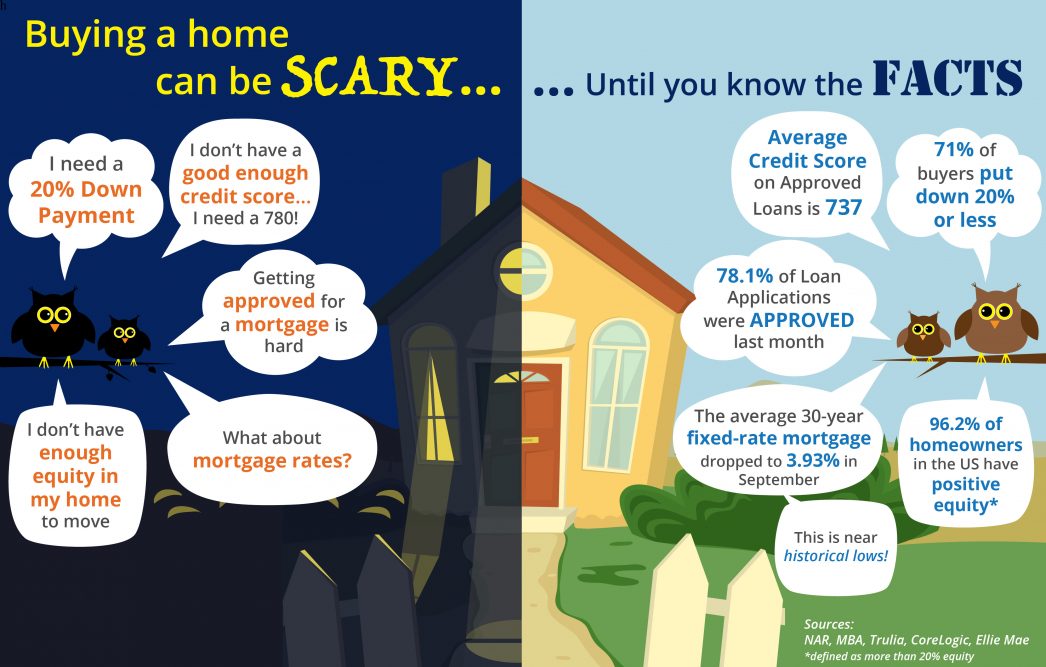

Taking the Fear Out of the Mortgage Process A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage. For many, the mortgage process can...

Buying a home can be SCARY…Until you know the FACTS

Buying a home can be SCARY…Until you know the FACTS Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts...

What credit Score Do You Need to Qualify for a Mortgage

What FICO® Score Do You Need to Qualify for a Mortgage? While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a...