3 Graphs that Show What You Need to Know About Today’s Real Estate Market

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

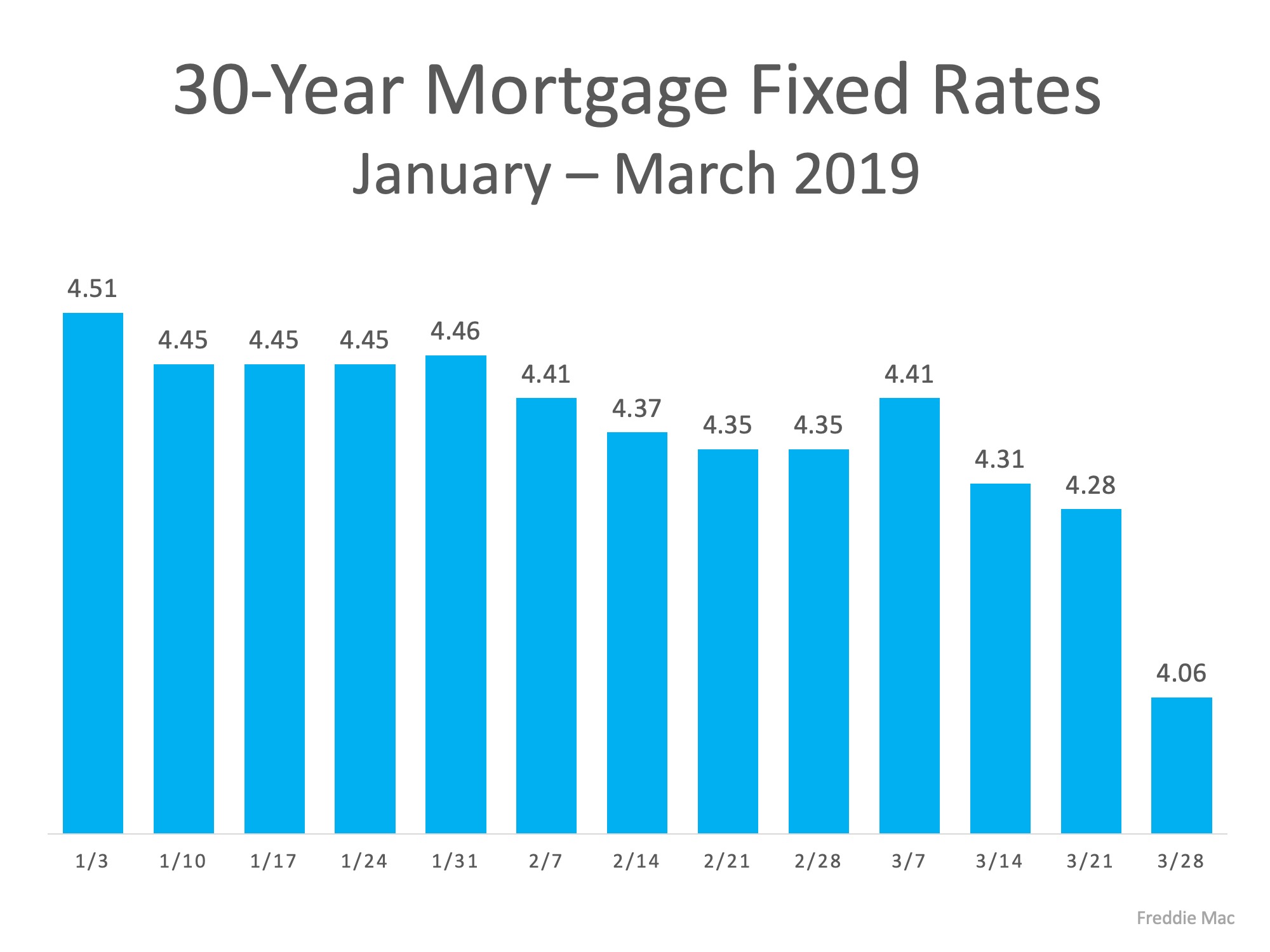

Interest Rates:

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economist at Freddie Mac

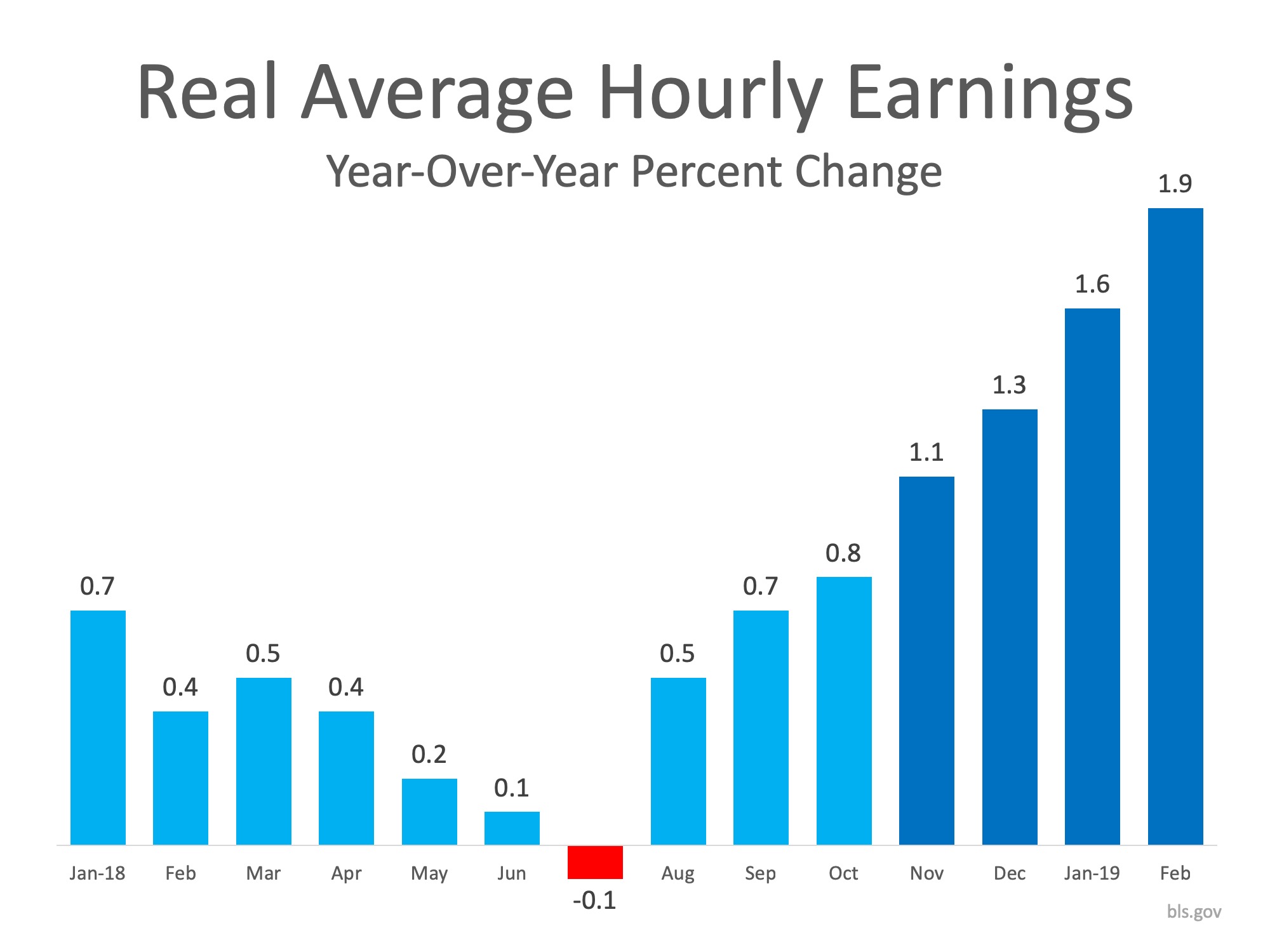

Income:

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

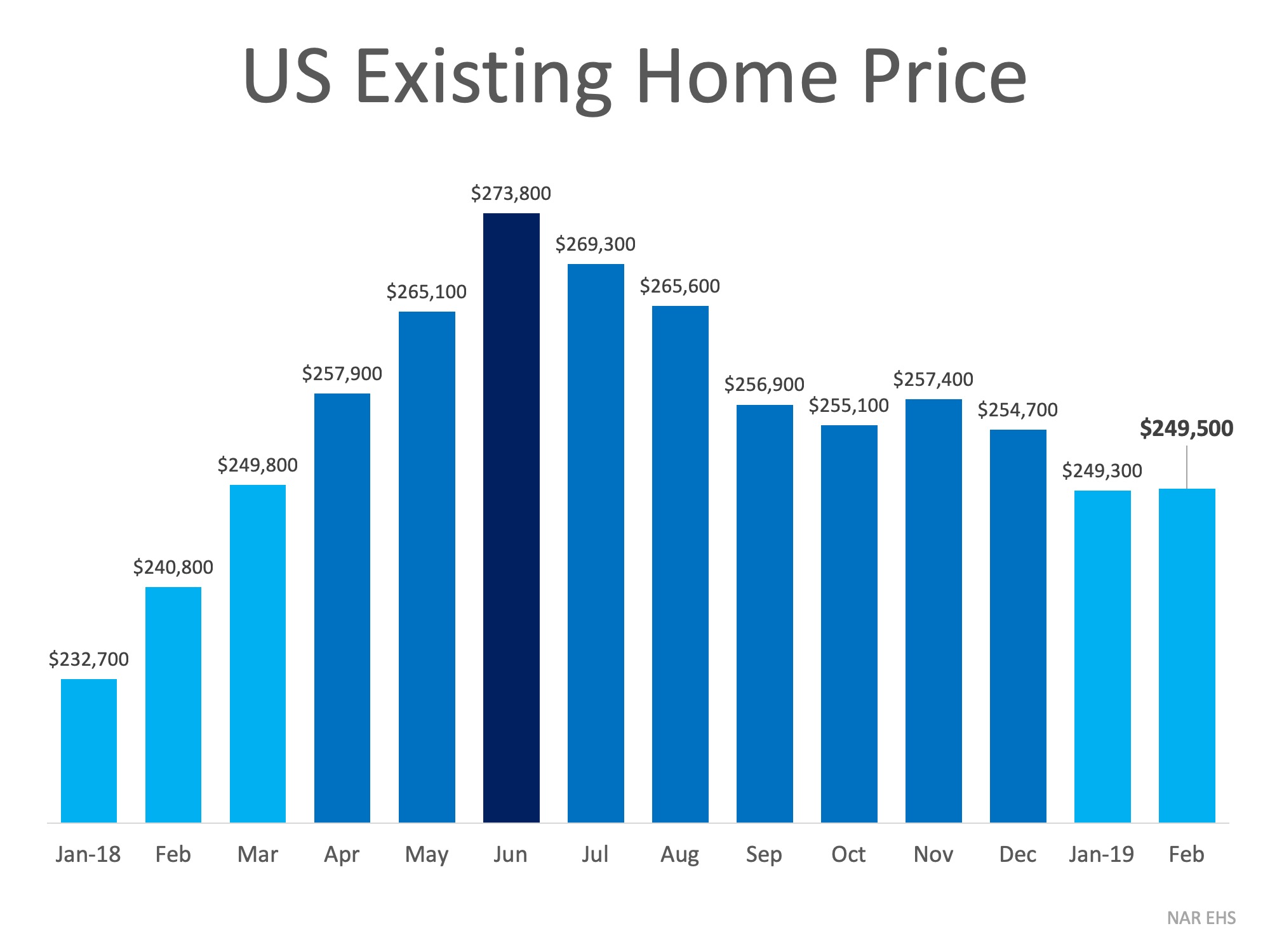

Home Prices:

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

Bottom Line

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

Utah Has The Highest Employment Growth

Why should I use a Realtor® to sell my home

Why should I use a Realtor® to sell my home? By Marty Gale Does selling my home myself save me money? I recently received a call from a Mortgage originator (Loan Officer) that is a friend of mind. What prompted me to write this article was a discussion he had...

home price appreciation each month for over a year

Home Value Appreciation Stops Falling, Begins to Stabilize The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer. In a...

Celebrating a Closing

Yvonne is celebrating the purchase of her lovely rambler home. Congratulations Yvonne!

Utah Buyer Demand Will Be Strong for Years

Home Buyer Demand Will Be Strong for Years to Come There has been a lot written about millennials and their preference to live in city centers above their favorite pizza place. Some have even gone so far as to say that millennials are a “Renter-Generation”. And while...

Pet-Friendly Homes Are in High Demand

Why Pet-Friendly Homes Are in High Demand One of the many benefits of owning your own home is the freedom to find your ‘furever’ friend. By pointing out the aspects of your home that make it ‘pet-friendly’ in your listing, you’ll attract these buyers, rather than...

Selling Your Family Home is a Type of Loss

Selling Your Family Home is a Type of Loss It’s easy to tell yourself that your house is just a building made of walls and ceilings and light fixtures and flooring, but when it comes time to sell, you may start to feel the sting of grief. After all, you don’t know if...

Now is the Time to Move-Up

Looking to Upgrade Your Current Home? Now’s the Time to Move-Up! In every area of the country, homes that are priced at the top 25% of the price range for that area are considered to be Premium Homes. In today’s real estate market there are deals to be had at the...

Utah Home Prices Top Three In the Country

Utah home prices increased 9.80 percent in the fourth quarter year-over-year, giving the state the third fastest growing home prices nationally, according to the Federal Housing Finance Agency. Idaho was No. 1, with prices there rising 11.93 percent. North Dakota was...

what credit score do you need to buy a house in utah

What Credit Score Do You Need To Buy A House? There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are...