3 Graphs that Show What You Need to Know About Today’s Real Estate Market

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

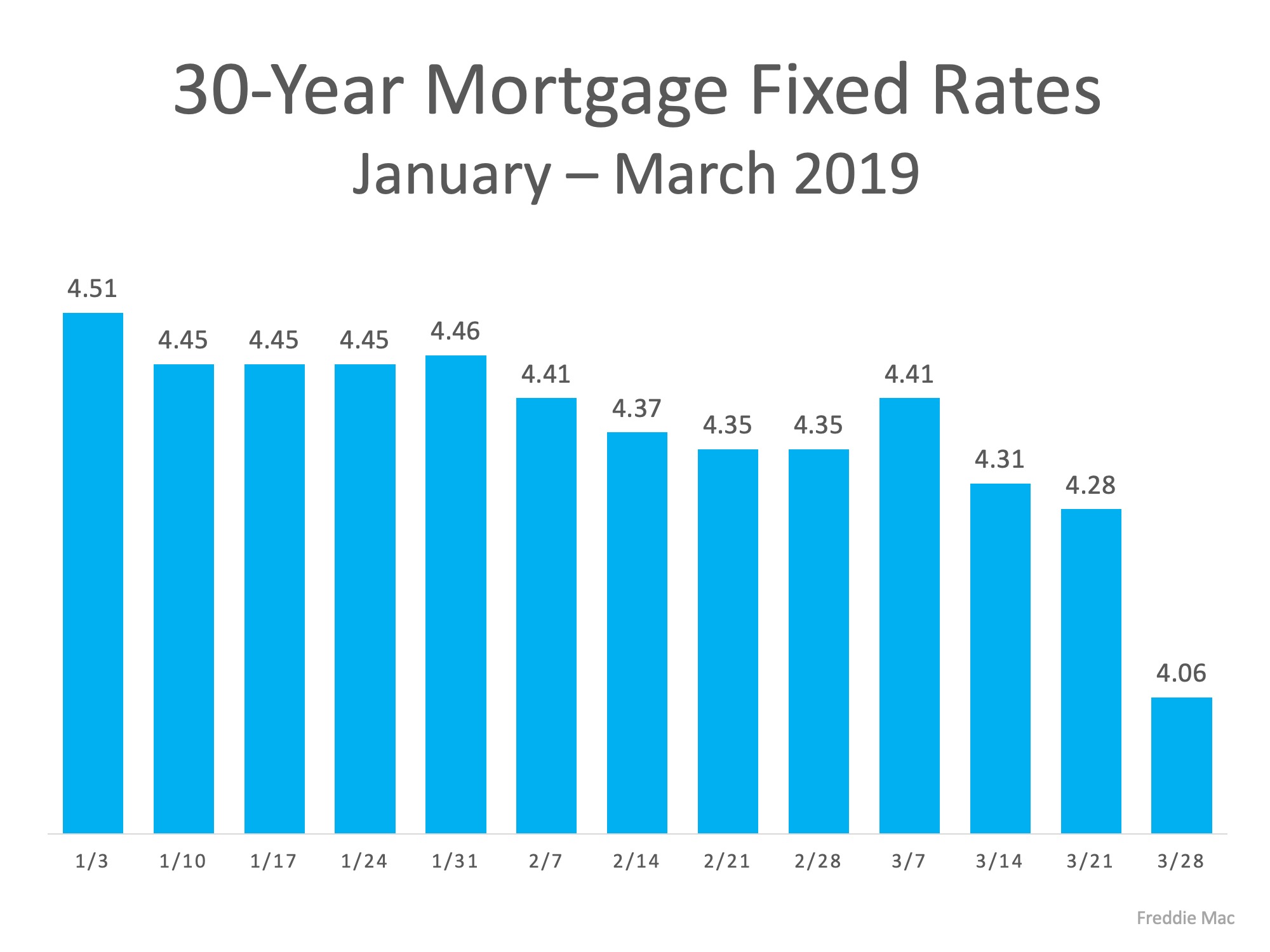

Interest Rates:

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economist at Freddie Mac

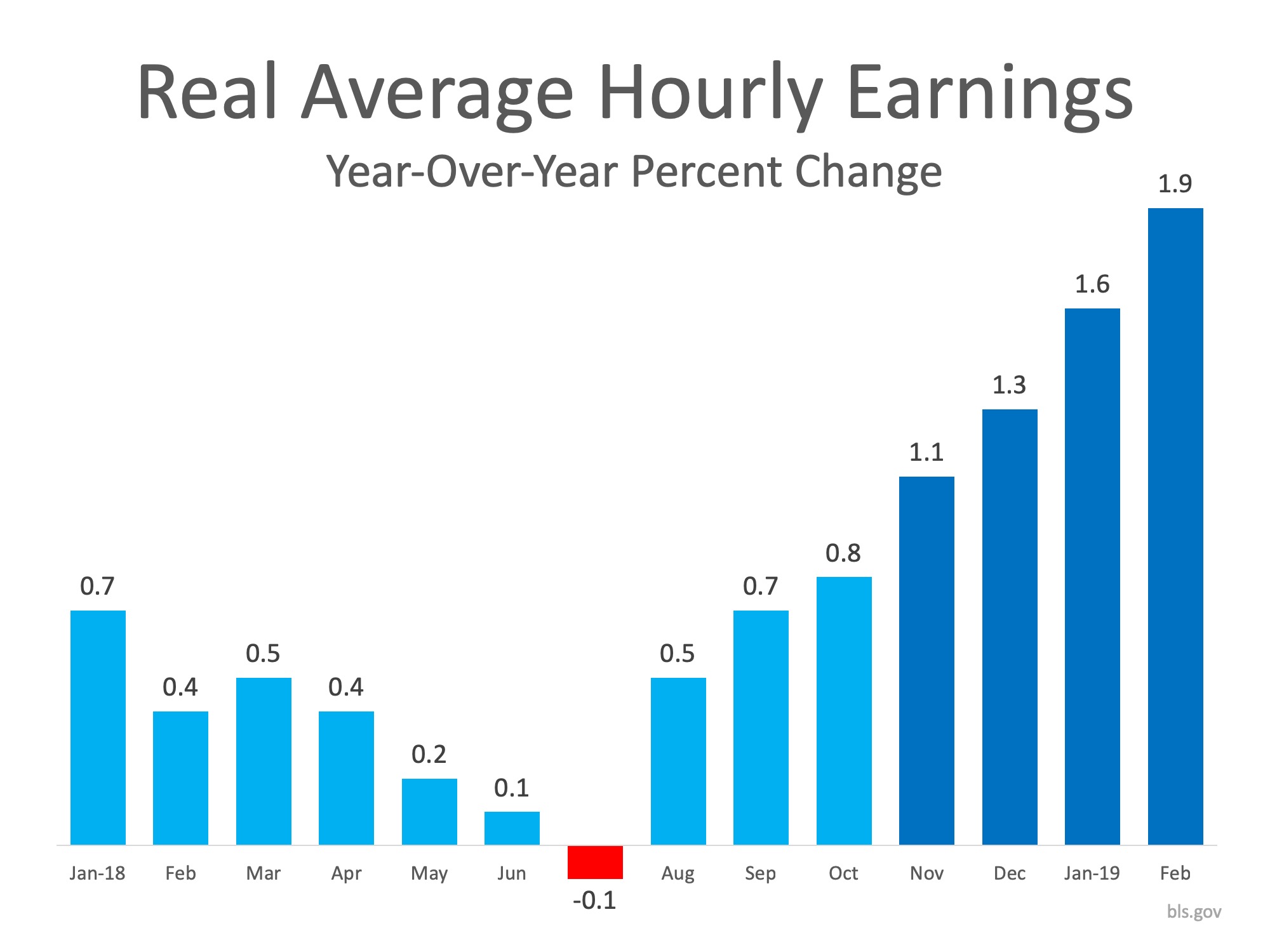

Income:

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

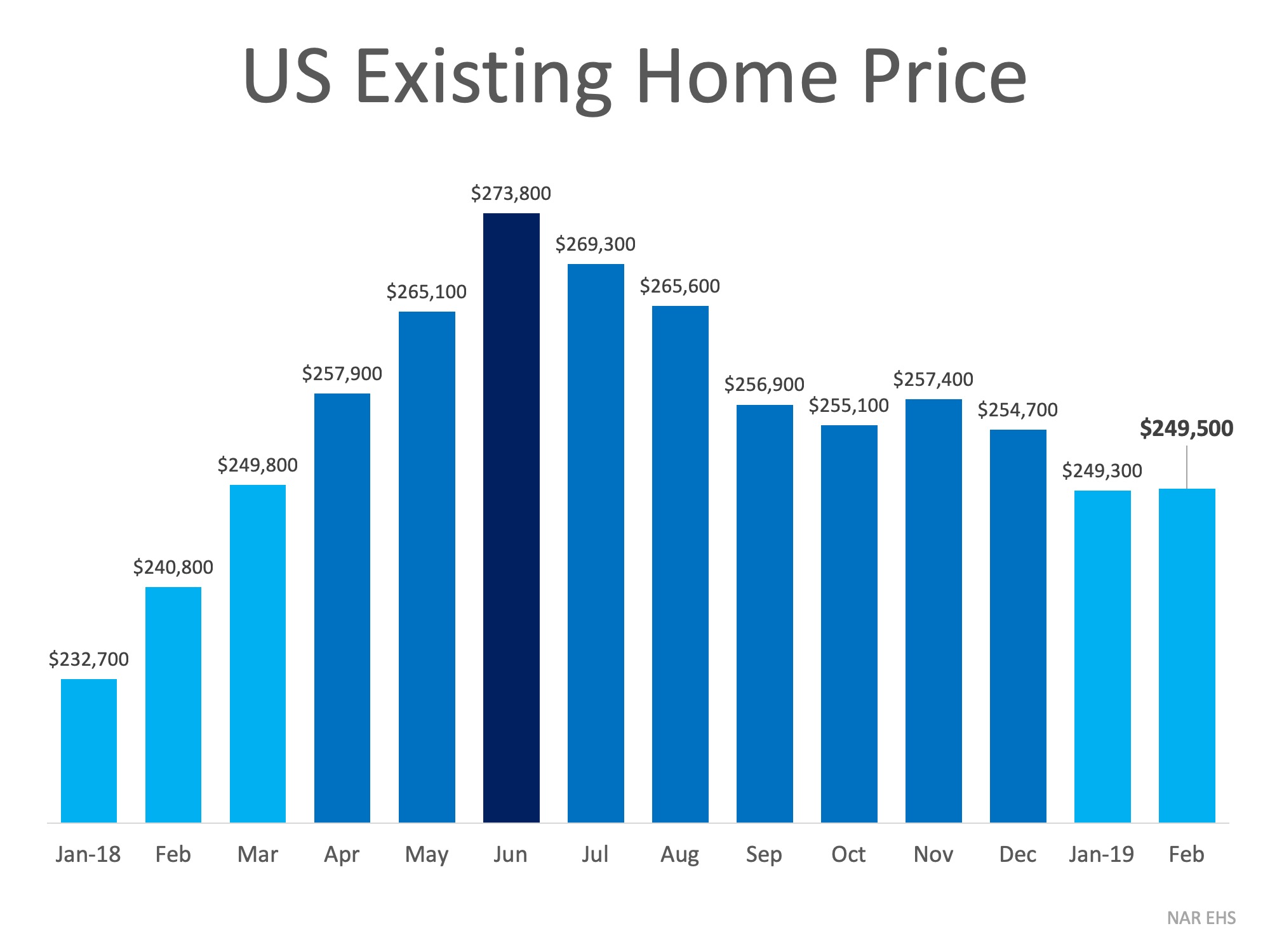

Home Prices:

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

Bottom Line

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

Should You Use Your Equity to Move Up

Utah Realty News

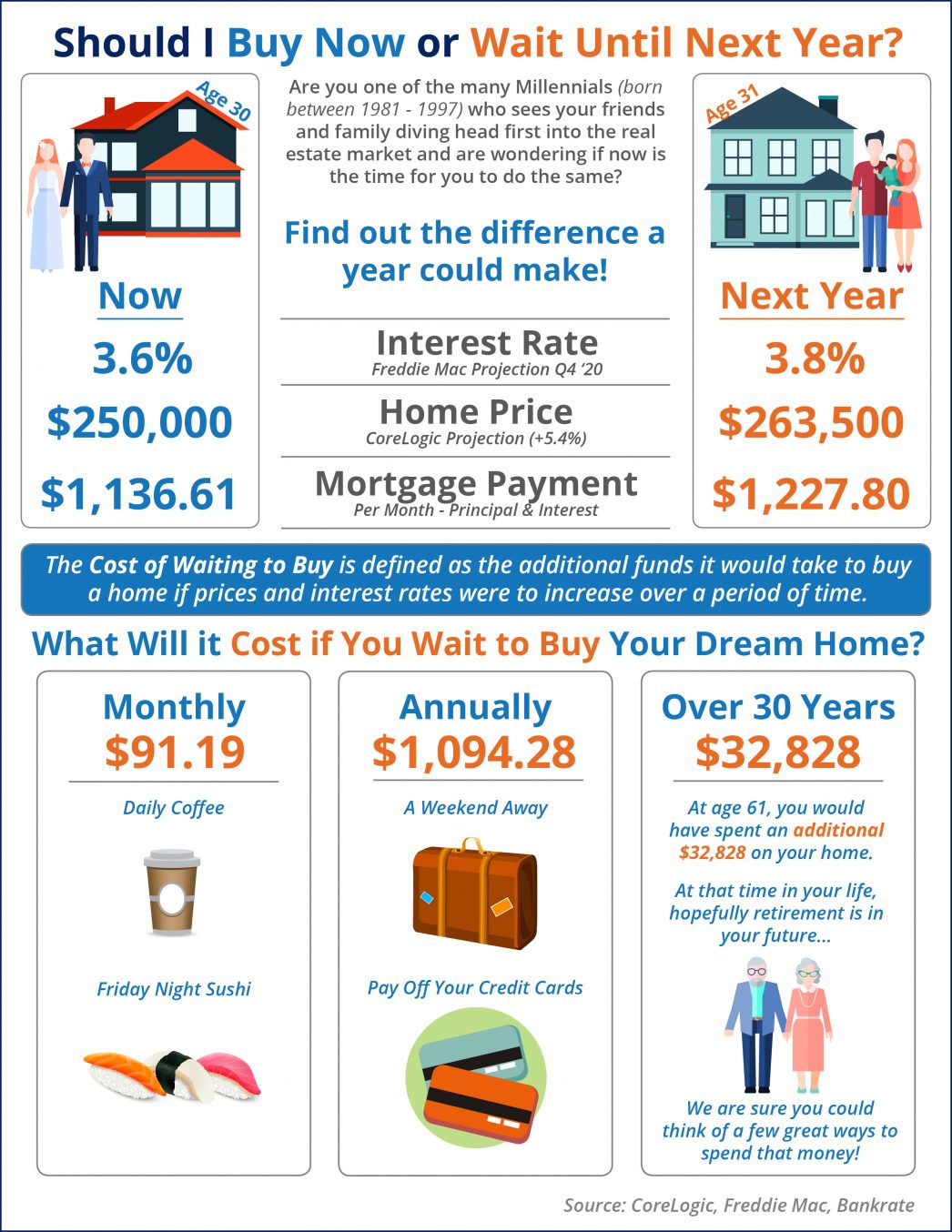

What Is the Cost of Waiting Until Next Year to Buy?

What Is the Cost of Waiting Until Next Year to Buy? Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will...

Is Your House “Priced to Sell Immediately”?

Is Your House “Priced to Sell Immediately”? In today’s real estate market, more houses are coming to market every day. Eager buyers are searching for their dream homes, so setting the right price for your house is one of the most important things you can do. According...

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year Utah had the second highest house-price appreciation of all states in the second quarter year-over-year, according to a new report by the Federal Housing Finance...

What Will Home Prices Look Like Over the Next Few Years

What Will Home Prices Look Like Over the Next Few Years? September 19th, 2019 Home prices will continue to rise throughout 2023. This means that now is a great time to sell! If you're thinking of listing your home, let's get together to determine your best move.

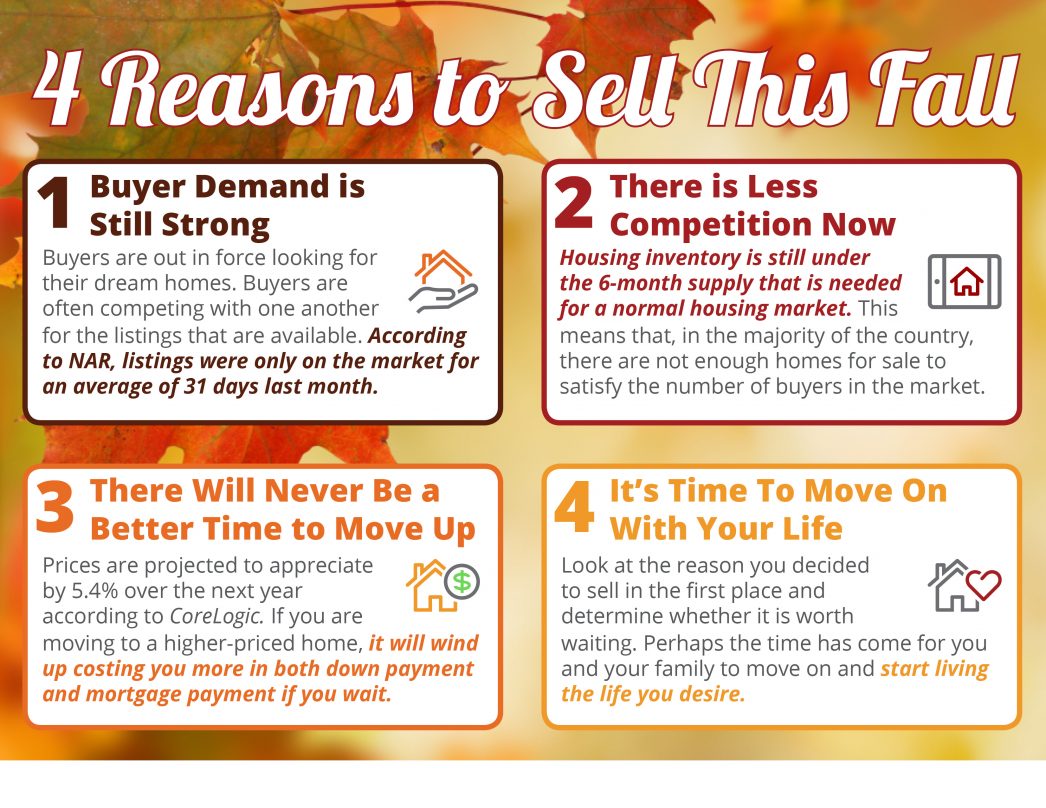

4 Reasons to Sell This Fall In Utah With Utah Realty

Utah Realty 4 Reasons to Sell This Fall Some Highlights: Buyers are active in the market and often competing with one another for available listings. Housing inventory is still under the 6-month supply found in a normal housing market. Homes are still selling...

Three Benefits of Growing Equity in Your Home

The Benefits of Growing Equity in Your Home Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is...

Utah Mortgage Rates at a 3 Year Low

Utah Mortgage Rates at a 3 Year Low

American Confidence in Housing at an All-Time High

Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore,...