3 Graphs that Show What You Need to Know About Today’s Real Estate Market

The Housing Market has been a hot-topic in the news lately. Depending on which media outlet you watch, it can start to be a bit confusing to understand what’s really going on with interest rates and home prices!

The best way to show what’s really going on in today’s real estate market is to go straight to the data! We put together the following three graphs along with a quote from Chief Economists that have their finger on the pulse of what each graph illustrates.

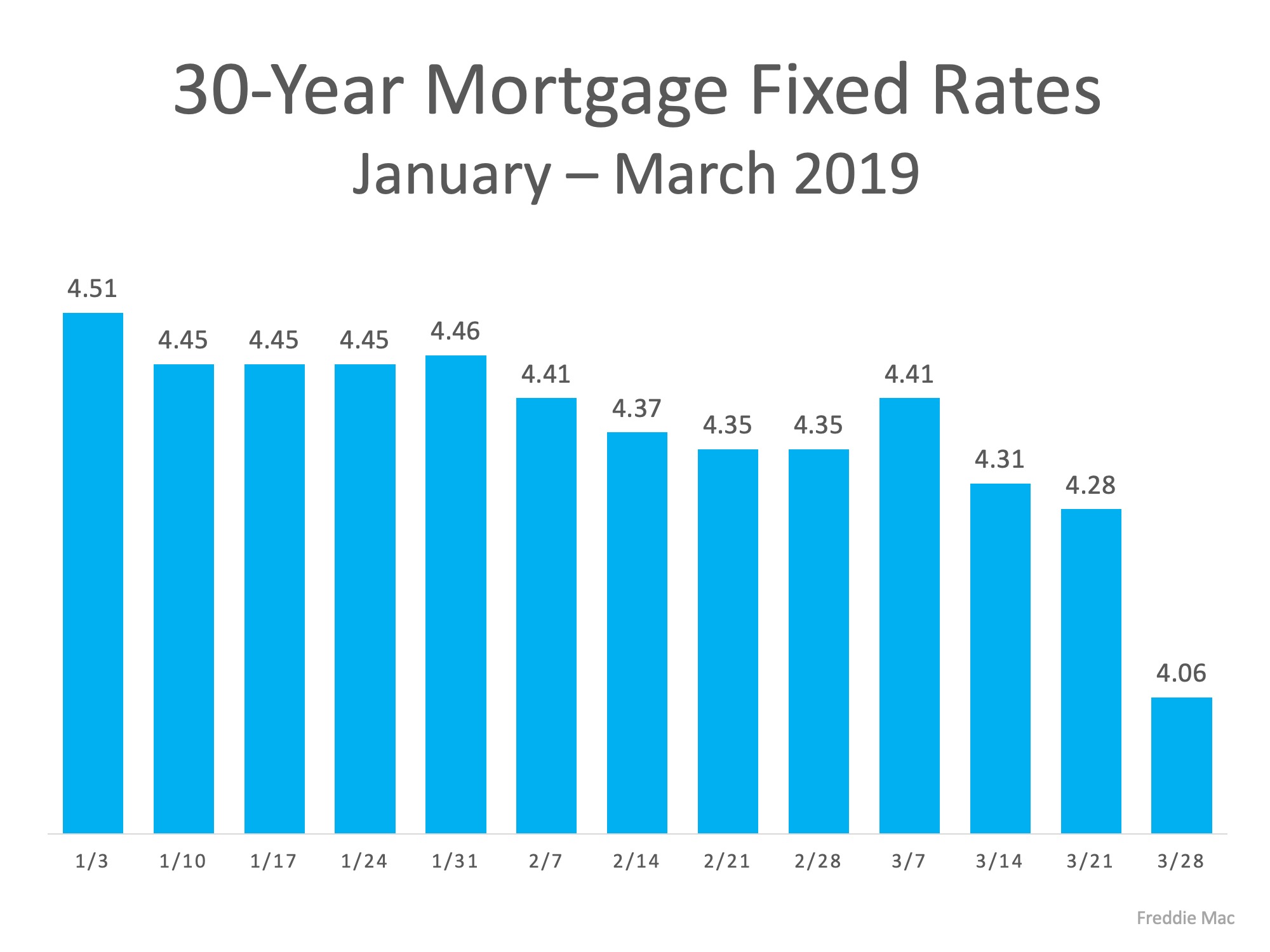

Interest Rates:

“The real estate market is thawing in response to the sustained decline in mortgage rates and rebound in consumer confidence – two of the most important drivers of home sales. Rising sales demand coupled with more inventory than previous spring seasons suggests that the housing market is in the early stages of regaining momentum.” – Sam Khater, Chief Economist at Freddie Mac

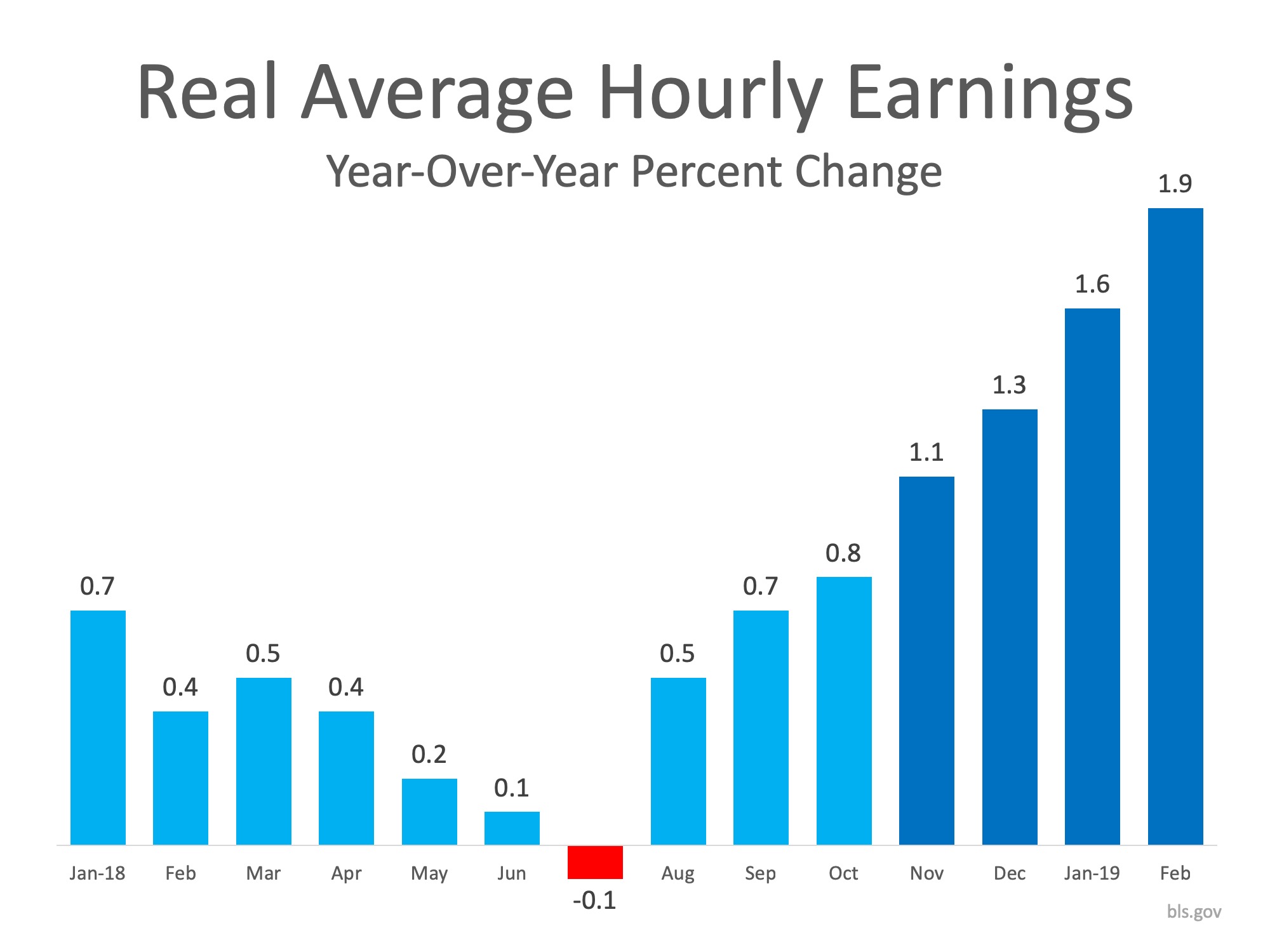

Income:

“A powerful combination of lower mortgage rates, more inventory, rising income and higher consumer confidence is driving the sales rebound.” – Lawrence Yun, Chief Economist at NAR

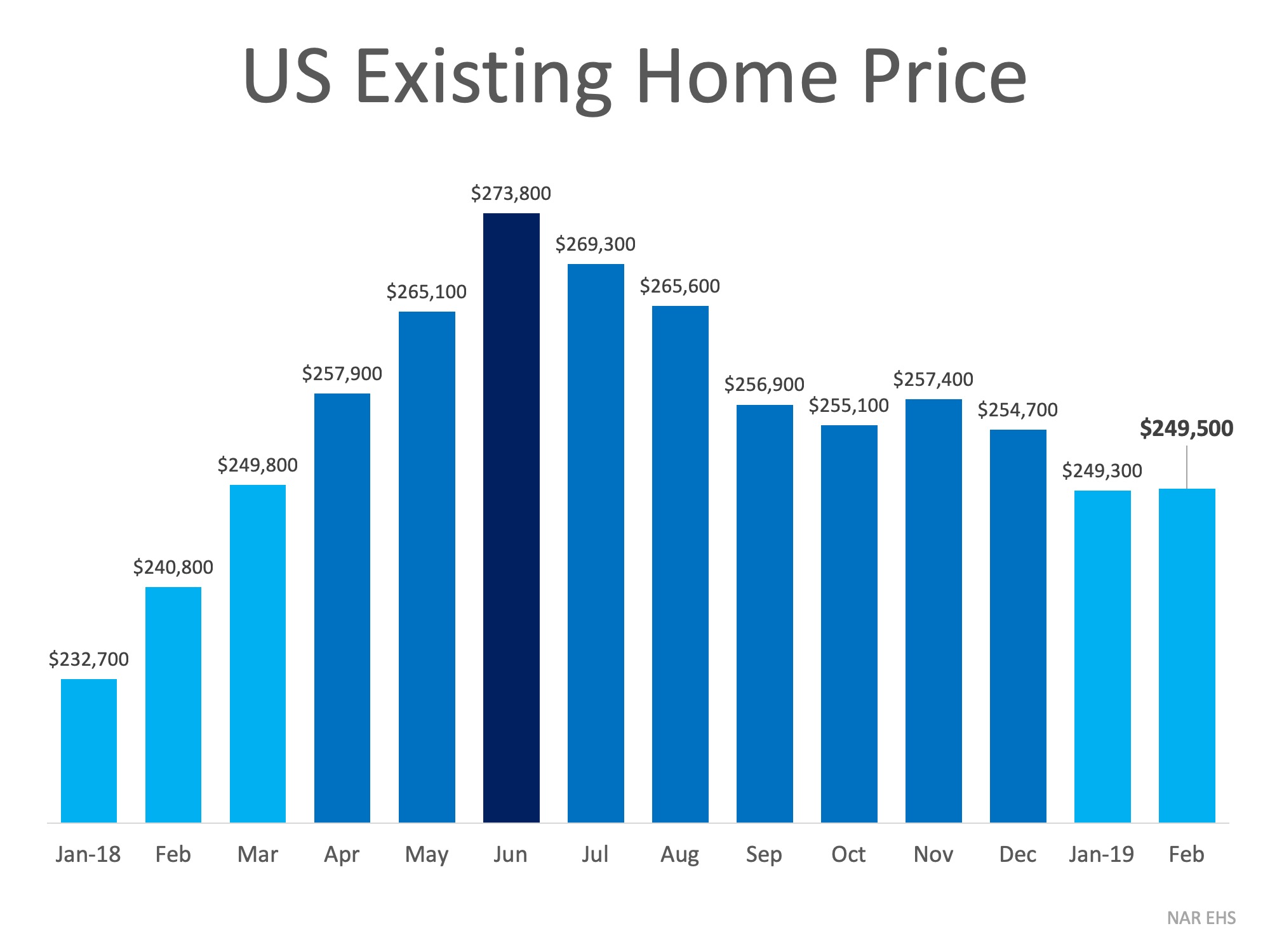

Home Prices:

“Price growth has been too strong for several years, fueled in part by abnormally low interest rates. A mild deceleration in home sales and Home Price Index growth is actually healthy, because it will calm excessive price growth — which has pushed many markets, particularly in the West, into overvalued territory.” – Ralph DeFranco, Global Chief Economist at Arch Capital Services Inc.

Bottom Line

These three graphs indicate good news for the spring housing market! Interest rates are low, income is rising, and home prices have experienced mild deceleration over the last 9 months. If you are considering buying a home or selling your house, let’s get together to chat about our market!

Economists Forecast Recovery to Begin in the Second Half of 2020

Economists Forecast Recovery to Begin in the Second Half of 2020With the U.S. economy on everyone’s minds right now, questions about the country’s financial outlook continue to come up daily. The one that seems to keep rising to the top is: when will the economy begin...

Buying or Selling a Home? You Need an Expert Kind of Guide

Buying or Selling a Home? You Need an Expert Kind of GuideIn a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate through the process. You need someone you can turn...

We Remember & Honor Those Who Gave All

We Remember & Honor Those Who Gave All We remember, today and always.

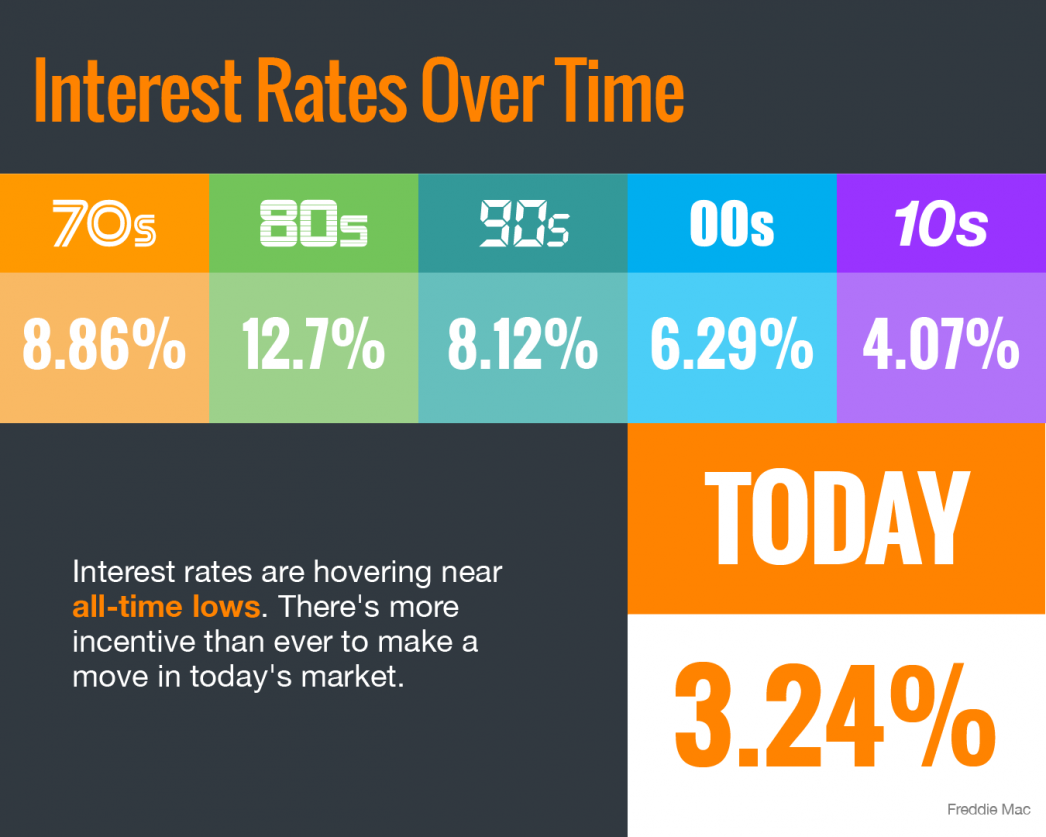

Interest Rates Hover Near Historic All-Time Lows

Interest Rates Hover Near Historic All-Time LowsSome HighlightsMortgage interest rates have dropped considerably this spring and are hovering at a historically low level.Locking in at a low rate today could save you thousands of dollars over the lifetime of your home...

Summer is the new Spring for Placing your home on the Market

Experts Predict Economic Recovery Should Begin in the Second Half of 2020

Experts Predict Economic Recovery Should Begin in the Second Half of the Year One of the biggest questions we all seem to be asking these days is: When are we going to start to see an economic recovery? As the country begins to slowly reopen, moving forward in...

6 Reasons Why Selling Your House on Your Own Is a Mistake

6 Reasons Why Selling Your House on Your Own Is a Mistake There are many benefits to working with a real estate professional when selling your house. During challenging times like the one we face today, it becomes even more important to have an expert help guide you...

Housing Market Positioned to Bring Back the Economy

Housing Market Positioned to Bring Back the EconomyAll eyes are on the American economy. As it goes, so does the world economy. With states beginning to reopen, the question becomes: which sectors of the economy will drive its recovery? There seems to be a growing...

#1 Financial Benefit of Homeownership: Family Wealth

#1 Financial Benefit of Homeownership: Family WealthWhile growing up, we were taught by our parents and grandparents that owning a home is a financially savvy move. They explained how a mortgage is like a “forced savings plan.” When you pay rent, that money is lost...

Adapting Your Home As a Senior

Adapting Your Home Adapting with Age Most of us would prefer to age in our current home. But as health and aging issues make more areas of the home hard to access or pose a greater risk of injury, doing so can be difficult. We can begin to feel trapped and that...