The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

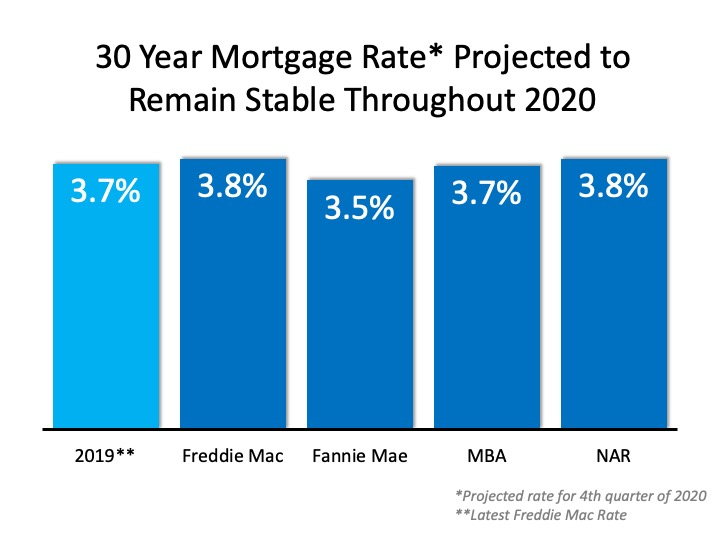

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

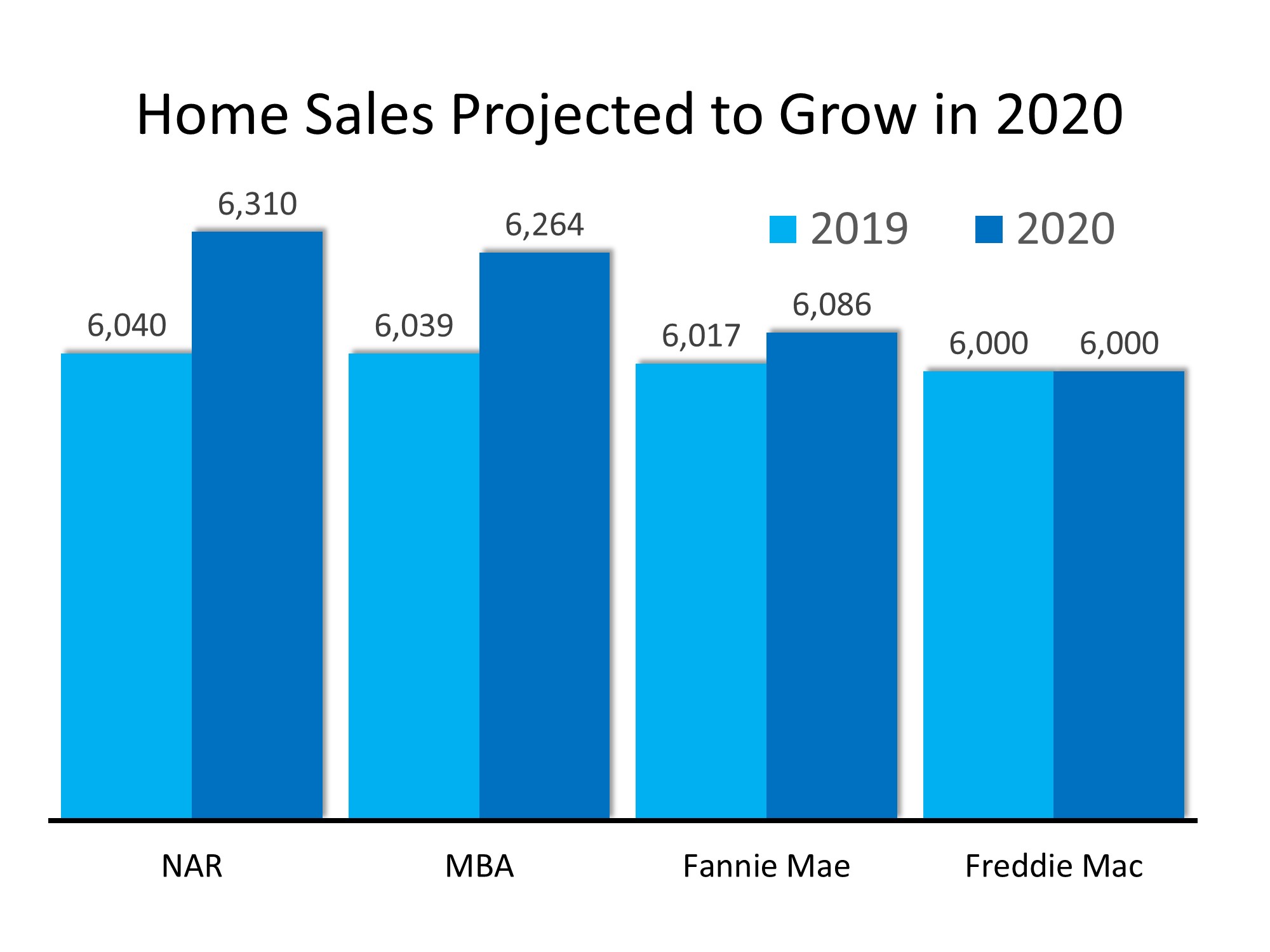

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

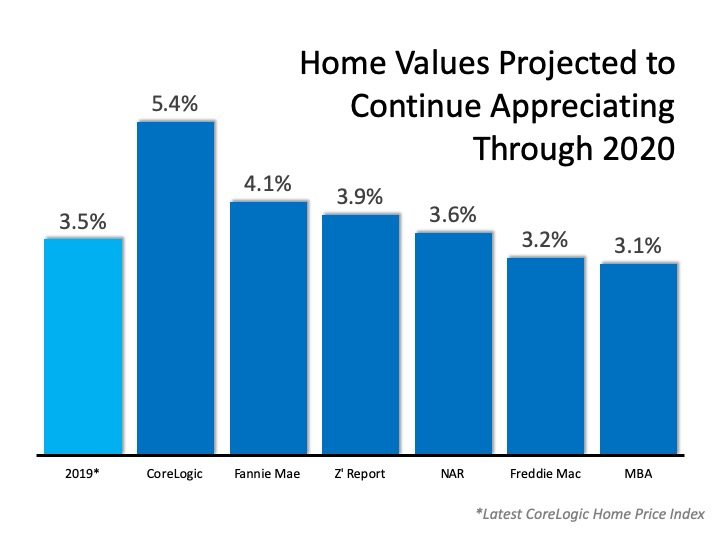

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

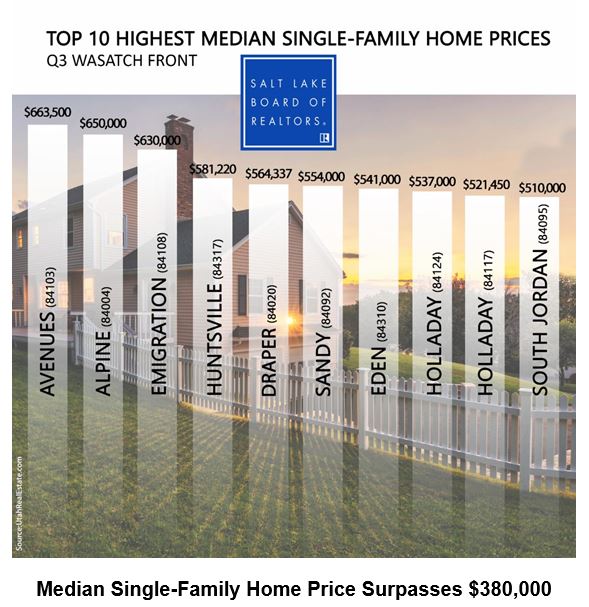

Top 10 Highest Single Family Home Prices Utah

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the...

Veterans Day 11-11-19

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice. This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI...

Protected Class

Things you should not have your clients put in a letter to a buyer or seller. Protected Class A group of people with a common characteristic who are legally protected from employment discrimination on the basis of that characteristic. Protected classes are created by...

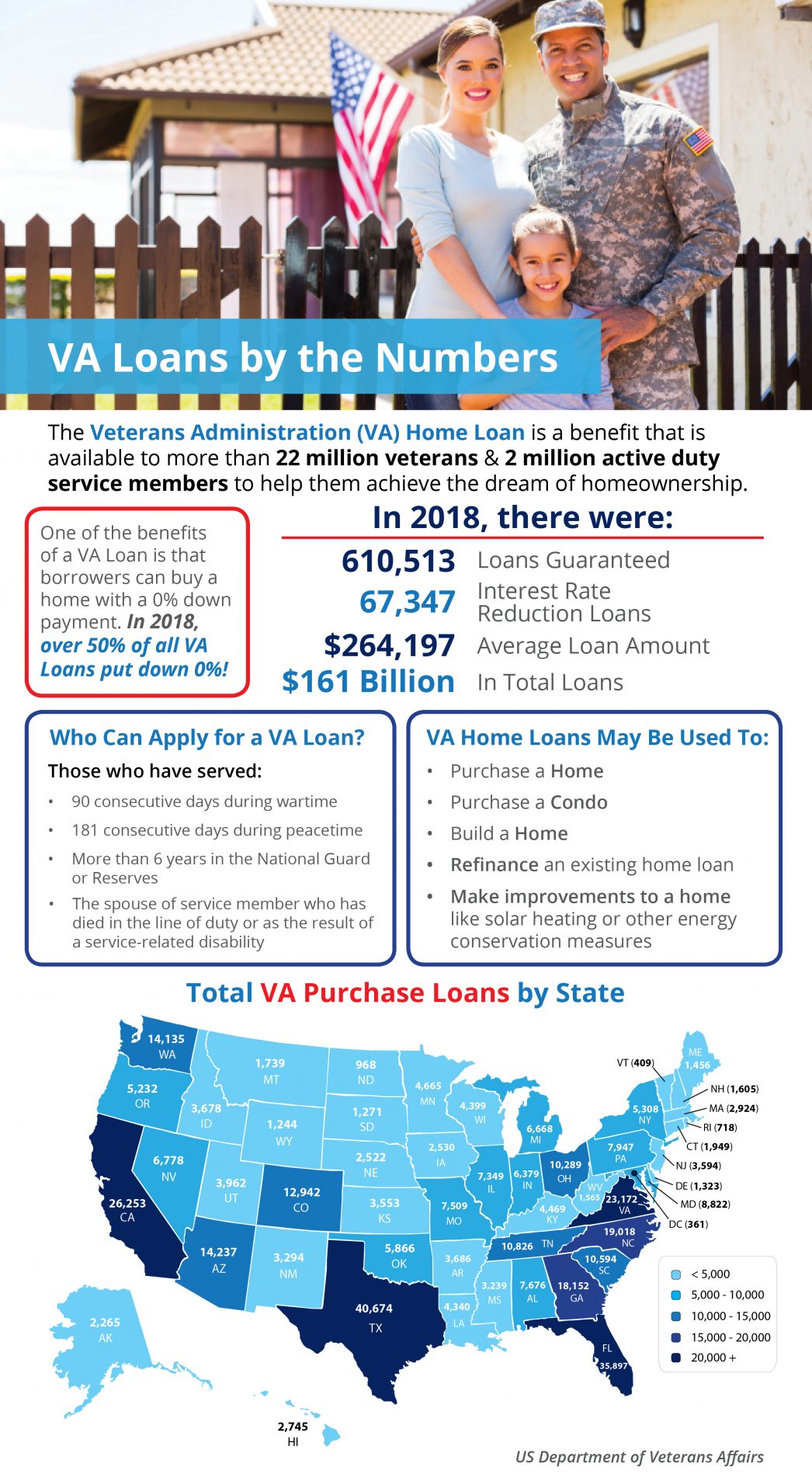

Utah Realty Presents VA Home Loans by the Numbers

Utah Realty Presents VA Home Loans by the Numbers Some Highlights: The Veterans Administration (VA) Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members to help them achieve the dream of homeownership. In...

The #1 Reason to List Your House in the Winter

The #1 Reason to List Your House in the Winter Many sellers believe spring is the best time to put their homes on the market because buyer demand traditionally increases at that time of year. What they don’t realize is if every homeowner believes the same thing, then...

Don’t Get Spooked by the Real Estate Market!

Have a Hauntingly Good Halloween! Having an agent to help guide you is key in today's complex housing...

Taking the Fear Out of the Mortgage Process

Taking the Fear Out of the Mortgage Process A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage. For many, the mortgage process can...

Buying a home can be SCARY…Until you know the FACTS

Buying a home can be SCARY…Until you know the FACTS Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts...

What credit Score Do You Need to Qualify for a Mortgage

What FICO® Score Do You Need to Qualify for a Mortgage? While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a...