The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

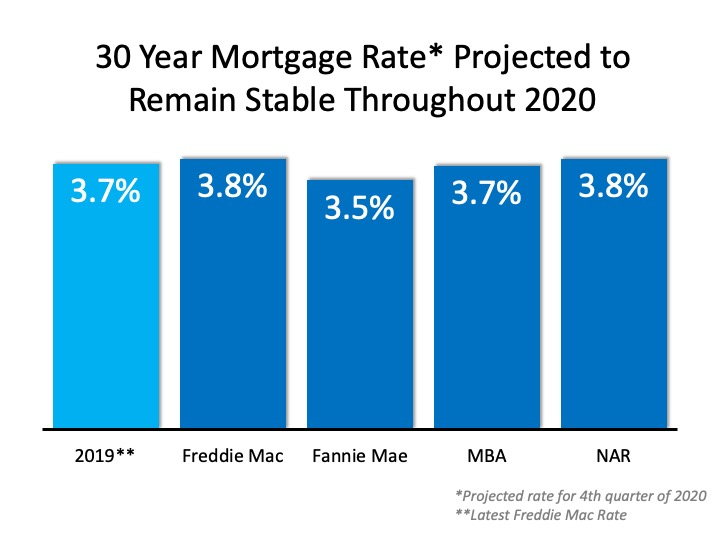

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

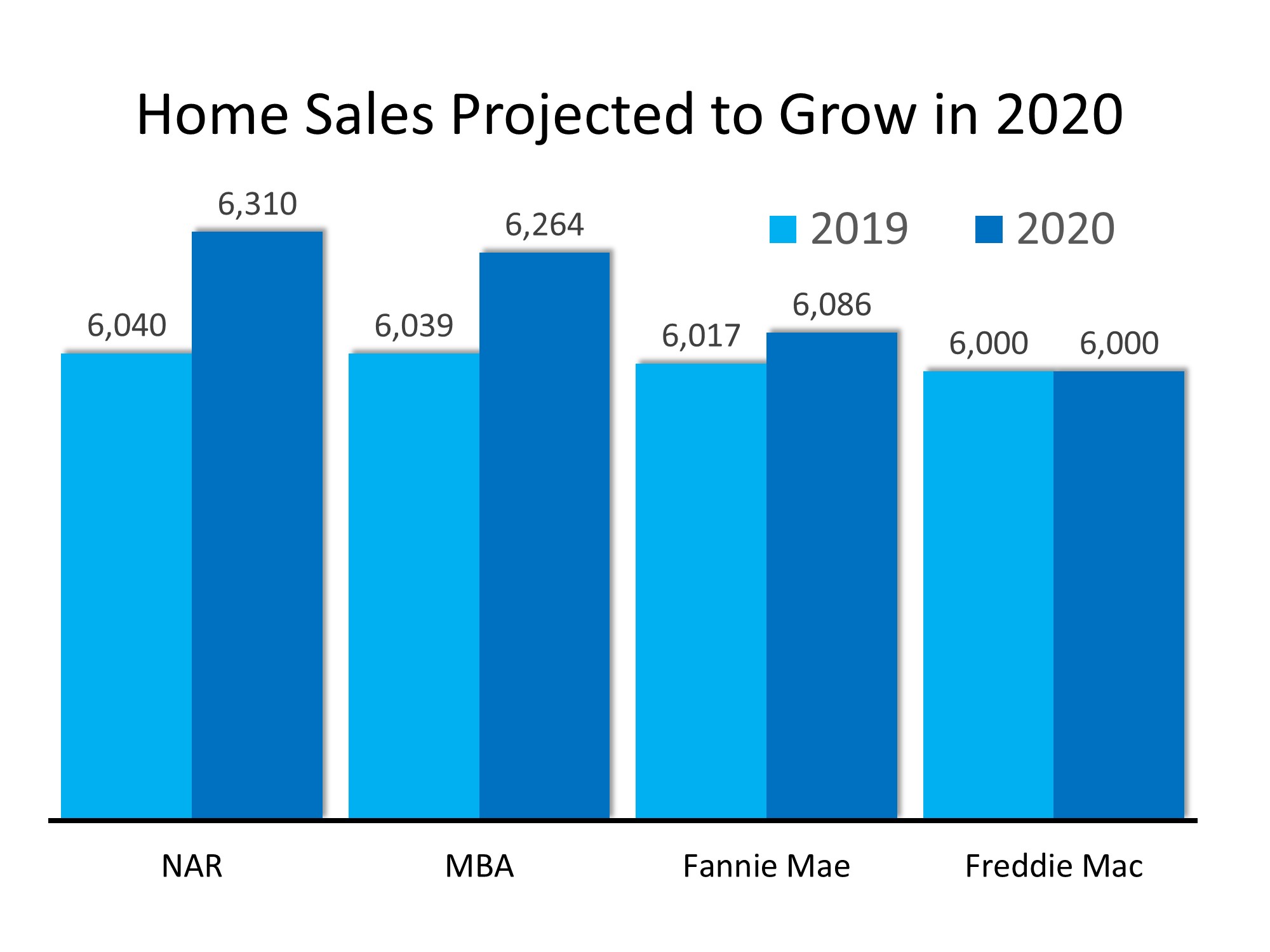

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

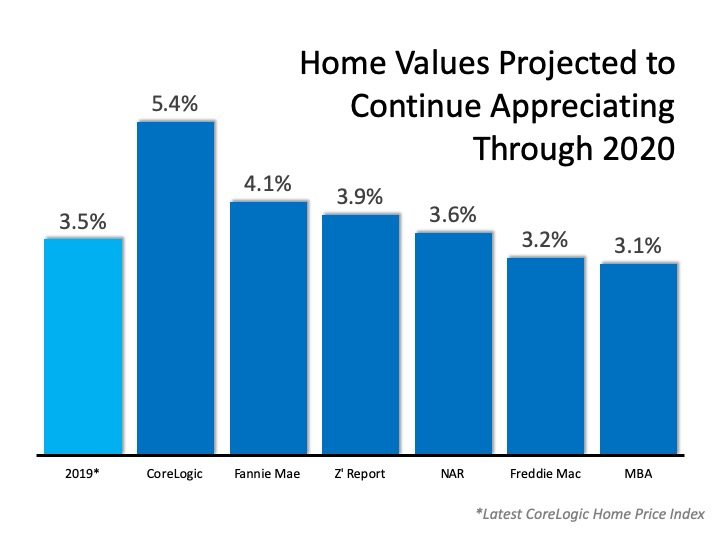

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

More Temporary Bumps in the Road to Recovery

We know there are bumps in the road when it comes to today’s economy and the housing market, and that’s to be expected under the current conditions. The good news is, experts are forecasting that home prices will continue to rise. DM me to discuss your plans in this...

Confused About the Economic Recovery? Here’s Why.

Confused About the Economic Recovery? Here’s Why.As we continue to work through the health crisis that plagues this country, more and more conversations are turning to economic recovery. While we look for signs that we’ve reached a plateau in cases of COVID-19, the...

U.S. Homeownership Rate Rises to Highest Point in 8 Years

U.S. Homeownership Rate Rises to Highest Point in 8 YearsFor nearly two months, most of us have been following strict stay-at-home orders from our state and local governments. It is a whole new way of life that has put our daily lives on pause. On the other hand, many...

The 3 Sciences That Are Driving Today’s Expert Economic Projections

[et_pb_wpl_widget_carousel id="wpl_carousel_widget-4" _builder_version="4.4.2"][/et_pb_wpl_widget_carousel][et_pb_wpl_widget_carousel id="wpl_carousel_widget-5" _builder_version="4.4.2"][/et_pb_wpl_widget_carousel][et_pb_wpl_widget_search...

Why the Housing Market Is a Powerful Economic Driver?

Why the Housing Market Is a Powerful Economic Driver?With businesses starting to slowly open back up again in some parts of the country, it’s important to understand how housing can have a major impact on the recovery of the U.S. economy. As we’ve mentioned...

Buying a Home Right Now: Easy? No. Smart? Yes.

Buying a Home Right Now: Easy? No. Smart? Yes.Through all the volatility in the economy right now, some have put their search for a home on hold, yet others have not. According to ShowingTime, the real estate industry's leading showing management technology provider,...

Rise to the Top of the Pool by Selling Your House Today

Rise to the Top of the Pool by Selling Your House Today With the release of the latest Economic Pulse Flash Survey from the National Association of Realtors (NAR), results show that people selling their houses today are holding strong on price. According to the most...

What Impact Might COVID-19 Have on Home Values?

What Impact Might COVID-19 Have on Home Values?A big challenge facing the housing industry is determining what impact the current pandemic may have on home values. Some buyers are hoping for major price reductions because the health crisis is straining the economy.The...

New Technology Is Powering the Real Estate Process

Technology Is Powering the Real Estate Process Technology is the driving force behind many of today's real estate transactions. Let’s connect to discuss how working together to go digital can give you an edge when buying or selling your home.

Uncertainty Abounds in the Search for Economic Recovery Timetable

Uncertainty Abounds in the Search for Economic Recovery TimetableEarlier this week, we discussed how most projections from financial institutions are calling for a quick V-shaped recovery from this economic downturn, and there’s research on previous post-pandemic...