The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

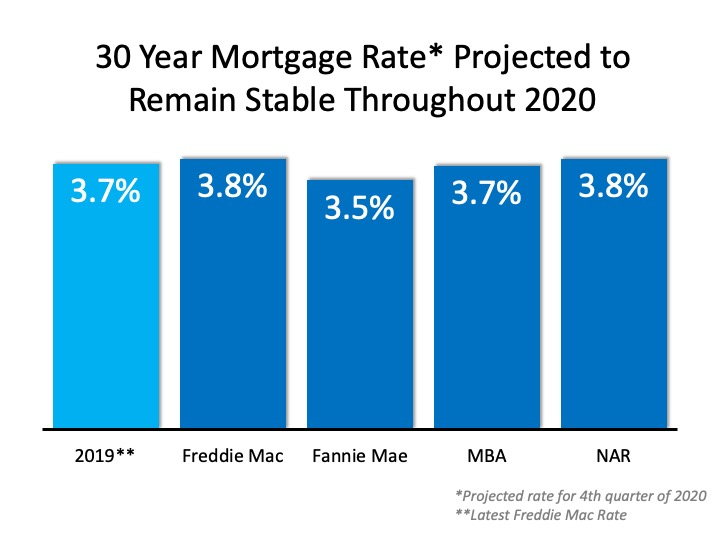

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

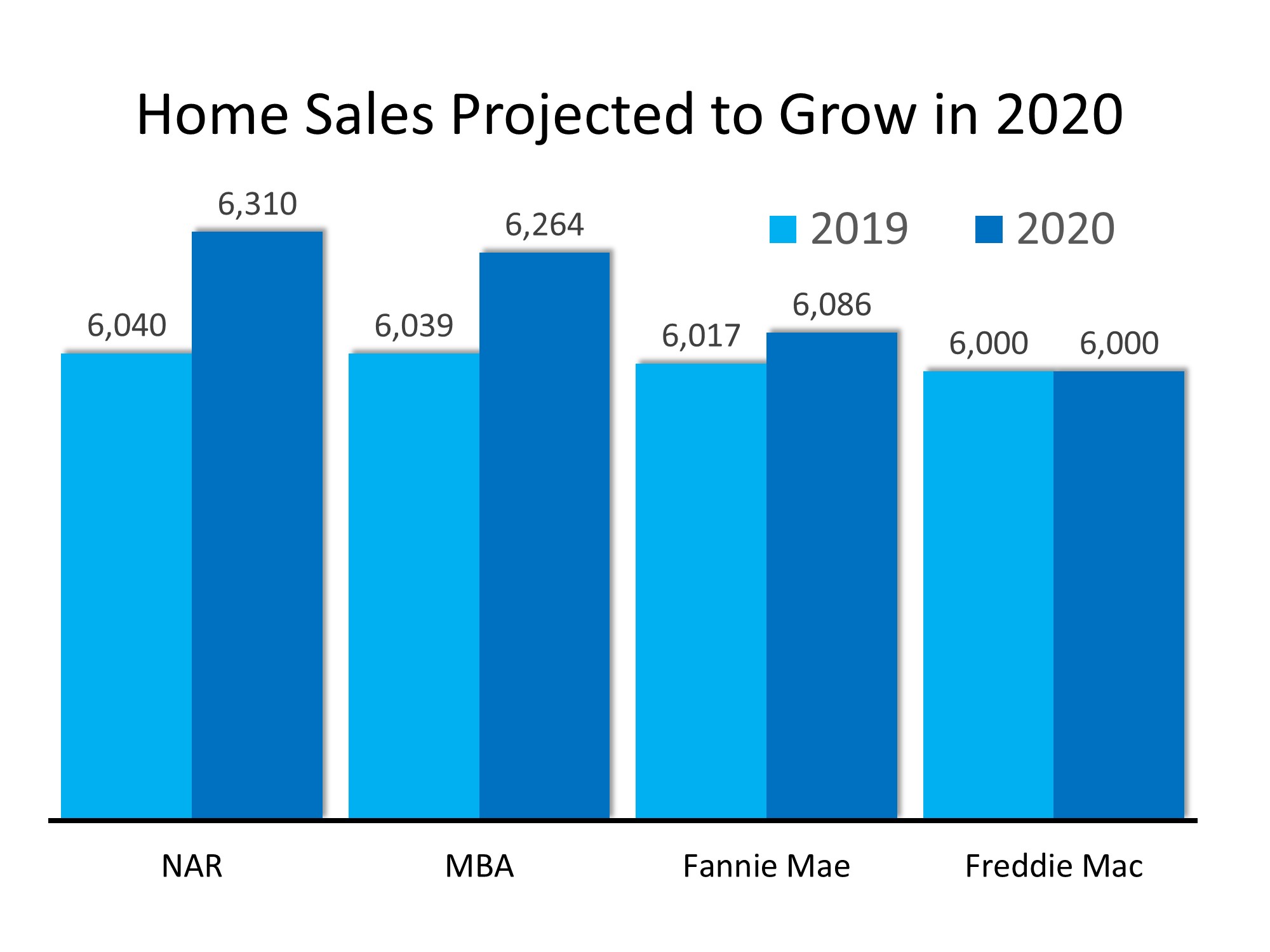

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

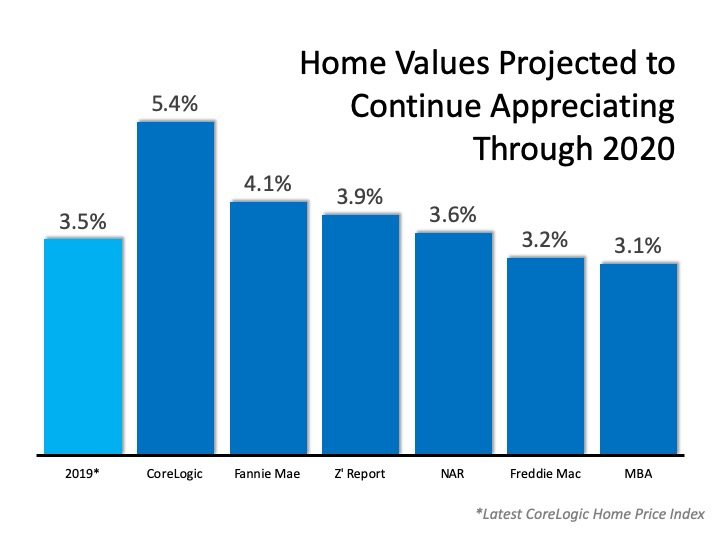

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

2020 Homeowner Wish List

Some HighlightsIn a recent study by realtor.com, homeowners noted some of the main things they would change about their homes to make them more livable.Not surprisingly, more space, an updated kitchen, and a home gym rose to the top of the list.If you’re thinking of...

What the Experts See Coming for the Housing Market May 14th, 2020

What the Experts See Coming for the Housing Market Experts are optimistic that the housing market will rebound as the country emerges from stay-at-home orders. Let's connect to discuss how these key insights may fuel your plans to buy or sell a home this year.

Will the Utah Housing Market Turn Around This Year?

Will the Housing Market Turn Around This Year?Today, many people are asking themselves if they should buy or sell a home in 2020. Some have shifted their plans or put them on hold over the past couple of months, and understandably so. Everyone seems to be wondering if...

A Surprising Shift to the ‘Burbs May Be on the Rise

A Surprising Shift to the ‘Burbs May Be on the RiseWhile many people across the U.S. have traditionally enjoyed the perks of an urban lifestyle, some who live in more populated city limits today are beginning to rethink their current neighborhoods. Being in close...

Unemployment Report: No Need to Be Terrified

Unemployment Report: No Need to Be TerrifiedLast Friday, the Bureau of Labor Statistics (BLS) released its latest jobs report. It revealed that the economic shutdown made necessary by COVID-19 caused the unemployment rate to jump to 14.7%. Many anticipate that next...

Will Utah Home Values Appreciate or Depreciate in 2020?

Will Home Values Appreciate or Depreciate in 2020?With the housing market staggered to some degree by the health crisis the country is currently facing, some potential purchasers are questioning whether home values will be impacted. The price of any item is determined...

A Day When Americans Can Return to Work

A Day When Americans Can Return to WorkSome HighlightsTaking a moment to reflect upon what we’ve heard from historical leaders can teach us a lot about getting through the many challenges we face today.We're all eager for the day when every American can safely return...

Unemployment: Hope on the Horizon

Unemployment: Hope on the HorizonTomorrow, the unemployment rate for April 2020 will be released by the U.S. Bureau of Labor Statistics. It will hit a peak this country has never seen before, with data representing real families and lives affected by this economic...

Caremongering Spreads Goodness, Not Fear

Caremongering Spreads Goodness, Not Fear As news of Covid-19 started gearing up, Allison Bradley felt heartbroken when she spotted seniors running errands and grocery shopping around her town, Kelowna, B.C. “My goodness, you are risking so much by being out here. It’s...

Why Home Equity Is a Bright Spark in the Housing Market

Why Home Equity Is a Bright Spark in the Housing MarketGiven how we have seen more unemployment claims than ever before over the past several weeks, fear is spreading widely. Some good news, however, shows that more than 4 million initial unemployment filers have...