2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Expert Housing Market Forecasts for the Second Half of the Year

Expert Housing Market Forecasts for the Second Half of the Year The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help...

Happy 4th of July

Happy Independence Day

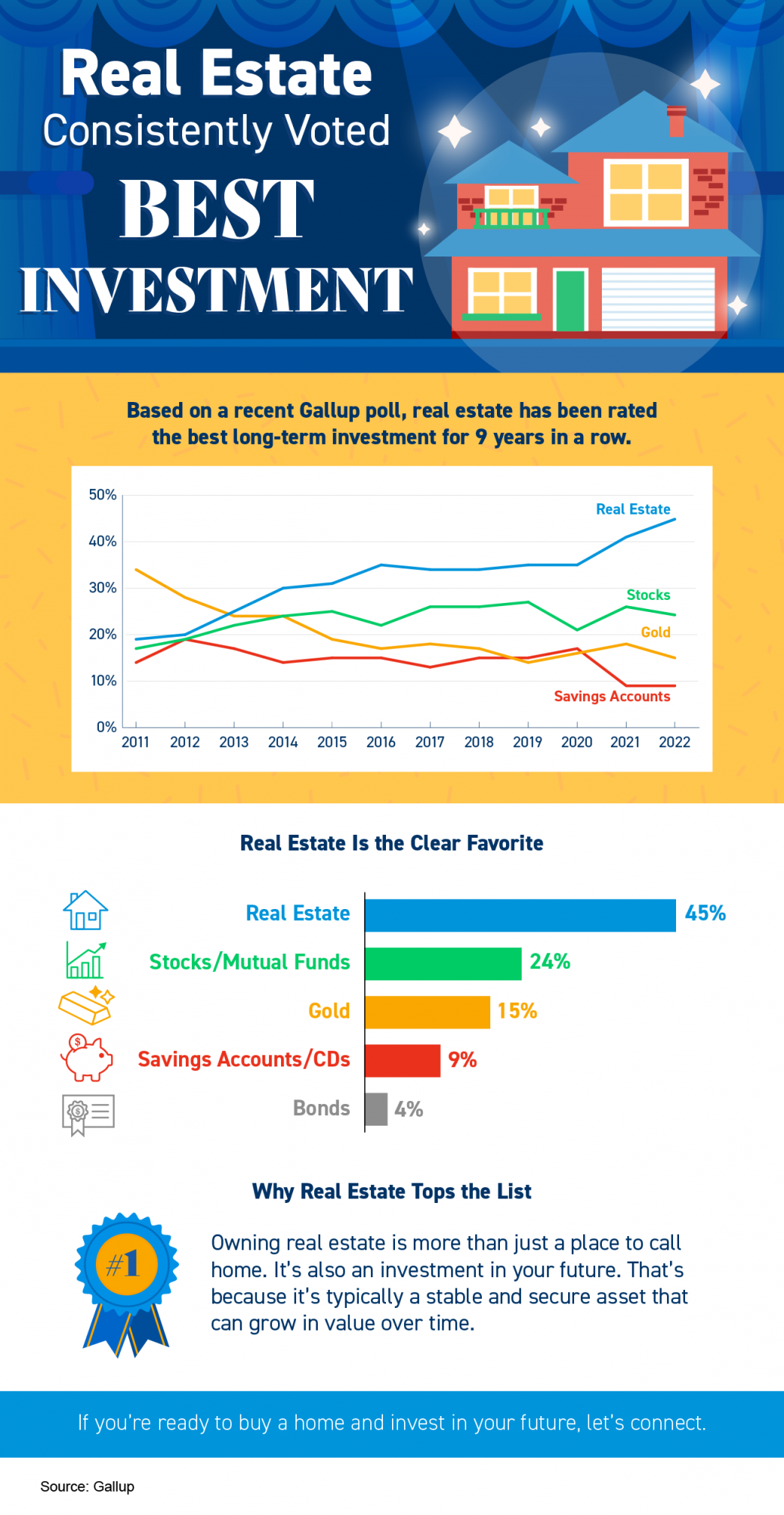

Real Estate Consistently Voted Best Investment

Real Estate Consistently Voted Best Investment Some Highlights Based on a recent Gallup poll, real estate has been rated the best long-term investment for nine years in a row. Owning real estate is more than just a place to call home. It’s also an investment in your...

Why an Agent Is Essential When Pricing Your House

Why an Agent Is Essential When Pricing Your House Some Highlights When it comes to pricing your house, there’s a lot to consider. The only way to ensure you price it right is by partnering with a local real estate professional. To find the best price, your agent...

A Recession Doesn’t Equal a Housing Crisis

If you're following the news, you might be wondering what could happen to the housing market if there's a recession. Let's connect to discuss why history shows a recession doesn't equal a housing crisis.Buy or Sell with Marty Gale "Its The Experience" Principal Broker...

The Average Homeowner Gained $64K in Equity over the Past Year

The Average Homeowner Gained $64K in Equity over the Past Year If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price...

More Americans Choose Real Estate as the Best Investment Than Ever Before

More Americans Choose Real Estate as the Best Investment Than Ever Before Americans’ opinion on the value of real estate as an investment is climbing. That’s according to an annual survey from Gallup. Not only is real estate viewed as the best investment for the ninth...

Why the Growing Number of Homes for Sale Is Good for Your Move Up

Why the Growing Number of Homes for Sale Is Good for Your Move Up Are you thinking about selling your current home? If so, the biggest question on your mind may be: if I sell now, where will I go? If this resonates with you, there’s something you should know....

June is National Homeownership Month

How Homeownership Impacts You June is National Homeownership Month, and it’s the perfect time to reflect on how impactful owning a home can truly be. When you purchase a house, it becomes more than just a space you occupy. It’s your stake in the community,...

Sellers Have an Opportunity with Today’s Home Prices

"IT'S THE EXPERIENCE" It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone. You may be wondering if prices are projected to rise or fall…or how much competition you may...